Discuss your challenges with our solutions experts

1 minute read

With analysis from our global upstream research team, our in-house Lens Upstream super-users

Key takeaways

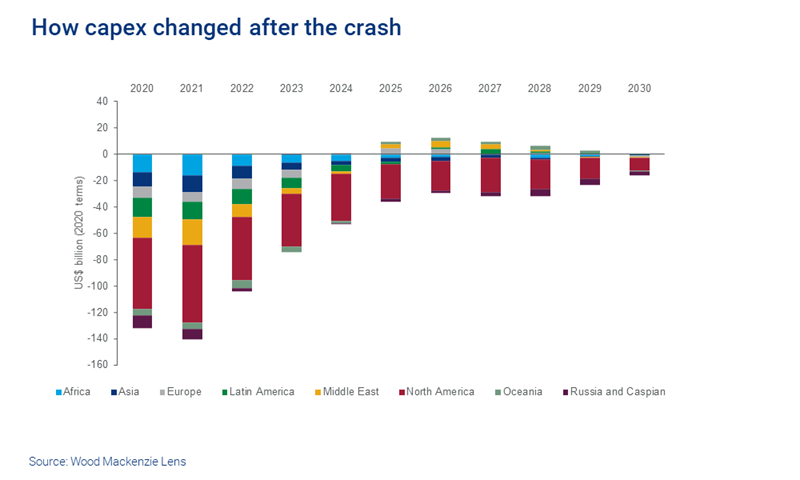

• Global upstream development spend for 2020 is 30% lower than our pre-crash view. North America is hit hardest; along with Africa and Asia. These regions may never recover to pre-crash levels.

• Only nine major FIDs are expected in 2020 versus our pre-crash view of around 50 new project approvals.

• OPEC+ oil production cuts and market-driven shut-ins reshape near-term supply outlook.

• Valuations for oil sands and heavy oil hit hardest in % terms – down >50% – but more than US$1 trillion wiped off conventional onshore and offshore projects.

• More than 40% of future projects now generate an IRR of less than 15%.

• Tight oil and heavy oil cash flows suffer the most, but overall resilience has improved since the last downturn.

Subscribers can access the global report (and find links to the regional reports) here.

Global upstream

The oil price crash and market uncertainty are all-encompassing. They have affected all regions, all operators and all resource themes. In early March, we anticipated the industry’s response would be rapid and decisive. It has been. Tough calls have been made, despite a lack of clarity on the depth and duration of coronavirus-related impacts on oil and gas demand.

To date, cuts to expenditure have largely been in line with our expectations. New project spend has stagnated and output has been curtailed, most notably among OPEC+ participants and in the US tight oil sector.

We have also reacted quickly to reflect the latest view in our global upstream dataset, analysis and tools. Our Lens Upstream outlook evolved as the price plummeted, culminating in the data here. In the last three months, we have updated more of our bespoke, granular asset models than ever before in our long history of upstream analysis.

Our “After the crash” Insight series, showcases our transformed global valuation modelling outlook. The series compares our latest Lens Upstream models with how they stood at the end of Q1. Much has changed.

Read on to find out how the upstream sector has responded to the oil price crash in the North Sea, Latin America, US Lower 48 and many more regions around the world. Follow the links to the store to purchase the full reports.

US Lower 48

- Operators have put tight oil flexibility to the test, quickly dropping rigs and deferring completions. 2020 capex is down 39% from our pre-crash view, primarily in the Permian basin.

- Record low prices and near-full storage tanks forced some operators to shut-in production. Despite big oil production losses, Permian leads the recovery with 85% of supply growth through 2025. Moreover, falling associated gas volumes may lead to higher gas prices.

US Gulf of Mexico (GoM)

- Leaner and nimbler, US GoM is better prepared to weather the downturn this time. The region is resilient at low oil prices and more than 80% of oil production has a short-run marginal cost of US$10/bbl Brent.

