How can governments introduce more competitive fiscal terms?

With capital scarce, terms must be attractive to win new investment.

1 minute read

Graham Kellas

Senior Vice President, Global Fiscal Research

Graham Kellas

Senior Vice President, Global Fiscal Research

Over 30 years, Graham has advised on taxation matters and supported complex fiscal negotiations.

View Graham Kellas's full profileIn an environment where finances are stretched and companies are focusing on reducing breakevens on new projects, only the lowest cost and highest return investments will get the green light. But generating profits at current prices is not simply down to a company's ability to keep costs below current prices; governments also play a key role.

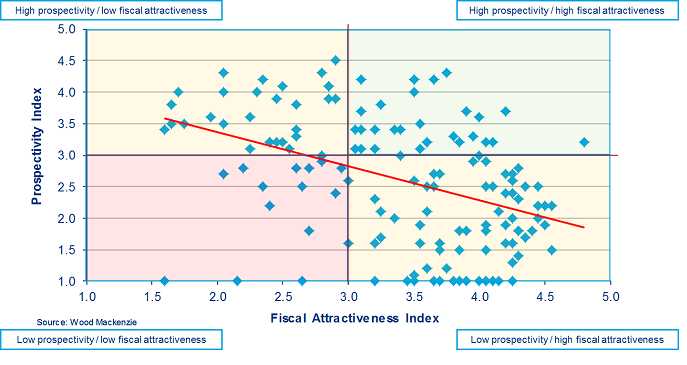

While prospectivity is invariably the number one driver for investment decisions, the potential value of discoveries is heavily influenced by a government's fiscal regime. And with capital scarce, terms must be competitive if a government is to have any success in attracting new investment. As a result, many governments around the world have begun reviewing their fiscal terms.

What makes a fiscal system 'competitive'?

Governments wanting to ascertain the competitiveness of their terms must first establish their baseline competitiveness on a 'pre-government' basis. This requires :

• Identifying who its competitors are

• Determining prospectivity

• Estimating costs and prices associated with future discoveries

Rather than consisting of the same competitors each time, the peer group competing with a given government for investment changes according to the potential investor, who may be focused on a specific region, basin maturity level or type of investment. Assessing prospectivity relies on available data or speculation, as does the process of estimating costs and prices. These initial considerations establish a baseline for evaluating a fiscal system's competitiveness.

The final step is to add in the fiscal terms. How does the 'pre-government' competitive position change once this licensing and fiscal system is applied? Does the fiscal system reduce or boost the relative attractiveness of the opportunities on offer, compared to other countries?

How is a government's 'fair share' of revenue determined?

Most attention in fiscal policy is given to the sharing of revenue associated with future discoveries, which has a significant impact on the perceived competitiveness of a government and its fiscal system. Is it 'fair' for the government to receive revenue without sharing in the risks?

Arguably yes, because it is the owner of the resources and should receive a share of their value when produced. But what share of revenue is 'fair'? Is it a fixed number for all projects, or should it vary as project economics vary? Should it be fixed for the life of a project or vary throughout? If the government gets revenue from indirect taxes on investment, before the project generates any revenue, is that part of its 'fair share'?

We discuss this issue — along with whether to target the fiscal system on revenues or profits, whether to fix the fiscal terms or enable companies to bid them, and how to assure investors that terms will remain stable in future — in greater depth in our latest insight.

Fiscal competitiveness: when $50 is only $25

To remain competitive in the current climate and attract new investment, governments around the world are reviewing their fiscal terms. As they make these big decisions, they will be asking themselves:

- How do we remain 'competitive', while retaining a 'fair share'?

- Do we target the fiscal system on revenues or profits?

- Do we fix the fiscal terms to allow companies to bid them?

- How do we assure investors that terms will remain stable in the future?

We discuss each of these issues in detail in our latest insight. Complete the form above to download a copy.

Find out more

Graham Kellas will be hosting an Oil and Gas Fiscal Week in collaboration with CWC. The week will include a Government Fiscal Summit and Fiscal Systems Training Course where we'll provide you with the tools and analysis to optimise fiscal competitiveness and investment. Find out more and register here.