The digital imperative: why upstream oil and gas is embracing advanced analytics

And how digitalisation saved one unconventional producer US $1 billion

1 minute read

Where and how is digitalisation likely to impact upstream oil and gas? In our earlier "Laggard or Leader" insight we identified up to US$150bn in annual operating cost savings that could be achieved in the energy and natural resources sectors through digitalisation. In our latest research, we take a closer look at the likely impact on the upstream sector. We believe there are huge prizes on offer at every stage of the upstream lifecycle.

Looking beyond the financial benefits of digitalisation, there are opportunities to improve health and safety across the industry by moving workers from the field to the office. Businesses stand to benefit from the sharing of data, knowledge, experience and insights as cross-functional teams form.

What's new?

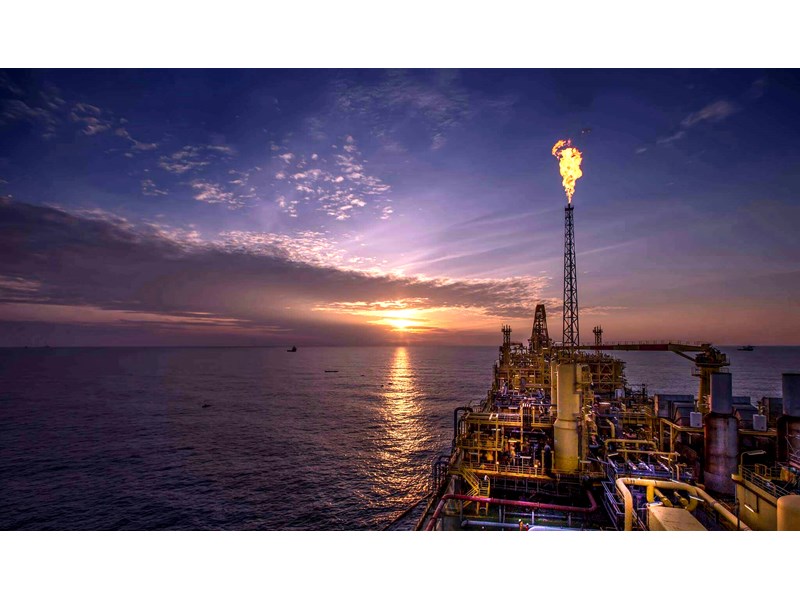

The oil and gas industry has always been at the cutting edge of technological innovation. Look at what has been achieved. We've extracted oil from deep underground in the harshest offshore environments. And produced hydrocarbons from the nanodarcy permeability of shale rock. The staggering complexity of tasks like these has engendered an industry of innovators and inventors.

On that basis, anyone in the industry talking about digitalisation may legitimately ask, "what’s new?” What does seismic interpretation deal with if not Big Data? What are geophysicists and engineers if not data scientists?

What’s new is a number of technologies that have emerged over recent years outside of the oil and gas sector. The industry produces Big Data, but advances in analytics, including machine learning and artificial intelligence (AI), provide new ways of interpreting this data, producing previously unknowable insights. While large volumes of data in the past could be a problem, Big Data is now an asset. Moreover, advances in cloud computing and edge analytics mean firms do not need a supercomputer or a Supermajor's IT budget to capitalise on this opportunity. Microsoft Azure, Amazon Web Services and Google Cloud make cloud storage and analytical engines available to everyone.

In theory this is a great pairing: a highly innovative industry and the latest digital technologies. But there is a disconnect; the E&P sector is conservative when it comes to adopting new technologies. Innovations in the conventional business take many years to penetrate the sector. Yet technology and digitalisation are characterised by rapid adoption and fail-fast attitudes, with those able to adapt quickly capitalising. As digitalisation permeates the upstream sector, successfully managing the cultural impact across organisations will dictate the success of digitalisation.

Why embrace it?

You only need to look at what CEOs of the biggest oil and gas companies are saying to realise the strategic importance being placed on digitalisation.

Digitalization is touching every part of Repsol; Upstream, including the development projects, exploration, downstream, the corporate center and it will change how we plan, we develop, we monitor and we are managing our businesses while we are at the same time improving margins and efficiency, lowering costs and delivering long-term value.

