Get Ed Crooks' Energy Pulse in your inbox every week

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

The charge made by climate campaigners has generally been that oil companies have downplayed the risks of climate change in public, while acknowledging the threat in private. New York’s case was in a sense the opposite of that.

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

The alliance that evolved into the European Union began as the European Coal and Steel Community in 1952. So it is in keeping with the institution’s heritage that one of the most ambitious initiatives in its history covers energy and industrial policy. The European Green Deal, launched by the European Commission on Wednesday, was described by Ursula von der Leyen, the commission’s president, as a “man on the moon moment”, but that really underestimates the scale of the changes that are planned.

The objective is to make Europe “the world’s first climate-neutral continent by 2050”, which the Commission describes as “the greatest challenge and opportunity of our times”. The agenda of measures needed to set the EU on a path to reach that goal gives a sense of just how ambitious it is, with almost 50 “key actions”, including the following:

- a strategy for adding more offshore wind power;

- more demanding emissions standards for combustion-engine vehicles;

- support for zero-carbon steel;

- a Just Transition Fund to help regions hurt by the shift away from higher-emitting industries.

The plan could be one of the most important deals in Europe for a generation, the economist Mariana Mazzucato wrote in the Financial Times. But von der Leyen acknowledged that the launch of the plan was only “the start of a journey”, and it now needs to win support from EU member states. Many are sceptical about adopting such a radical agenda for decarbonisation; Poland, Hungary and the Czech Republic were already raising objections on Wednesday, Reuters reported.

One of the most noteworthy aspects of the plan is the proposal for a “carbon border adjustment mechanism”, in other words, an import tariff for some goods, based on the emissions created when they are produced. The mechanism would help EU industries otherwise vulnerable to competition from countries without such stringent curbs on emissions. It could also be adopted by other countries. In the US Joe Biden, the front-runner to be the Democratic party’s candidate for president, has pledged that if elected his administration would “impose carbon adjustment fees or quotas on carbon-intensive goods from countries that are failing to meet their climate and environmental obligations”.

Valentina Kretzschmar, WoodMac’s director of corporate research, said the impact of the Green Deal on energy companies could be significant, particularly because of the move to raise the EU’s target for cutting carbon emissions by 2030, from 40% currently to at least 50%.

“Pressure on European fossil fuel producers to follow Repsol’s lead in committing to net-zero carbon by 2050 will continue to ramp up,” she said.

“And oil and gas exporters to Europe, including Russian gas and US LNG, could face a diminishing demand outlook and an impact on their revenues from carbon taxes.”

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page and we'll send you an email when the latest issue goes live

- Bookmark this page to have access to the full archive of Energy Pulse

Another climate lawsuit fails

In the absence of any federal policy to address the threat of climate change, US states and cities have in the past few years renewed efforts to use litigation to put pressure on energy companies over their greenhouse gas emissions. These attempts have suffered repeated setbacks, however, and this week the campaign fell to another defeat, when New York’s supreme court concluded that ExxonMobil had not made any “material misrepresentations” to investors about how its investment decisions are affected by its views on climate risk.

The case, brought by New York state’s attorney-general, was always something of an unusual one. The charge made by climate campaigners has generally been that oil companies have downplayed the risks of climate change in public, while acknowledging the threat in private. New York’s case was in a sense the opposite of that: its complaint alleged that ExxonMobil had given investors the impression that it was taking due account of climate risk by using a “proxy cost of carbon” of up to $80 per ton of CO2 by 2040 in OECD countries, but in practice was understating the risks by internally using lower numbers to guide some of its investment decisions, particularly in the oil sands of Alberta.

New York state law, including the Martin Act, prohibits any material misrepresentation when companies sell shares or conduct business. In his decision, however, Justice Barry Ostrager concluded that the state had failed to make its case, and ruled that ExxonMobil had not made any material misrepresentations. The company mentioned the projected $80 per ton proxy cost of carbon by 2040 in several places, including its 2014 reports Energy and Climate and Energy and Carbon – Managing the Risks, but the judge ruled that those discussions were not materially misleading, particularly in the context of ExxonMobil’s other disclosures such as its annual reports and its Outlook for Energy publication. He also pointed out that the state had not produced statements from any investors who said they had been misled, and described the testimony of the state’s expert witnesses as having been “eviscerated on cross-examination”.

