Could US gas producers capture more margin?

After a year of torpor, the US gas market springs into life

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

Where did that come from? A year of torpor, then the US gas market springs into life. Henry Hub price has shot up to over US$4.50/mmbtu in a volatile week after flat-lining below US$3/mmbtu since last March.

The cause - a perfect storm: low inventory, cold weather, no wind generation and supply freeze offs. The market was short winter gas, traders scrambled to cover positions and the rest, as they say, is history.

I chatted with Kristy Kramer, Head of US Gas Research, about the implications.

First, have US gas market fundamentals changed?

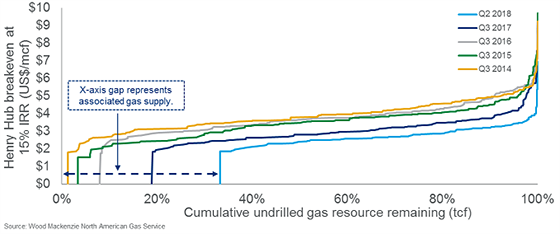

No way. The market has more gas than it can cope with over any time horizon other than this kind of short-term squeeze. The emergence of huge volumes of Permian gas has structurally lowered the cost curve for the foreseeable future. Permian gas comes, effectively for free, produced in association with tight oil.

Zero cost Permian gas made up just 2% of US gas resource in 2014; now it’s well over one-third with the continued development of tight oil. That means higher cost gas has been pushed out of the market, including dry gas in the Marcellus in the North East, which is a long way from the Gulf Coast, the biggest market.

We lowered our Henry Hub forecasts this summer for the fourth time in succession to reflect the changing cost curve. We don’t expect Henry hub to exceed US$3/Mcf in real terms before 2025 or US$4/Mcf before 2031. This blip doesn’t change that view, but it is a timely reminder that Henry Hub, like any commodity, can be prone to extreme volatility.

Second, is it good news for producers?

Yes, though it’s more a psychological fillip than a real boost to cash flow. E&Ps, especially dry gas producers, have been under the cosh as prices have slid. They’ve had to adjust budgets to work with sub-US$3/Mcf gas, and any jump in price beyond that helps. In practice there are few able to deliver volumes at short notice, and with access to pipe to get it to market, to take advantage of a brief rally. Most producers sell forward much of their output and won’t make any more money.

The Henry Hub price is key to US LNG’s competitiveness

Kristy Kramer

Vice President, Head of Gas and LNG Consulting

Kristy brings over fifteen years of gas and energy industry experience to her role leading our Gas and LNG Consulting.

Latest articles by Kristy

View Kristy Kramer's full profileBy 2023, US LNG will make up almost one-quarter of the global market.

Third, how will it affect future buyers of US LNG?

Henry Hub-priced US LNG is the big new thing in the global gas market. Volumes are currently modest at around 30 mmtpa. But as the new projects being built are brought on stream that number will treble to 90 mmtpa within five years. By 2023 US LNG, currently largely Henry Hub priced, will make up almost one-quarter of the global market. So the Henry Hub price is key to US LNG’s competitiveness against other LNG volumes which typically will be linked to oil prices.

Around half of US LNG is sold to buyers free-on-board (FOB). The plant operator does the gas procurement, an operation of scale to secure large volumes of gas for multiple customers and with scope for generating additional margin. The gas is priced on the NYMEX Henry Hub settlement, uplifted by 15% to cover procurement costs. So the contracts will have exposure to price volatility in financial markets; but over time, the financial settlement aligns with the physical market. Any price fluctuations will be absorbed and ‘averaged’ in the procurement price.

The other half of US LNG is produced via tolling deals with the LNG plants. The tollers are a range of power and gas utilities, portfolio LNG players and traders which have to procure upstream gas for themselves. The current price volatility highlights the challenges and risks to new and inexperienced players in this game to secure gas consistently that gives them price-competitive LNG.

Fourth, how can upstream producers get more skin in the game?

They have eyed with envy LNG buyers making better margins. Should they stick rigidly selling into Henry Hub when the outlook for the US gas price is flat as a pancake in the long term? Why not shoot for more margin by agreeing to support LNG exports and linking the price to oil-based LNG contracts or spot LNG prices? Pricing innovation is coming as the US LNG gathers momentum!