Josu Jon Imaz, CEO, Repsol

We will reach a 7% reduction in production costs thanks to: advanced algorithms to ensure reduced asset downtime and higher production rates; and, predictive analysis systems, based on big data, which allow us to optimize maintenance, logistics and well operating costs.

Claudio Descalzi, CEO, ENI

As we’ve said, energy firms are at different points in the digitalisation journey. Unconventional players in the US, driven by the overall cost competitiveness of that market, are probably the furthest along the path to realising the benefits of digital transformation. Conventional upstream has likely made the least progress, despite the size of the potential gains.

Upstream executives are right to be sceptical of promises to transform cost structures; they have been burned before by these kinds of promises. Still, L48 operators have adopted Big Data initiatives and advanced analytics and been rewarded. The cost curve for tight oil has been materially lowered, and digitalisation has played a critical role. The companies that really embrace this trend – utilising their data as an asset and scaling the application of digital technologies – will be the ones to benefit the most.

Talk to Greig about digitalisation in upstream

US$75Bn. That’s the annual cost saving on offer from digitalisation in upstream over the next five years. But how close is the industry to achieving this?

Fill in the form to talk to Greig about digitalisation in upstream.

Digitalisation in practice

How one unconventional producer saved US $1 billion

As we’ve discussed, Lower 48 companies are more advanced in their adoption of digitalisation than their conventional upstream peers. Some of that has been through technologies that sort and operationalise data to unlock structurally lower costs. PowerAdvocate, Wood Mackenzie’s sister company, does exactly this. Recently, PowerAdvocate worked with a US-based unconventional producer to transform the way the producer understood and analysed third-party supplier costs.

PowerAdvocate started with an analysis of the customer’s third-party spend. This spending was structured and enriched, creating a new accurate, granular dataset. The analysis unlocked by this dataset was telling: PowerAdvocate found that hundreds of millions of dollars were incorrectly understood. This customer thought they were spending US $480 million on rig charges; PowerAdvocate’s analysis identified nearly US $800 million in spending. The analysis also provided more granularity on how that spending was composed of rig operating charges, rig standby time, and tools, materials, and consumables. This information was powerful. The customer found that they could determine where they were paying different rates for the same equipment in a specific play; they could ensure that they were always paying the lowest negotiated rates; and they could improve their negotiating leverage with some suppliers.

What’s more, PowerAdvocate and this customer used the cleansed, enriched data set to do more sophisticated analysis about third party supplier productivity by adding information from production management and field data capture systems. This analysis revealed that, in fact, one low-rate wireline supplier was nearly 40% less productive than a more costly, but more productive vendor, identifying a multi-million-dollar opportunity. When applied to all major service categories within a play (or a region), this analysis is particularly powerful as it highlights where suppliers’ work rates varied.

Holding costs steady in changing markets

Identifying opportunities to spend more efficiently yields powerful savings, but PowerAdvocate also worked with this customer to help them to identify ways to hold costs steady in rising markets. PowerAdvocate did this by creating cost models for the customer’s key procured goods and services. These analytical tools break down the procured equipment or service into component parts, which were modelled to the specifics of the customer’s business, down to the supply and demand dynamics in the Permian, for example, and to the specific technological configuration of the rig (stage length, pressure, and so on). The customer could then understand the competitiveness of their rates and negotiate accordingly.

As a result of these activities, PowerAdvocate’s customer found US $1 billion of savings in their third-party spend.

-

US $1 billion

This unconventional producer found US $1 billion of savings in their third party spend.

-

25%

And cut costs by 25%.

-

US $800 million

The customer thought they were spending US $480 million on rig charges... their actual spend was 1.7x higher.

-

40%

PowerAdvocate discovered a difference in productivity between two suppliers of 40%.

About PowerAdvocate

PowerAdvocate believes that the foundation of successful digitalisation is good data. Without good information, the other benefits of digitalisation, like lower-cost operations and better decision making, cannot be reliably produced.

Intelligence for energy companies seeking a data-driven approach to cost management

Visit the PowerAdvocate blog, Cost Insights