The judge made clear that ExxonMobil did not deny that greenhouse gas emissions from oil and gas contribute to global warming, but he added: “this is a securities fraud case, not a climate change case.” His decision is clearly written, and worth reading in full if you are interested in energy companies and climate risk. One striking point was his observation that the Energy and Carbon report “had no market impact and was, as far as the evidence adduced at trial reflected, essentially ignored by the investment community.”

Chevron writes down asset values

Chevron announced that it expected to take a non-cash after-tax charge of $10 billion-$11 billion in the fourth quarter for impairments on the values of some of its assets, after revising down its view of long-term commodity prices.

The asset writedowns also reflect a shift in capital allocation. Chevron said it would “reduce funding to various gas-related opportunities”, including its assets in the Marcellus and Utica shales and the proposed Kitimat LNG export plant in British Columbia, as well as other international projects. The company is “evaluating its strategic alternatives for these assets, including divestment.” Over half the total charge relates to the Appalachian shale gas assets, many of which were acquired when Chevron bought Atlas Energy in 2010 for $4.3 billion. Another asset affected is the Big Foot oil project in the Gulf of Mexico, which went into production in November last year.

The writedown was disclosed along with Chevron’s $20bn capital and exploration budget for 2020. The total is the same as was planned for 2019, but there are some differences in the breakdown. Planned spending in the Permian basin next year is $4bn, up from the $3.6bn that was announced as the plan for 2019. Meanwhile, intended global exploration funding for 2020 is down to $1bn, compared to $1.3bn planned for this year.

As Liam Denning of Bloomberg Opinion put it, Chevron’s push to streamline its portfolio was a signal that the era of the “sober-major” is upon us.

Repsol, BP and Equinor have all in the past few months announced impairment charges for writing down the value of assets. WoodMac’s Tom Ellacott, senior vice-president of corporate research, said he expected more writedowns to follow in the fourth quarter reporting season.

A muted impact from the IMO 2020 ship fuel regulations

From the time the International Maritime Organization first agreed its new global rules for the sulphur content of shipping fuels back in 2016, there were warnings that they could cause huge disruption in world crude and products markets. With three weeks to go before the regulations take effect on January 1, it seems clear that the impact has been less traumatic than some had feared. Alan Gelder, WoodMac’s head of oils analysis, said back in October that he did not expect much impact on key markers such as Brent crude, and so far our view has been proved right. The regulations have helped support crude prices at time when there is excess supply in the market, but have not caused any dramatic price spikes.

Many shippers are now buying the new IMO-compliant very low sulphur fuel oil, which is priced at a premium to crude, rather than high sulphur fuel oil, which is at a discount, so freight costs are going up. WoodMac expects the increased demand for distillate fuel to support crude prices in 2020. But warnings that the regulations could send crude prices to $100 a barrel and beyond have been unfulfilled.

The US Senate’s energy and natural resources committee this week held a hearing on the regulations, discussing the reasons why the shipping and fuels industries had been able to adapt without creating the market turbulence that some forecasters had expected.

Lisa Murkowski, the committee’s chairman, observed there seemed now to be “something resembling a consensus among many analysts that the impacts of IMO 2020 will be less than what was projected just a year ago”. She said the refining and shipping industries had responded to the new regulations, by increasing production of low sulphur fuels and fitting exhaust gas scrubbers to allow some ships to continue using high-sulphur fuels. It was critical for compliance to continue at full speed, she added: “There is no stopping IMO 2020”.

There had been suggestions that the Trump administration might try to push the IMO to delay enforcement of the new rules. However, Derrick Morgan, senior vice-president at the American Fuel and Petrochemical Manufacturers, which represents US refiners, told the committee that his group “supports maintaining an on-time and consistent adoption of IMO 2020”. He said the US refining industry was “well-positioned to be a leader in producing and supplying lower sulphur marine fuels to a global shipping fleet and realising the environmental and health benefits expected from IMO 2020.”

There will, however, be a short grace period of a couple of months that should help the changeover, as the full enforcement regime does not kick in immediately. The IMO rules that make it illegal for ships without exhaust gas scrubbers even to carry high sulphur oil in their fuel tanks do not take effect until March 1.

