Discuss your challenges with our solutions experts

In 2017 we expect the oil and gas sector to be on a firmer footing than any time in the previous two years. Although 2017 brings a myriad of uncertainties, from a new Trump administration to OPEC’s production cuts to the Paris Agreement’s low-carbon protocols, the new year also ushers in much-anticipated optimism for the global upstream industry. Is 2017 the dawn of a cautious recovery for the E&P sector?

Back in the black: 2016 will mark the bottom of the investment cycle

After a two-year slump, the cycle will turn in 2017. E&P spending will grow by 3% to US$450 billion. Yet this is still 40% below the heady days of 2014, reflecting deep cost-cutting and a move toward smaller, more incremental projects.

US Independents will respond first to rising prices, leveraging their advantaged assets and access to capital. US unconventionals spend could be up by over 25%. But spend for the bigger players will continue to trend down. The Majors’ combined development investment will fall by around 8% as spend in recent capital-intensive projects winds down.

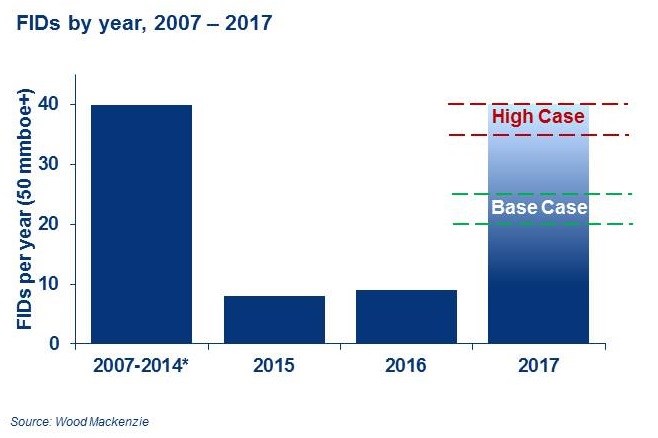

A leaner industry will emerge from the gloom. Costs have already come down by 20% on average, and a further 3-7% reduction is expected in 2017. This will pave the way for a doubling in FIDs compared to last year. Capex per barrel of oil equivalent for these projects averages just US$7 per barrel (bbl), down from US$17/bbl for the 2014 project sanctions. The projects also give more bang for their buck – with an internal rate of return (IRR) increase from 9% to 16%.

Doing more with less — but still a way to go

The US unconventional sector exemplifies how operational efficiencies can offset low capex and potentially even cost inflation. There has been a dramatic increase in efficiency in the sector, exemplified by the drillers, who are managing to complete wells up to 30% quicker. We think there’s potential for a further improvement in drilling speed of 20-30% for early-life plays such as the Wolfcamp and SCOOP/STACK.

Deepwater projects remain more challenged. Many of the projects slated for FID in 2017 are competitive with tight oil, but many longer-term deepwater pre-FID developments are still out of the money. Of the 40 larger pre-FID deepwater projects, around half fail to hit a 15% IRR at US$60/bbl.

The industry has selected the best projects to optimise and take forward. In 2017 it will have to turn its attention towards optimising the next wave of developments to get them sanction-ready. Governments will also have a role to play in improving fiscal terms to attract scarce E&P capital.

So what does this mean for the service industry?

Hard times are still ahead for oilfield services, but recovery is in the cards. Companies will be pushing forward with fewer projects and streamlining efforts across the board. Tight Oil is one to watch in the coming year. We expect production to grow by an average 2% across our Corporate Service universe — impressive given development spend was slashed by over 40% between 2014 and 2016. All eyes will be on how quickly the US tight oil sector responds to rising prices.

Improving exploration economics, lower M&A prices and some exciting discovered resource opportunities will help facilitate this shift towards adapt and grow, providing opportunities for the financially strong looking to step up new ventures and business development.