Discuss your challenges with our solutions experts

Downstream integration: a peak demand strategy for NOCs

1 minute read

Alan Gelder

VP Refining, Chemicals & Oil Markets

Alan Gelder

VP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

Assessing the refineries at risk of closure

-

Featured

Oils & chemicals 2024 outlook

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Survival of the fittest refineries

-

Opinion

Will international shipping be net zero by 2050?

-

Opinion

Are APAC’s retail markets full of Eastern promise for oil majors?

Updated on 16 November 2018 with additional insight and data points.

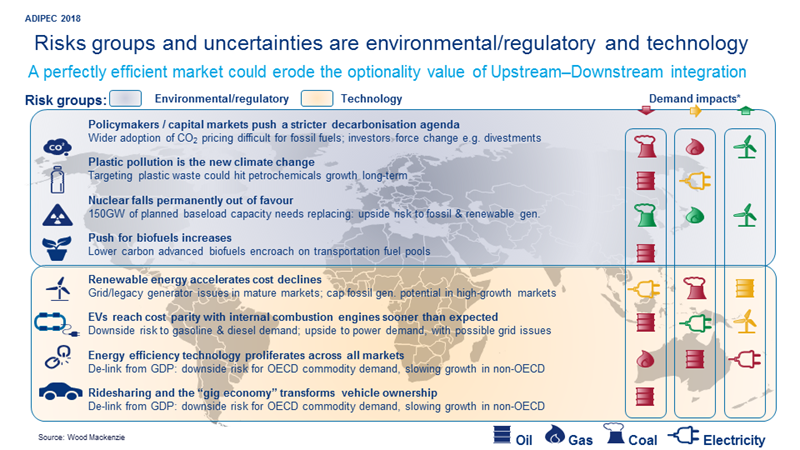

The prospect of peak oil demand undoubtedly introduces risks to the world's crude exporters. Although we predict global demand to continue to grow through 2035, there are already signals that decline could be coming. What does the scenario look like for resource-rich NOCs? And why might vertical integration be the most promising peak-demand strategy? I posed these questions at ADIPEC 2018, where I also explored the risks and uncertainties surrounding upstream–downstream integration.

NOCs hold the lion's share

Demand for transport fuels (gasoline and diesel) has peaked already in Europe and is expected to peak in the US in the next five years and globally by 2030. Certain sectors are already feeling the early effects of global demand decline. In a scenario of early and radical energy disruption, it's possible that if market elements are just so — slower petrochemicals growth, faster electric vehicle adoption — global demand could peak as early as 2025.

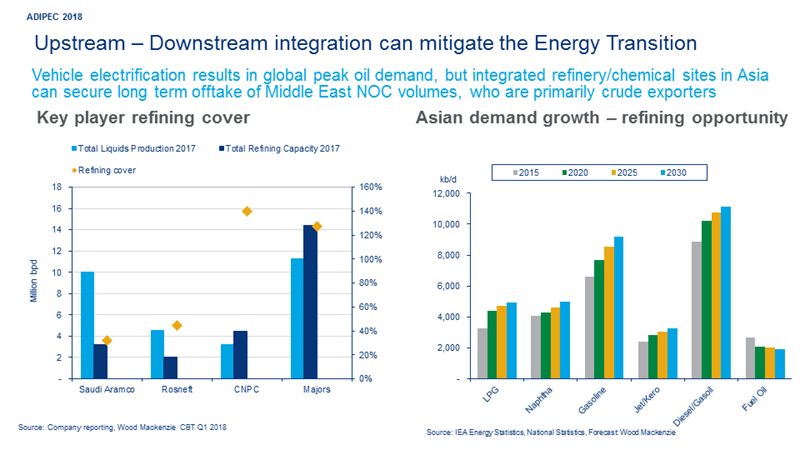

NOCs control approximately 63% of the world’s remaining commercial oil reserves, or 945 billion barrels, with a wide range of production costs. Those at the higher end of that cost curve are more vulnerable to a disruption in the market. With few means to adapt for a low-carbon future, the best strategy for these resource-rich NOCs must focus on markets in need of long-term, low-cost oil.

Domestic strategy expands to emerging economies

In recent years, many resource-rich NOCs have fed their crude into domestic refineries to meet demand growth and benefit from a low-risk investment. But now their focus is shifting to international refining in emerging economies, particularly in Asia, where demand is growing. These resource-rich, export-oriented NOCs can provide capital for these refineries while securing additional outlets for their crude production.

The challenges of this investment strategy, however, are complex. Companies must carefully consider the host country's ability to absorb large volumes of additional product supply. For instance, both China and India are large growth markets, but are structurally surplus refining capacity – any new investment in refining capacity would only further increase product exports.

Indonesia: desirable demand growth and fuel balance

With China and India forecast to remain net exporters in 2025, Indonesia presents attractive near-term investment opportunity given its current production deficit and projected demand growth. Resource-rich NOCs, Rosneft and Saudi Aramco, recently both showed considerable interest in joint venture opportunities in Indonesia.

Vertical integration for the win

Beyond commercial returns, international refining also means more employment and capability development opportunities, as well as stronger inter-government relations. And in a future environment of declining global oil demand, ownership of highly competitive refining assets could be critical to sustaining upstream supplies for NOCs.

The 'winners' in this environment will be those resource-rich NOCs with integrated business models that will sustain them in a competitive overall supply chain as global demand falls.