In Asia, compliance with the new rules is likely to start at about 80%-85%, according to Sushant Gupta, WoodMac’s research director for oils. But he expects that level to improve quickly.

In brief

Greta Thunberg, the 16-year-old Swedish climate campaigner, has been named Time magazine’s Person of the Year. Thunberg spoke at the COP 25 climate talks in Madrid, saying the meeting “seems to have turned into some kind of opportunity for countries to negotiate loopholes and to avoid raising their ambition”.

The key issue at the talks is the implementation of Article 6 of the 2015 Paris climate agreement, which will have important implications for international carbon markets. Kathryn Harrison of the University of British Columbia reported that negotiators remained “a long way from agreement” on how the implementation should work.

Shares in Saudi Aramco began trading following the company’s listing on the Tadawul exchange. They jumped 10% on their debut, and a further 10% on Thursday, before dropping back to close 4.55% higher on the day. During the day the company’s market capitalisation broke through the $2 trillion valuation long sought by Saudi Arabia’s leaders, although at the closing share price of 36.80 riyals it was just a little below that figure.

Concerns about methane’s role as a greenhouse gas have contributed to a growing focus on leaks and venting from the oil and gas industry in recent years. An international group of scientists under the umbrella of the Global Carbon Project has been looking at building up an integrated picture of the sources and sinks of atmospheric methane, and a discussion paper including some of their initial conclusions was published recently. The ranges in the estimates are wide in some cases, but the broad picture seems straightforward. Over 2008-17, based on the central estimates, methane emissions from the oil and gas industry averaged about 79 million tons per year, roughly double the 42 million tons from the coal industry. The central estimate for agriculture and waste, meanwhile, is more than twice as large, at 206 million tons per year.

Harold Hamm is giving up the position of chief executive at Continental Resources, which he has held since he founded the company 52 years ago in 1967 at the age of 21. He is “stepping up” to become executive chairman on January 1, the company said, and will be replaced as CEO by Bill Berry, a former ConocoPhillips executive who joined Continental’s board as a director in 2014.

US onshore wind generation capacity has exceeded 100 gigawatts. Meanwhile Britain’s wind power industry hit a new record output at more than 16 GW on Sunday night.

Bush fires that covered Sydney with hazardous smoke have raised the pressure on the Australian government to do more to tackle the threat of climate change.

What has been described as the world’s first commercial fully electric aircraft completed a test flight in Vancouver. The flight lasted less than 15 minutes, CNN reported.

Tesla’s Model 3 electric cars, built in China, will be eligible for state subsidies there, the company said last week.

And finally: Tesla’s prototype electric Cybertruck does not yet have a driver’s side mirror or windscreen wipers. But Elon Musk has been driving it around Los Angeles all the same, attracting his usual blaze of publicity and possibly persuading even more potential future customers to put down their $100 deposits. The Cybertruck is intended to go into production in “late 2021”.

Smart reads

Simon Flowers — Kicking the hydrocarbon habit, part II

Nick Butler — Moscow is being forced to change its energy strategy

Neil Hume — Fossil fuel producers lay out case for big final rally

Jonathan Thompson — Wyoming’s coal-fired economy is coming to an end

David Roberts — Could squeezing more oil out of the ground help fight climate change?

Quote of the week

“The ambitious implementation of developed countries’ commitments to provide support to developing countries is a precondition to any discussion on progression of current commitments.” — In a joint statement at the COP 25 climate talks, the environment ministers of the BASIC group of countries — Brazil, South Africa, India and China — said they had “grave concerns” about the progress of international action to address the threat of global warming. In particular, they highlighted a “lack of progress” on the financial aid, technology transfer and other support promised in the 2015 Paris agreement to help them curb their greenhouse gas emissions.

