Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

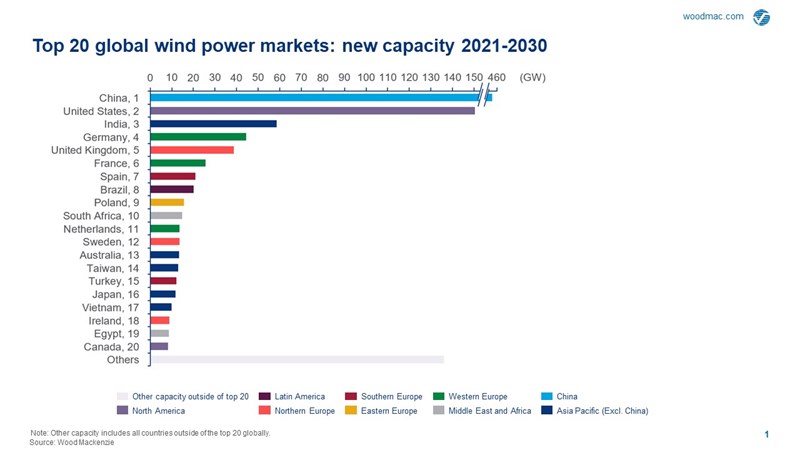

Global installed wind power capacity set to grow by 9% to 2030

China’s power needs add 48 GW additional capacity to 10-year outlook

1 minute read

Global wind power capacity is expected to grow at a cumulative annualised growth rate (CAGR) of 9% between 2021 and 2030, according to a new report by Wood Mackenzie, a Verisk business (Nasdaq:VRSK). By the end of the decade, cumulative global wind power capacity is projected to hit over 1,756 gigawatts (GW).

Wood Mackenzie’s Q4 forecast reported a 69-GW increase in new capacity additions globally compared to the previous quarter’s outlook for the period 2021-2030. China has provided a major uplift to the latest forecast. The country’s 48-GW quarter-on-quarter (QoQ) upgrade accounts for nearly 70% of the increase to the global 10-year outlook.

Wood Mackenzie research director Luke Lewandowski said: “Rapid growth in power demand driven by China’s industrial sector and the recent power shortage in September sparked China’s determination to accelerate the development of renewable energy. Hence, we have upgraded our China wind power capacity outlook. The market is expected to add 458 GW this decade and will continue to lead the global rankings in terms of new capacity added.”

Principal analyst Xiaoyang Li added: “Acute demand for power along China’s coastline triggered a 13-GW upgrade in the offshore wind sector, largely concentrated from 2023 to 2026. The country’s commitment to net zero emissions is expected to drive 88 GW of additional offshore wind capacity between 2021 and 2030.”

QoQ outlook adjustments in the US and Europe combine to contribute 22 GW of additional capacity as these markets respond to decarbonisation targets and expected incentive mechanisms.

An expectation that Congress passes a 100% Production Tax Credit extension yields a QoQ upgrade of nearly 12 GW in the US, primarily impacting the 2026 to 2030 period when annual capacity additions will average 18 GW if grid investments materialise. The US is currently ranked second to China in terms of global new capacity this decade, with 150 GW of capacity addition.

A 3.3-GW QoQ upgrade in south Europe’s outlook, due primarily to wind developers winning the entirety of a 1.1-GW tech-neutral allotment in October, contributed to nearly 10 GW uplift across Europe this quarter. Upgrades in the rest of the region reflect a broad effort to ramp up compliance toward 2030 targets.

Wood Mackenzie has made minimal adjustments in the QoQ outlook for the Middle East and Africa although advancement of wind builds in South Africa, Oman, Israel, and Egypt indicate development is on pace with the forecast.

Bucking the trend of increasing capacity additions is Japan, who dropped five positions down to 16th position in the top markets for new wind capacity rankings. A 2.5-GW downgrade QoQ in Japan caused by a more conservative offshore target than anticipated resulted in a nearly 800-megawatt downgrade to the outlook for Asia Pacific excluding China. The country is now projected to add 11.7 GW of new capacity this decade.

Vietnam, Asia Pacific’s rising star, reported a 33-fold increase in new capacity additions in just one year as developers have pushed to capitalise on the wind FIT that expired at the end of October. The market is currently ranked 17th in global wind capacity additions with 9.9 GW of new installations expected this decade.

Principal analyst Robert Liew said: “Vietnam has leapt from being an emerging market to become the second largest regional wind market (Asia Pacific excluding China) for capacity additions this year. The official 3.3 GW released by the Ministry of Industry & Trade is likely to include projects that have managed to secure COD certificates despite not being fully completed, as companies rushed to secure wind FITs before it expired at the end of October 2021.”