1 minute read

Graham Kellas

Senior Vice President, Global Fiscal Research

Graham Kellas

Senior Vice President, Global Fiscal Research

Over 30 years, Graham has advised on taxation matters and supported complex fiscal negotiations.

Latest articles by Graham

-

The Edge

Why the transition needs smart upstream taxes

-

Featured

Energy fiscal policy 2024 outlook

-

Featured

Conflicting ambitions will shape the upstream fiscal landscape in 2023 | 2023 outlook

-

Opinion

Fair share: why a new approach to mined energy transition resources is needed

-

Featured

Stage set for tougher fiscal terms for upstream operators in 2022 | 2022 outlook

-

Opinion

How carbon pricing could reshape upstream oil and gas economics

Investors remain perplexed by the US tight oil phenomenon. But the economics of tight oil actually share all the characteristics of conventional deepwater developments.

Graham Kellas

Senior Vice President, Global Fiscal Research

Over 30 years, Graham has advised on taxation matters and supported complex fiscal negotiations.

Latest articles by Graham

-

The Edge

Why the transition needs smart upstream taxes

-

Featured

Energy fiscal policy 2024 outlook

-

Featured

Conflicting ambitions will shape the upstream fiscal landscape in 2023 | 2023 outlook

-

Opinion

Fair share: why a new approach to mined energy transition resources is needed

-

Featured

Stage set for tougher fiscal terms for upstream operators in 2022 | 2022 outlook

-

Opinion

How carbon pricing could reshape upstream oil and gas economics

At first glance, it is difficult to compare these two divergent growth themes. Yet we’ve shown that they are more similar than you think.

In the first of our three-part series, we explore how both themes have transformed in the last few years. While fundamental differences exist, the expenditure and cash flow profiles of these very different plays are converging. And in our second insight, we take it a step further to ask: what happens if we use the same investment metrics to evaluate both propositions?

That analysis was conducted on project fundamentals: revenue and costs only. In part three, we push our study further still and assess the impact of fiscal terms: how do we factor in the cost of acquiring land? What about royalty rates? How big is the resource owner’s share of value? And what’s the project risk?

Here, we summarise our main findings. Download your complimentary copy of the report to get the full analysis.

Deepwater can’t compete with tight oil on fiscal terms

A wide range of fiscal terms applies to both tight oil and deepwater. Tight oil investors that own land can have ‘royalty-free’ production. Combined with relatively low state and federal taxes in the US, the resource owner share of project value for tight oil landowners is the lowest of any major producing country in the world. No deepwater terms can compete with this.

Weighing up project risks

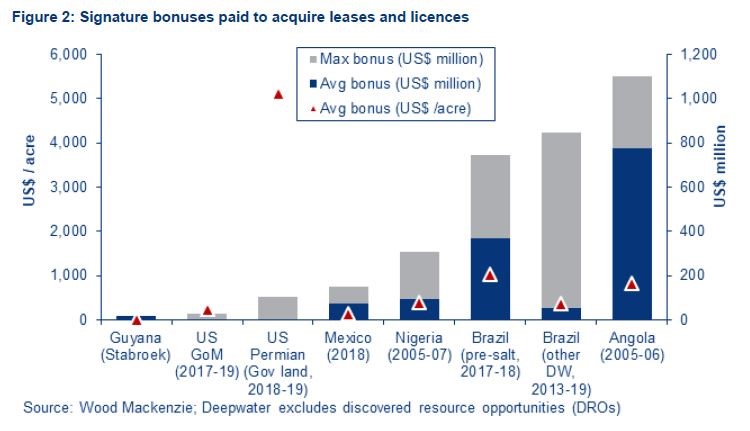

Tight oil leases contain known resources; it’s the quality and future commerciality of these resources that carry the risk. In contrast, deepwater exploration may result in multiple large discoveries, spread over a large area (think Stabroek in Guyana). Or it may result in no commercial discoveries at all. Discovery risk has a significant impact on the price investors are willing to pay for deepwater acreage.

