Discuss your challenges with our solutions experts

Last Friday, Delaware pure-player Jagged Peak executed its IPO strategy raising approximately US$500 million, roughly US$200 million shy of the expected high point. In our latest report, our analysts explore what factors led to this disappointing IPO and how Jagged Peak may be able to change investors' opinions this year.

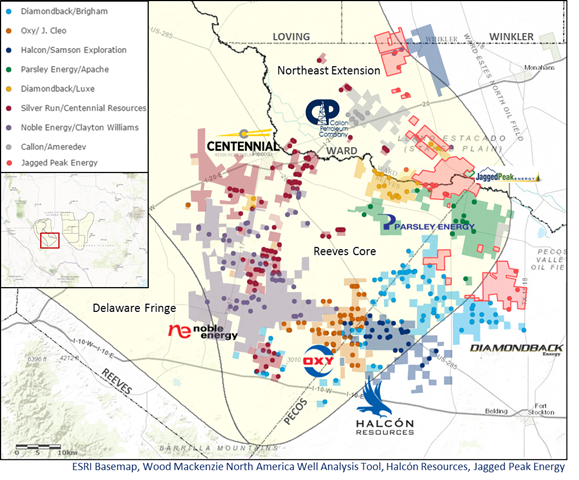

Equity markets have praised Permian operators over the past 12-18 months, so a Delaware pure-player disappointing in the IPO market may seem like an anomaly. However, a closer look at Jagged Peak's 61,000 net acres might reveal more about the attractiveness of its position. Created using our North America Well Analysis Tool, this acreage map indicates that the majority of southern Delaware basin deals over the past year have taken place to the west of Jagged Peak's position, in line with our sub-play boundaries.

Acreage position may be one of the most significant factors leading to the lower-than-expected IPO. Using a simple market cap to net acreage metric to compare acreage valuations, Jagged Peak is priced at US$46,000/acre (adjusted for flowing production), comparable to Permian outperformers RSPP and FANG. While these companies have portfolios that are more de-risked and contain a more robust production profile, Jagged Peak has noticeable gaps in its acreage position, with the Pecos acreage specifically less attractive than northern Ward County.

Although the Jagged Peak IPO came in under expectations, closing at US$14.33 per share on the first day of trading versus an expected range of US$16 to US$18 per share, the capital raised will still help fund the company's 2017 drilling program and repayment of debt under its credit facility. Jagged Peak might also be able to change investors' opinions this year as it uses the IPO proceeds to prove up its acreage position on the outskirts of our sub-play boundaries. The company is currently running three rigs in the basin and is looking to double that number throughout the year.