Breaking conventions – tackling the high-cost culture

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

New thinking to kick start upstream investment

The industry outside the US L48 is still struggling to commercialise oil and gas discoveries. New thinking and new ways are needed if operators are to usher in a new era of investment in conventional projects. A dip in oil prices below US$50/bbl may be just what’s needed to concentrate minds and encourage companies to challenge industry conventions.

We model 132 pre-FID greenfield projects in our database classified as 'probable'. A total of US$364 bn of investment is needed to bring them on stream. On the surface, there seems to be plenty in the hopper for the conventional operators to get their teeth into.

Other stats are more sobering. The average breakeven Brent price for these projects is US$65/bbl (15% IRR), even after a 20% global reduction in costs since 2014. An average of 15 years has passed since the first discovery on projects sitting in the hopper. The glacial pace towards commercialisation hints at inherent problems.

There are two fundamental reasons why conventional upstream is at this pretty pass of high breakevens and snail-like progress: complexity and culture.

Complexity comes in two guises: from reaching into geographical frontiers and tougher geologies; and self-imposed complexity in managing the business. The latter overlaps with culture, itself rooted in the industry’s ultra-cautious belt and braces approach to offshore development. Together, the two add up to costs.

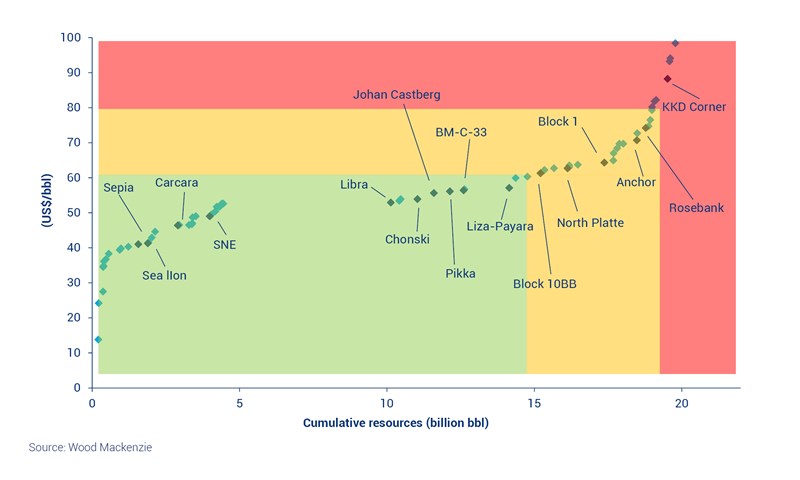

The cost factor is apparent in the sensitivity of the hopper to oil prices. Norman Valentine, research director of Corporate Analysis, calculates that 15 bn bbls of conventional oil discoveries achieve a 15% IRR below US$60/bbl, but just 5 bn bbls work under US$50/bbl.

Liquids-oriented conventional players will rapidly go ex-growth at current oil prices. An envious look will be cast at the L48 where over 15 bn bbls of tight oil resource makes a 15% IRR under US$50/bbl. (Pre-FID projects at risk).

Smaller projects dominate the low breakeven rankings among conventional projects. The industry is prioritising low-risk, smaller projects near infrastructure which are quicker to bring on stream. Big projects tend to be stand alone, more expensive and prone to the woes of complexity.

How can the industry get costs down and investment moving?

First, we think there is more to come from reducing costs in areas where progress is already being made — project optimisation, reducing facility size, changing facility concept, cutting well count, improving well design and well efficiencies.

Second, new thinking is needed, a re-examination of the industry’s approach to conventional development. We don’t anticipate radical change to the architecture — projects will still centre on platforms, wells and pipelines. But we reckon there is scope in the way projects are managed — planning, contracting, the design process, delivery, the supply chain and the people. To tighten up on costs, how projects are brought to commercialisation and project execution itself.

A shift towards a manufacturing process and standardisation

Reservoirs vary, but the operational template has evolved to pad drilling, tighter well spacing, near-wellbore fracking and high-volume completions. Best practice transfers swiftly. Leading L48 drillers have made big productivity gains by locking in the best rigs and best crews on longer term contracts rather than what’s been available at the lowest price.

The service sector on which conventional investment relies has been brought to its knees by margin pressure. Recent consolidation will bring economies of scale and financial stability. But future contracts based on maximising efficiency rather than lowest available price might reap commercial rewards to both sides.

Lessons to be learned

Outside upstream, much might be learned from the automotive and aerospace sectors.

Both seem able to deliver high-spec products at competitive cost whether constructing multiple variant models of cars or aeroplanes. Artful management of all aspects of the supply chain and capital discipline are key to success here.

The oil industry could start by opening up the traditional relationship between operator and suppliers to maximise standardisation and minimise duplication. Outsourcing, offshoring and low-cost delivery models could deliver big cost savings and free up capital. Digitalisation, robotics and automation, and predictive analytics applied to surface and sub-surface processes all have a role to play.

There’s an opportunity for sector leadership to embrace new thinking and practices. The incentive is a competitive portfolio of conventional growth opportunities.