- US GoM remains afloat, but budget cuts have still been swift. Some fields have been shut in because of unprecedented low oil prices. Investment, exploration and FIDs have all seen major recalibrations.

Visit the store to find out more about this report

Latin America

- In relative terms, the region has made the biggest cuts to 2020 capital spending globally. NOCs have made the biggest cuts, mostly by deferring rather than cancelling projects, with Brazil’s pre-salt bearing the brunt of deferrals.

- Reduced exploration budgets provide some flexibility in difficult times, but exploration is still vital for future growth – we’re forecasting a return to previous levels of activity and investment in the region in 2021.

Buy this report in store or watch the video below as Maria Fadul, LATAM upstream research analyst, uses Lens to better understand several potential scenarios and assumptions impacting Latin America:

Canada

- There is no hiding how sensitive Canada’s oil sands sector is to pricing – expected cash flows fall by over US$32 billion from our pre-crash view. Gas plays in Alberta and British Columbia are also exposed to the downturn but not nearly to the same extent.

- Upstream investment is set to fall by more than US$8 billion in 2020. With Canada having never fully recovered from the 2015 downturn, 2020 capital spending is now expected to be nearly 80% lower than 2013 levels.

Alaska

- 2020 budgets have been slashed, production has been shut-in and nearly all drilling activity suspended. Almost US$3 billion of investment has been lost between 2020 to 2022.

- This year’s exploration season has come to a halt with 50% of wells deferred and several pre-FID projects now delayed. 2020 had been cast as the year North Slope production would grow after decades of decline – how things can change.

The North Sea

- Operators have moved quickly to rein in spend. 2020 budgets have been slashed with FIDs deferred, infill drilling campaigns cancelled and most discretionary spend withheld.

- Production will suffer an immediate drop, partly down to Norway's production cuts. In the longer term, output depends on FID approvals. The North Sea project pipeline remains plentiful, but operators will be looking for more clarity on the market situation before moving ahead with new developments.

Continental Europe

- Capital expenditure is down 35% in 2020-23 versus our pre-crash view. Even tougher decisions are still to come on pre-FID projects, from offshore Netherlands to the Black Sea and Cyprus.

- Continental Europe’s upstream sector was already in transition and beset by above-ground challenges – from environmental to regulatory. Its future is now more uncertain than ever.

Russia and Caspian

- OPEC+ oil cuts – enforced since May – have reshaped the near-term liquids outlook, with high compliance expected from Russia, Kazakhstan and Azerbaijan.

- Capital expenditure is down 17% (US$18 billion) in 2020-21, in US dollar terms, versus our pre-crash view. While OPEC+ production cuts reduce drilling activity, currency depreciation, the coronavirus pandemic and project deferrals also drive down capex in US dollar terms.

Visit the store to find out more about this report

Africa

- Upstream spend in 2020 is down US$14 billion versus our pre-crash view. No resource theme is immune, but capex cuts and deferrals are particularly severe in deepwater (West Africa) and LNG (Senegal/Mauritania and Mozambique).

- FIDs targeted in the next 18 months are down from 22 to 3, and upstream value in Africa is down one-third (US$200 billion).

The Middle East

- There will be a sharp drop in imminent FIDs and 2020 capital expenditure will be US$16 billion lower than our pre-crash view.

- In total, we have removed US$50 billion of investment (2020 terms) from our outlook for 2020-25 because of project delays and cost-efficiency measures. However, deep investment cuts do not offset the valuation impact of lower production (OPEC+ cuts) and oil prices.

Asia Pacific

- Despite the region’s growing focus on gas, it does not escape unscathed. Over US$60 billion of spend has been cut over the next five years. Virtually all projects are hit, with deferred pre-FID LNG projects in Australia, lower NOC spending in South East and Southern Asia, and major capex cuts across much of China's onshore assets.

- Even with the deep investment cuts companies have announced, most are unable to offset the valuation impact of a lower oil price outlook.