Dividends or growth – Big Oil’s dilemma

The industry is adapting to low oil prices. But can upstream grow in this environment?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

-

The Edge

Hydrogen: how carbon intensity rules can muddy the waters

The question is a profound one, the answer in reality more about sustaining the business and maximising returns rather than pursuing growth.

I posed a few questions on the state of the industry's financial flexibility to Tom Ellacott, our SVP of Corporate Analysis.

Q. Has the industry got finances on the right track?

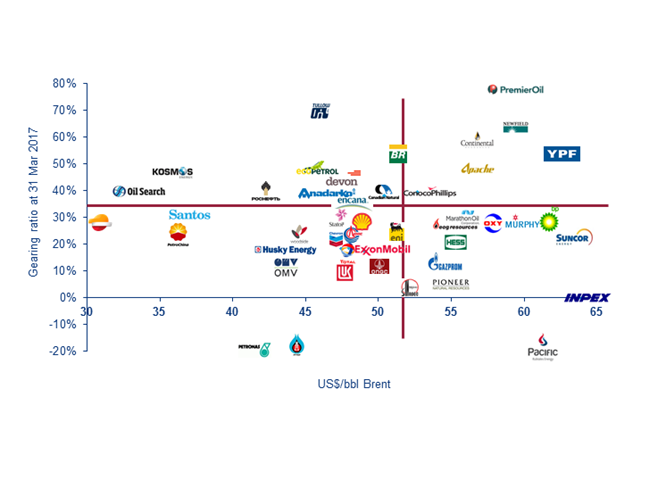

A. Cash flow breakevens have been halved from US$94/bbl in 2014 to US$51/bbl in 2017 and 2018, excluding asset sales. After the price crash cutting costs, investment and in some cases dividends, was a necessity, but it's still been a commendable performance.

Breakevens for all, bar 12 of the 52 companies in our coverage, fall between US$45–60/bbl, but there are outliers. Repsol is well below US$40/bbl, whereas Inpex needs US$76/bbl in calendar 2017 as it nears the end of the investment phase on the giant Ichthys LNG project. Its cash flow breakeven will fall sharply when production starts at the turn of the year.

Q. Can more costs be cut if oil prices stay low?

A. Yes, in the short run there's some scope to pull the same levers. But the next big step down in costs will be structural and secular – upstream needs to reset costs to make a return at the bottom of the cycle.

Upstream can embrace concepts already embedded in downstream, where over-capacity squeezed margins much earlier. Tighter supply chain management, outsourcing, offshoring and low-cost delivery models could deliver substantial large-cost savings and free up capital.

Digitalisation, robotics and automation, and predictive analytics will all play a big role in the future.

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

Opinion

ADNOC acquires 10.1% stake in CCUS player Storegga

-

Featured

Upstream corporate 2024 outlook

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

The Edge

What's on CEOs' minds

-

Featured

Oil and gas companies will recalibrate strategies | 2023 outlook

Q. Is debt under control?

A. Yes, in that net debt has been falling over the last year, with asset sales a big factor. Liquidity has returned to M&A markets and many companies have seized the opportunity to sell assets. Leverage across the sector has fallen from the peak of 43% in Q1 2016 to 34%, but is still above the 20–30% we regard as comfortable. More asset sales are on the cards. We expect portfolio high grading to be a feature across the value chain – upstream, midstream and downstream – for the foreseeable future.

Q. Is the industry investing enough to sustain itself?

A. Global upstream investment is down over 40% since 2014, cumulatively US$0.8 tn. Conventional investment has been hit hard and is still at low ebb. It's encouraging that we've seen more FIDs this year so far (13) than in the whole of 2016, but projects are typically smaller. Costs need to come down further for companies to be confident enough to invest in bigger, new conventional projects.

Only in tight oil has there been any meaningful shift to growth, with operators able to tap equity and debt markets to drill up big, in-the-money well inventories. But tight oil is very price-sensitive.

With WTI softening of late, we're watching to see if budgets are cut back this current Q2 results season.

Q. Are the Majors sacrificing growth for dividends?

A. The Majors are now spending as much on dividends as investment, and that's a big change since 2014. The investment rate for the Majors fell by 27% from US$28/bbl in 2014 to US$20/bbl currently – this is spend on exploration and development per barrel produced, a rough proxy for the capital needed to sustain volumes. At the same time, dividends have been maintained through the downturn (with the exception of Eni) at a rate of US$19/bbl (though BP, Total, Statoil and Shell keep the cost down by offering scrip).

The big factors behind the drop in investment rate are capital discipline, lower costs and fewer in-the-money projects. More projects need to achieve tougher hurdle rates for companies to sustain the business over the long term, so the focus on driving costs down is paramount.

But until that happens, returns to shareholders will consume an increasing proportion of the Majors' cash flow – dividends for sure, and we might even see a return to buybacks if there is surplus cash.