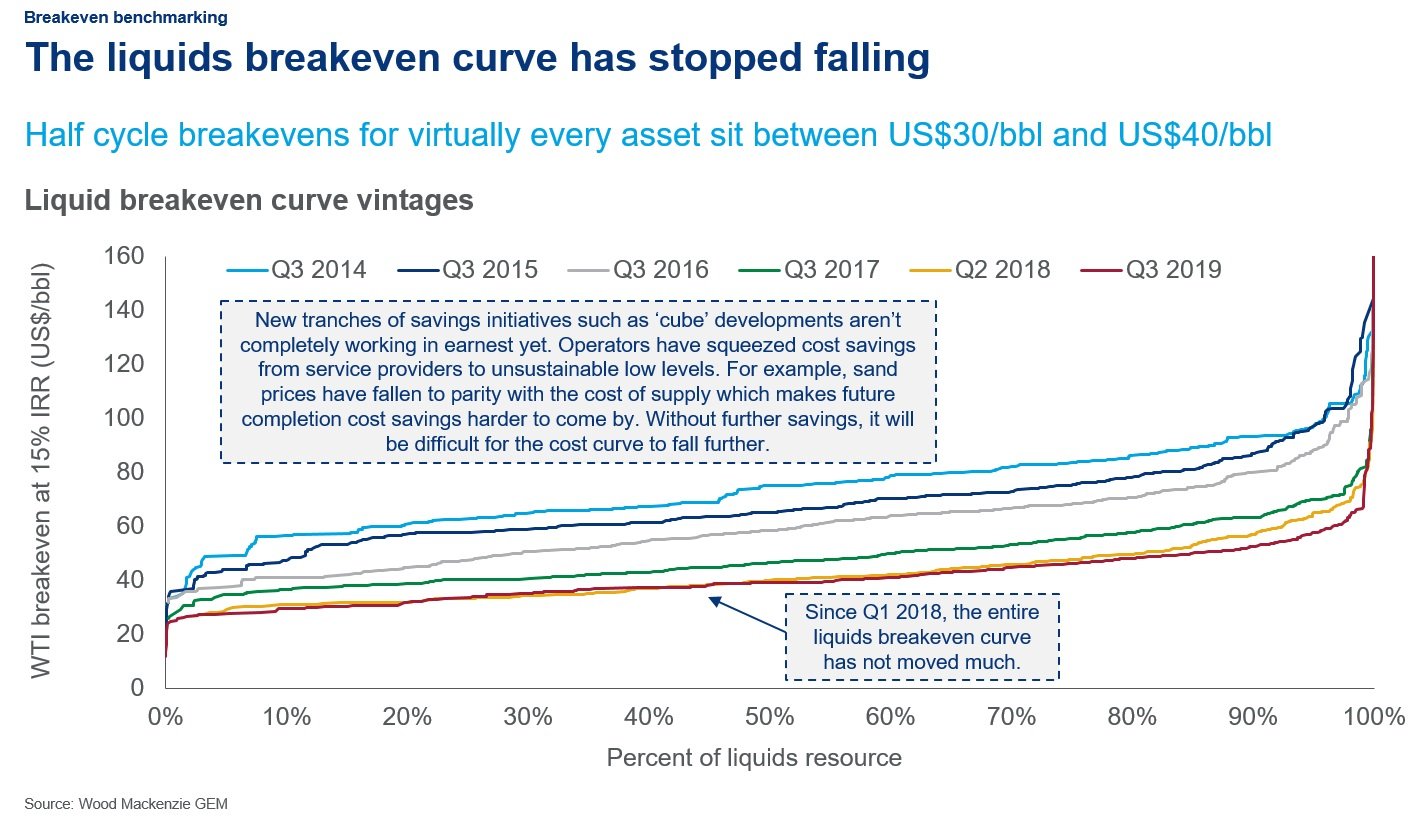

Chart of the week

This comes from a presentation that Ryan Duman, WoodMac’s principal analyst for Lower 48 upstream research, gave recently. A steady decline in production costs has been crucial to the shale oil revolution in the US over the past decade. But now it looks as though, since early last year, those costs may have bottomed out. The successive lines here show cost curves year by year getting lower each time, until 2019. The promise of ever-cheaper barrels, which has been an important element in the case for investing in shale, now seems to be fading away.

Coming next

The big event in the world of energy over the next couple of days will be the conclusion of the COP 25 climate talks in Madrid, and in particular the decision, if any, on the implementation of Article 6 of the Paris agreement.

Energy Pulse will be back next week with a look ahead to what we can expect in the world of energy and commodities in 2020. See you then.