Discuss your challenges with our solutions experts

Energy view to 2035 in five charts

Comparing Wood Mackenzie to the IEA, BP and XOM

1 minute read

David Brown

Director, Energy Transition Practice

David Brown

Director, Energy Transition Practice

David is a key author of our Energy Transition Outlook and Accelerated Energy Transition Scenarios.

View David Brown's full profileEach year, we benchmark our analysis of global cross-commodity trends to similar outlooks from the International Energy Agency (IEA NP), BP and ExxonMobil (XOM). This comparison addresses several major cross-commodity uncertainties, including the impact of renewables on fossil fuel demand, when — or if — emerging markets will leapfrog from traditional hydrocarbons to renewables in the power and transport sectors, and the impact of carbon policy on long-term fuel choices.

From our full analysis, we have distilled our outlook into five charts that examine global supply by fuel, demand by country and emerging markets in Asia Pacific. The data included in this presentation is comprised from our Energy Markets Service datasets.

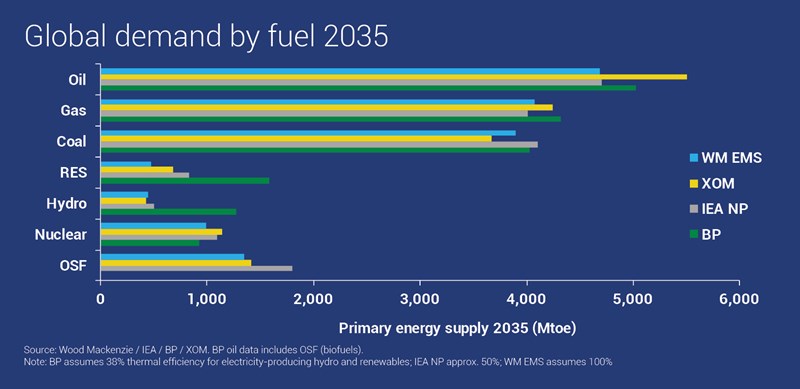

Hydrocarbons dominate global supply

Outlooks agree that oil is the largest fuel, with XOM in the lead as far as projections are concerned, followed by BP; Wood Mackenzie (WM EMS) and the IEA NP are very similar. Gas displaces coal as the second largest fuel across all forecasts, except the IEA NP. Fuel demand growth is strongest during 2015-2025. All outlooks expect gas growth at around low to mid 3% from 2015-2025; in the back half of the forecast, post 2025, growth moderates materially — between 1-1.5% over 10 years due to slower economic growth and more efficient energy production, especially in the power sector.

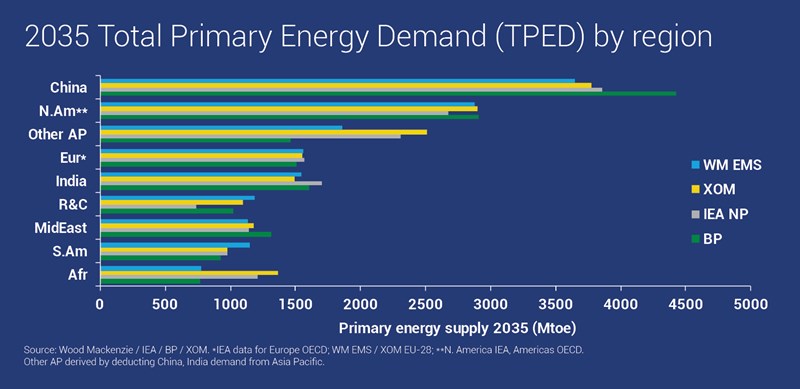

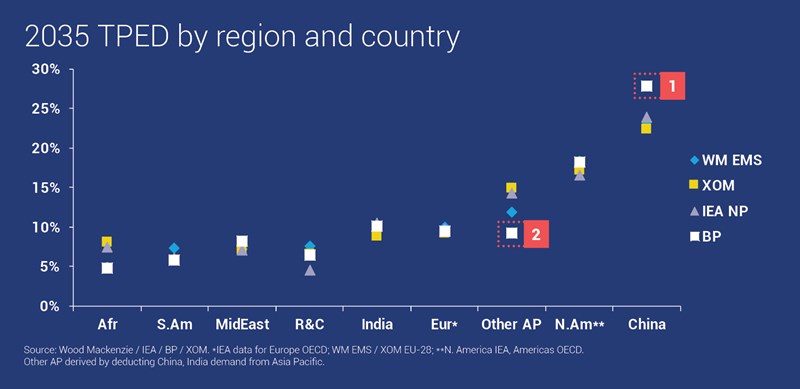

For energy markets, growth is no longer just about China. While this message is not necessarily new — we raised this in our initial View to 2035 series — the outlooks have different takes on the size of China relative to other markets.

As you can see, BP has a higher view on China's total energy demand by 2035 (see point 1 in the chart above), which equals around a 28% share of total energy demand globally. The other outlooks agree that China's demand profile is moderating long term, including WM EMS.

However, there is no consensus on which markets compensate for a slowdown in China. For example, BP is more conservative on the growth of markets ex-China (see point 2, our Other Asia Pacific category), while XOM is the highest on Other Asia Pacific growth across all four outlooks.

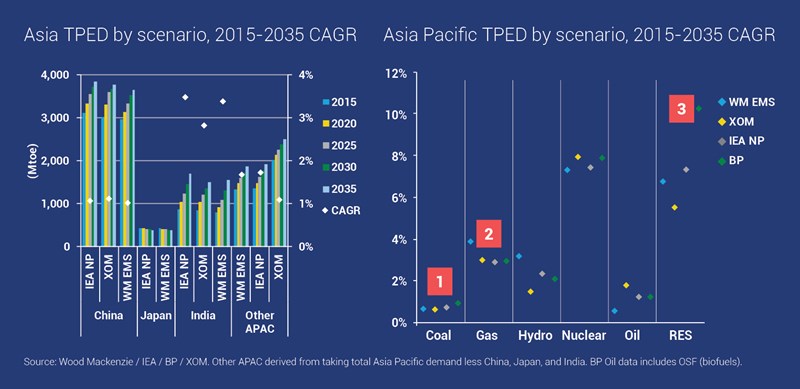

With energy demand growth in China and Japan moderating, where are the major growth markets in Asia Pacific? Let's focus on India, where WM EMS expects Total Primary Energy Demand (TPED) to nearly double over the next 20 years. The industrial sector is on pace to be one of India's largest sources of demand by 2020, supporting the country's industrialisation process. India's swift demand growth and infrastructure requirements will increase demand for coal, despite the ramp-up of gas and renewables.

Outlooks broadly agree on which fuels will win or lose across Asia Pacific. Coal is static across all forecasts, backed out by gas, nuclear and renewables (see points 1-3 in the chart above). WM EMS is highest on gas' growth compared to other outlooks, and is close to BP and the IEA NP on the outlook for renewables.

Energy Markets Service

With major uncertainties facing commodity markets, how can companies target new opportunities and analyse how disruptive trends will impact energy markets long term? With the Energy Markets Service (EMS), quantify how energy demand, supply, and net trade will evolve in established and emerging energy markets. EMS leverages Wood Mackenzie's entire commodity analysis platform to develop integrated research on fuel demand, the role of policy in fuel choices, and supply profiles across all fuels in the power and non-power sectors. It is underpinned by extensive expertise, proprietary models and robust market knowledge across the energy value chain.