Discuss your challenges with our solutions experts

It's been 15 months since the oil price cycle entered its current downturn. To many, this served as a rude awakening that the industry had become complacent in regards to costs. The fact is that it faces a structural cost problem which was easy to hide in the days of US$100 oil, but less so today.

What often comes to mind when discussing cost inflation is the deepwater project billions over budget, or the drilling rig that was five times the historical cost. This is certainly a major issue and operators have been eager to show investors how they have responded; quarterly reports are full of numbers on capex cut and contracts renegotiated. These actions reduce cost and preserve cash, a key priority, but there are questions on whether these sorts of responses tackle the fundamental issues in our industry.

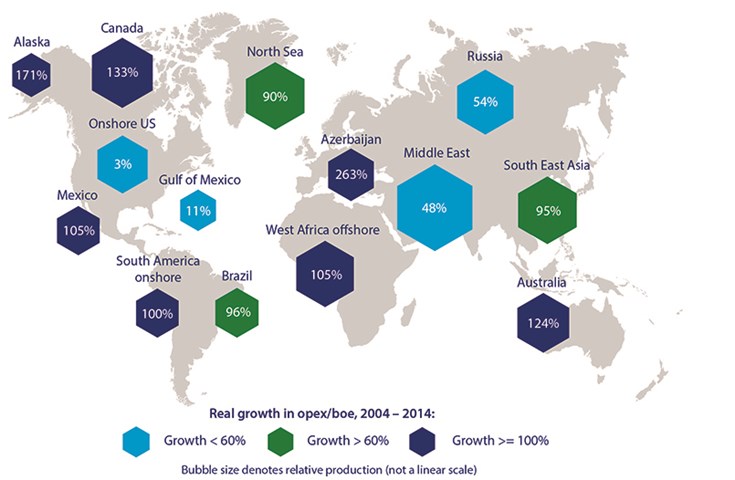

Globally, it costs 60% more (in real terms) to produce a barrel than it did 10 years ago. Many basins and development types have seen base costs expand by far more than this. For instance, the North Sea, West Africa and South-Eastern Asia saw costs per barrel grow by over 90% since 2005. Oil and gas can face unique challenges around remoteness, safety and regulation but it is hard to think of any other industry that would accept cost growth of this magnitude. Manufacturing, from aircraft and automotive to computing and machinery, has seen cost growth of just 5% over the last five years in the UK.¹

Operators have responded to this challenge — by reducing headcount, squeezing suppliers and cutting project scopes — but the question is whether they are doing so in a sustainable way. There is no doubt that third-party rates were due for a correction. There is clear evidence in many categories of significant rate reductions from service companies but the industry has seen significant cycles in the past. So the question this time around is: will anything be different?

The risk is that suppliers are being pushed to the limits in ways that will rebound onto operators when the cycle reverses. In the last oil price drop, this was clearly seen with day rates for jack-up rigs: rates fell by 35% between 2008 and 2011 before recovering by 2013. Service companies margins have collapsed in the last year (and, in fact, have been shrinking since 2009). Their obvious response is to cut capacity and consolidate to survive. This makes it increasingly likely that there will be another crunch when the market changes and operators start to increase activity levels.

Our recent industry cost survey highlights the divide between operators and suppliers. However, the differences are not always what might be expected. In certain areas, operators expect further reductions in price, and their expected reductions are beyond what the service companies are willing, or able, to offer. Conversely, when looking at subsea equipment or production and processing facilities, it is the suppliers who see the potential for greater savings. These savings depend upon the operators accepting new ways of working with them — although often discussed, this has rarely been implemented in a sustainable way.

This could prove a missed opportunity to make real performance improvements in day-to-day operations that are sustained beyond the industry cycle. Which is why, when oil majors claim to have "reset their cost base" for US$60 oil, I query whether this is really true, given that it depends on rate reductions that can be reversed and cuts that impact future production. Given the recent OPEC decision not to curtail supplies and the continuing downward pressure on prices, even $60 looks optimistic.

My view is that for the oil and gas industry to be truly sustainable at US$60 oil a new approach is needed — one that is smarter and less reactive, that works with suppliers rather than targeting them, and which locks in cost efficiency throughout the cycle.

[1] Office for National Statistics, MM19 Aerospace and Electronics Cost Indices, June 2015