Factoring in fiscal terms

Most tight oil production is subject to royalty, and the rates can be high. As royalty is based on revenue, not profit, this has a significant impact on margins and breakeven prices. Seemingly good projects can quickly turn bad if the royalty rate is too high. And the same is true for deepwater projects, where terms have stiffened following exploration success.

How do returns compare if we invest the same amount in tight oil and deepwater? Download the full insight to get an in-depth analysis of the numbers.

Quality acreage comes at a premium

Deepwater licence areas tend to be several orders of magnitude larger than tight oil and bonuses payable are much lower on a US dollar per acre basis. But the actual sums payable can also be huge – hundreds of millions of dollars – with no guarantee that commercial production will result.

Graham Kellas

Senior Vice President, Global Fiscal Research

Over 30 years, Graham has advised on taxation matters and supported complex fiscal negotiations.

Latest articles by Graham

-

The Edge

Why the transition needs smart upstream taxes

-

Featured

Energy fiscal policy 2024 outlook

-

Featured

Conflicting ambitions will shape the upstream fiscal landscape in 2023 | 2023 outlook

-

Opinion

Fair share: why a new approach to mined energy transition resources is needed

-

Featured

Stage set for tougher fiscal terms for upstream operators in 2022 | 2022 outlook

-

Opinion

How carbon pricing could reshape upstream oil and gas economics

How the energy transition could create tougher fiscal terms for upstream investors

Read now

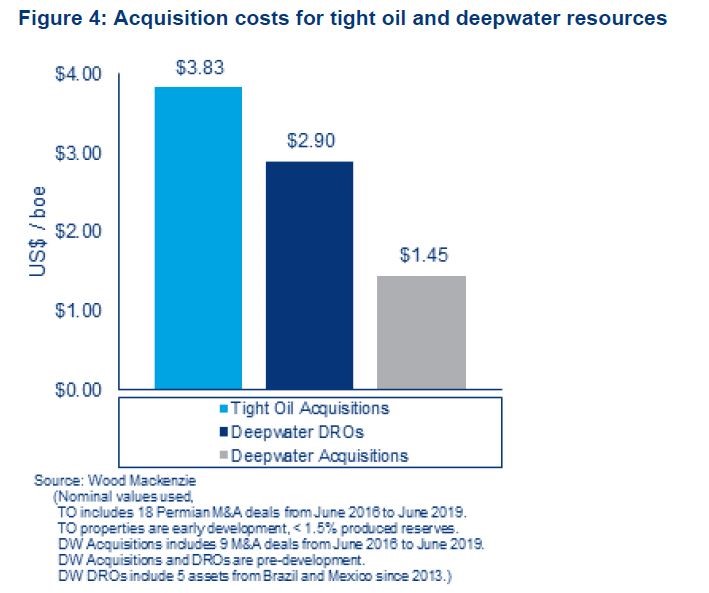

Most US tight oil and global deepwater acreage can be acquired for small signature bonus payments – but highly prospective acreage is expensive. At first glance, this comparison suggests that discovered deepwater resources are less expensive than tight oil. But this only tells part of the story.

There were far fewer deepwater transactions than in the Permian in the period covered by this chart (June 2016 to June 2019). And the popularity of the Permian meant that investors were keen to pile in and acquire acreage in one of the world’s few oil hotspots.

We compare bonus payments in more detail in our insight. Fill in the form on this page to get the full analysis.

So, where will investors get the most bang for their buck?

There is no such thing as a typical tight oil or deepwater asset. Instead, there is a wide spectrum of assets generating a huge range of values. Tight oil can be more valuable than deepwater. And vice versa. It all depends on the specific assumptions associated with the opportunities on offer. In short, it comes down to what matters most to the investor.

What do investors need to consider when comparing deepwater against tight oil? Download the full three-part series for an in-depth analysis of the economics.

Get part 1 here: Why tight oil and deepwater are more similar than you think

And part 2 here: Tight oil or deepwater: which is more valuable?

And get part 3 when you fill in the form on this page.