Emissions intensity: portfolio composition is the key

Understanding the drivers of emissions is critical to preparing for a lower carbon future.

1 minute read

Gavin Law

Senior Vice President, Emissions & Low Carbon Fuels Consulting

Gavin Law

Senior Vice President, Emissions & Low Carbon Fuels Consulting

Latest articles by Gavin

-

Opinion

Is natural gas more emissions intensive than coal?

-

Opinion

Emissions intensity: portfolio composition is the key

Companies are under increasing pressure to provide investors with additional information on the emissions associated with their upstream operations. Understanding the key drivers of company CO2 emissions and in particular emissions intensity is fundamental in helping companies manage their portfolios for a lower carbon future.

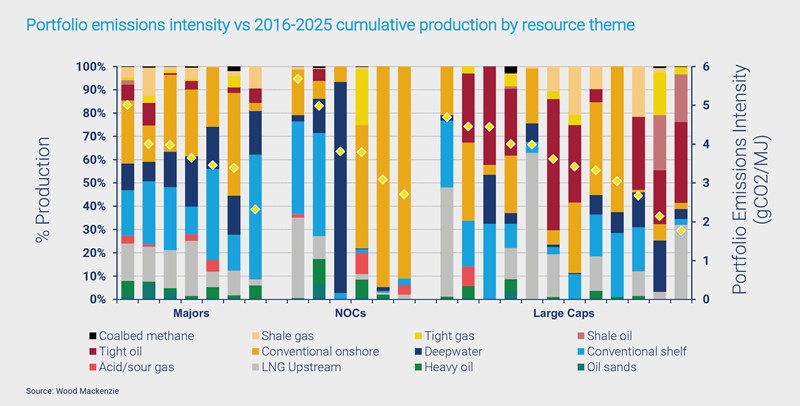

Several metrics are being used to compare companies’ emissions with their peers’. While absolute emissions of greenhouse gasses (GHGs) are important, it is not surprising that the biggest producers of oil and gas have the largest absolute emissions: the Majors have higher emissions than the Large Caps.

To compare companies on a level playing field, a fairer relative measurement is emissions on a per unit of production basis, or emissions intensity. This defines the amount of carbon dioxide (CO2) emitted by each company to produce a barrel of oil (or equivalent).

Based on this metric (measured in g(CO2)/MJ), companies show a significant range between <2 and 8 g CO2/MJ (or <12 to 48 kg CO2/boe). This implies that for the same amount of energy produced (in the form of oil or gas) some companies emit less than a quarter of the CO2 that other companies do.

Why the big difference?

While certain activities involved in the production process, such as flaring or venting of CO2, or emissions reduction initiatives, can have a significant impact on an individual asset’s overall intensity, one of the key factors in driving a company’s overall emissions of CO2 is the composition of its portfolio.

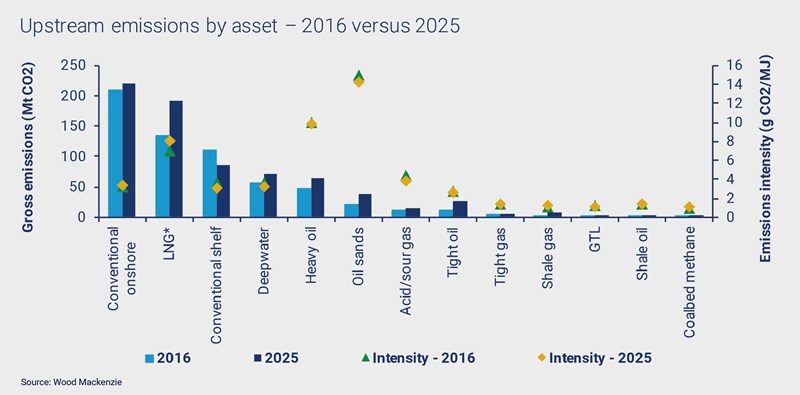

Since different resource themes such as LNG, heavy oil, or deepwater, demonstrate significantly different emissions intensities, a company’s balance of asset types can significantly affect its overall emissions intensity.

Since different resource themes have significantly different emissions intensities, a company’s balance of asset types can significantly affect its overall emissions intensity.

As a result, companies which have a large proportion of emissions intensive resource themes within their portfolio typically have higher overall emissions intensities.

Emissions rising faster than production

Our analysis suggests that over the next ten years upstream industry emissions will increase slightly faster than production. This is because three of the primary industry growth themes for the next ten years – LNG, oil sands and heavy oil – have emissions intensities two to three times greater than conventional oil or gas production.

While emissions mitigation efforts are undoubtedly increasing, companies will need to work hard to offset the effect of changing portfolios.