Discuss your challenges with our solutions experts

How will Alberta's carbon emissions cap impact oil sands development?

1 minute read

The world is becoming increasingly carbon conscious and Alberta is a prime example of a jurisdiction attempting to walk the tightrope between adhering to responsible emissions legislation and attracting spend and development.

Although it boasts an abundance of oil and natural gas resources, the province is taking a more aggressive path on reducing emissions with the Climate Leadership Plan. This includes the implementation of a new carbon price on greenhouse gas pollution for all emitters, a legislated annual oil sands emission limit of 100 Megatonnes (Mt), and a 45% reduction of 2025 methane emissions from oil and gas.

While the plan provides comfort to local citizens and international buyers, it also raises meaningful questions for oil sands asset owners and investors.

Limited room to grow

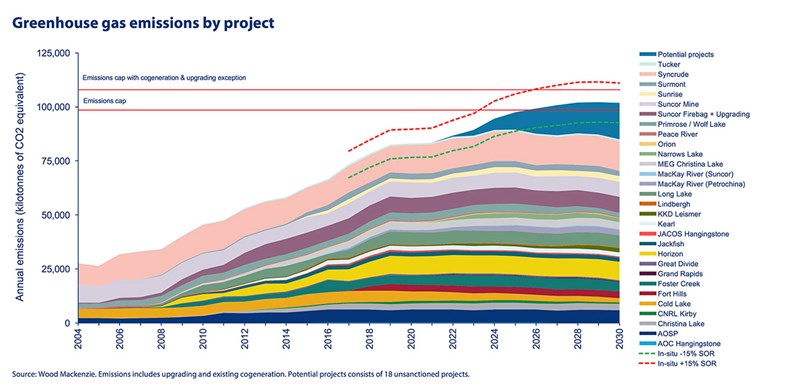

In 2016, oil sands emissions were approximately 66 Mt CO2e, leaving 34 Mt CO2e for future growth. We expect production from the 80+ development phases in our commercial outlook will reach 3.9 million b/d in 2025, emitting 90 Mt of greenhouse gases.

Development levels beyond our expectations are required for the cap to be reached but the potential does exist, with the oil sands boasting 170+ billion remaining recoverable reserves. More than 50 projects have also been excluded from our commercial outlook as we await greater certainty on project scheduling, financing or regulatory approvals.

The impact of technology

Development go-ahead for just a small portion of these potential projects would result in the cap being exceeded as early as 2027. However, given the track record of technological improvements and the renewed industry-wide focus on emissions reduction, we don't foresee the cap being reached until the end of the next decade at the earliest.

The chart above shows a project-by-project build up of emissions based on current efficiencies as well as our production and steam-oil ratio (SOR) forecasts. Technological improvements are expected to add more breathing room, with a 15% decrease in SOR predictions and efficiencies industry-wide — enough to fit a greater number of potential and current projects under the cap.

Carbon Competitiveness Regulation — a new pricing system

Alberta's existing carbon pricing system under the Specified Gas Emitters Regulation (SGER) requires large emitters (over 100 kt CO2e/yr) to gradually reduce their emissions intensity or pay a fine. This expires at the end of 2017 and will be replaced under the Carbon Competitiveness Regulation (CCR).

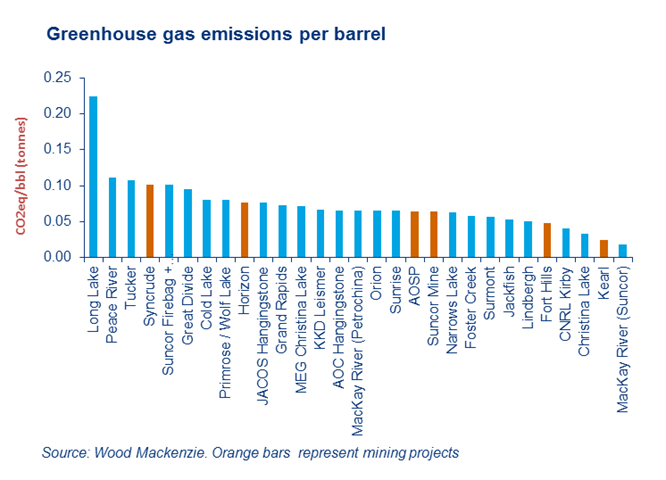

As a result of the change, we predict that projects will compete against each other to minimize emissions intensity and the associated carbon levy as opposed to their own project specific benchmarks. We expect the oil sands will have a per-barrel emissions standard or benchmark to adhere to, with current emissions intensities outlined below.

The magnitude of these fees is not yet clear, however we don't believe project economics will change radically in the near term. However, an increased price on carbon (particularly to the $50/tonne levy announced by the Canadian federal government) could potentially alter the economics of both producing and prospective projects.

How will legislation impact future oil sands development?

In December 2016, Statoil announced the sale of its entire oil sands portfolio to Athabasca Oil Corporation in a move that was seen as driven by decarbonisation efforts. However, while the decarbonisation theme is apparent, it's important to stress that cost concerns, as well as a return to a focus on offshore projects, also played a significant role for the Norwegian major.

Meanwhile, global oil prices remain the largest determinant for future plans in the oil sands. Producers are restarting investment plans in incremental phases — such as Cenovus at Christina Lake Phase G, Canadian Natural at Kirby North and MEG Energy at Christina Lake Phase 2B — while keeping an eye on changing legislation and technology possibilities that could make a difference.