The Majors and US tight oil

The story so far and what happens next

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

What does tight oil have in common with Facebook, Apple, Amazon, Netflix and Alphabet's Google stocks (known as FAANG stocks)? Answer: tight oil is arguably the upstream equivalent of these tech sector leaders. It’s the hot investment play in the oil and gas index, it outperforms like mad, and it’s been driving to distraction those that don’t own any.

Just like the tech giants, tight oil has risen rapidly from humble beginnings. And it has continually proved the doubters wrong, emerging as the dominant growth theme in the sector.

Production has leapt from zero six years ago to 5 million barrels per day today and will double to ten or 11 million over the next ten years according our forecasts, which is almost 10% of global supply.

Big Oil needs exposure to that growth, and the Majors have progressively muscled their way in. BP’s US$10.5 billion acquisition of BHP’s assets in July is just the latest example of tight oil influencing portfolio strategy. It's a change that’s been underway for the last few years, with the Permian the primary target.

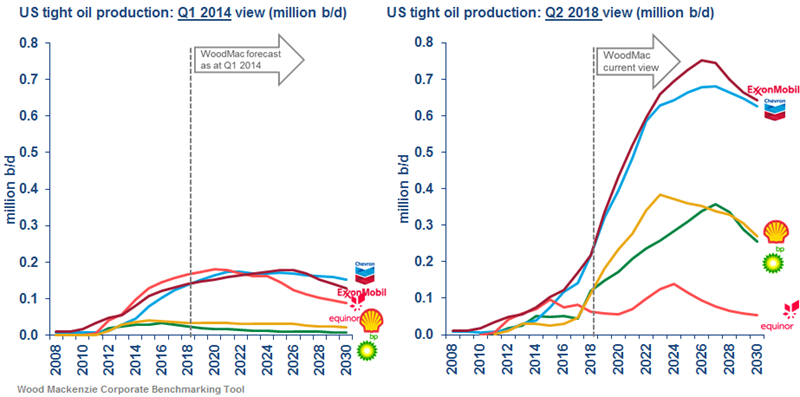

Tight oil is now an important driver of growth for most Majors. ExxonMobil, Chevron, Shell and BP have all assembled material tight oil assets that include the Permian; Equinor has sizeable Bakken exposure. Roy Martin, a research analyst in corporate research, expects the Majors’ combined tight oil production to climb from 0.7 million barrels per day in 2018 to a peak of 2.2 million in 2026. By then tight oil will be 10% of the Majors’ total production, representing one-fifth of liquids. It’s quite a shift from reliance on conventional and deepwater fields.

Besides growth and scale, the short investment cycle has helped to diversify portfolios. Operators can ratchet spend up or down, depending on price. Short-cycle has also fitted well into the industry’s present emphasis on capital discipline.

Last but not least, returns on new drilling look attractive. Full-cycle returns including acquisition costs are questioned with some justification. But looking forward, returns from tight oil beat all but the very best conventional and deep-water alternatives. The Majors’ inventory of yet-to-drill wells will generate an average internal rate of return of 45% based on US$65 per barrel of Brent (real), well above the 16% weighted average for pre-FID conventional projects.

So what’s next?

First, the Majors will want still more tight oil. The industrialisation of extraction means tight oil is increasingly a scale game. Access to capital is key – the big will get bigger. Under bidders for BHP's assets included Shell and Chevron, indicating unsated appetite for the right kind of assets. There’s certainly plenty of opportunity for more consolidation with over 120 operators of some scale operating in the prized Permian Wolfcamp play.

Second, what about the ‘have nots’? There’s been strategic polarisation among the Majors with Total and Eni eschewing tight oil. Unlike ExxonMobil, Chevron, BP and Shell, which had legacy USL48 positions before the tight oil boom, both effectively had to start from scratch. It’s always been difficult to justify buying into tight oil. The outsider has none of the advantages of a legacy platform - the operational nous, leveraging contiguous acreage, high grading inventory. Both of these European majors have made significant progress elsewhere to strengthen their conventional portfolios and may choose to stick to their knitting.

Third, investment in tight oil isn’t exactly risk free. Tech stocks are demonstrating in the current sell off that hot sectors have their downs as well as ups. As the world’s marginal barrels, tight oil’s value and cash flow are very sensitive to oil price. The plays are far better understood now after several years of development, and production growth for the next few years looks reasonably assured.

Yet the clue is in the name – tight oil. The geology should not be underestimated, and the challenges of extracting at a commercial cost will mount as operators begin to move out beyond the sweet spots into tougher rocks. For the Permian, that likely comes after 2020. It could go either way. We’ll explore some of these risks in The Edge next month.