The dramatic fall in oil prices — from over US$100 a barrel in mid-2014 to less than US$30 a barrel in early 2016 — has left the oil industry scrambling to contain the damage.

Upstream operators are deferring investment decisions, cutting activity and headcount and putting pressure on suppliers. Governments faced with falling oil revenues are reviewing fiscal terms. Service companies have responded to thin order books by reducing capacity. In the case of the Majors, cash for dividends now means increased borrowing.

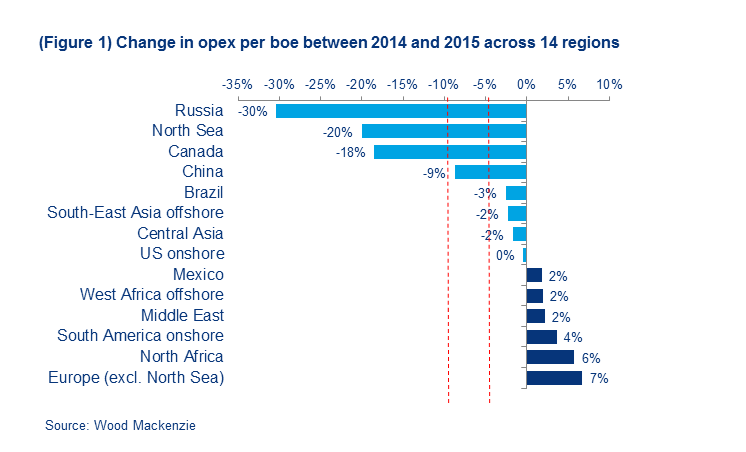

So has the industry finally reversed the long trend of opex inflation? Well, yes and no. At an aggregate level, a 9% annual reduction in opex per barrel costs is admirable and in line with the trend we noted in December. However, this is skewed by the roughly 30% reduction in Russia, which is largely due to the fall in the rouble, as well as a sizeable domestic supply chain. Stripping out Russia shows a global reduction of just 4% with large variations between regions and operators.

Looking at the top 14 producing regions around the world reveals a significant disparity: from about 20% in the North Sea to a 7% increase in Europe (Figure 1). Most surprisingly, six regions, accounting for 41% of total global hydrocarbon production, saw cost inflation both in 2014 and 2015 (excluding the Middle East, the remaining five regions account for 14% of global production).

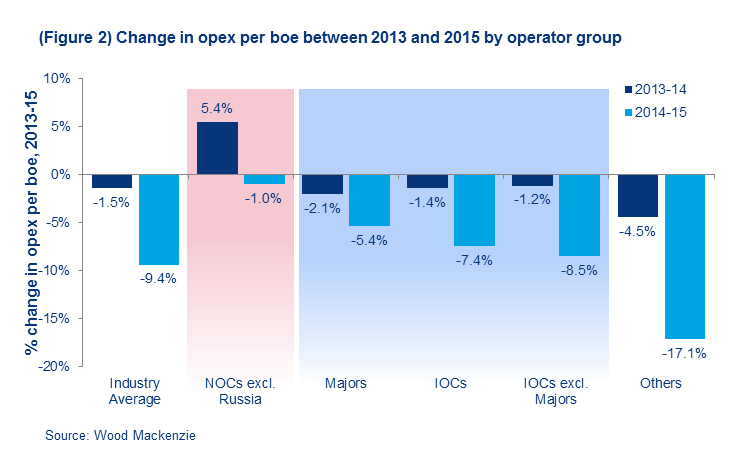

Large variations are also present across operator groups (Figure 2). Between 2014 and 2015, NOCs only managed a 1% decrease in opex per unit costs, and this was after average costs increased in 2014. In comparison, the Majors reduced opex by over 5% in 2015 and the IOCs (excluding the Majors) managed even better, with a total reduction of 8.5%. This indicates that NOCs started their cost reduction drives later than most and perhaps did not push as hard.

Given that the low price environment is likely to be here for some time yet, the question is whether the industry can use this moment as an opportunity to move to a truly sustainable cost structure.

We believe that since the oil price is unlikely to come to the rescue, the industry needs to do more to address the structural cost problems resulting from a decade of sustained cost inflation.