2020: the new oil sector supplier crunch bites

Contingency planning will be crucial for supply chain leaders

1 minute read

Back in 2015, the upstream oil and gas industry went through turmoil as the price of crude oil halved in less than a year. The crash was driven by a breakdown of the OPEC cartel and its collective unwillingness to cut production to prop up crude prices. Supply flooded onto the market, destabilising the delicate equilibrium, and the oil house of cards crumbled to record lows.

When oil companies eventually responded to the fact that a recovery was going to be a slow process, they responded drastically – slashing capital expenditure and SG&A costs and squeezing suppliers hard. What resulted was price discounting by suppliers, improved efficiency of drilling, exploration and production practices, and improved output.

In 2015, suppliers helped to create more from less

With considerable sweat and extra effort, suppliers such as oilfield services companies, engineering, procurement and construction firms and major equipment suppliers, supported the oil companies in creating more from less.

But back then the upstream sector was in a much better shape. Investment sentiment was strong, capital was relatively cheap, global GDP growth was solid and tight oil in the US Lower 48 was expanding. And, importantly, the supply chain was generating reasonably healthy financial returns.

The picture looks different in 2020

Fast forward to 2020 and this crash looks very different. The OPEC+ driven supply growth is compounded by unprecedented demand destruction and uncertainty about the path of the coronavirus outbreak.

Oil operators have learned from last time not to bet on a quick price rebound. We are seeing them respond to this oil price crisis with more rapid and robust discipline than we saw in 2014 and 2015.

Projects are being shelved, discretionary spend is being cut and the supply chain is being pushed for price concessions. The situation is likely to shake out differently this time around and cuts by operators will be faster and deeper.

A financial challenge across the supply chain

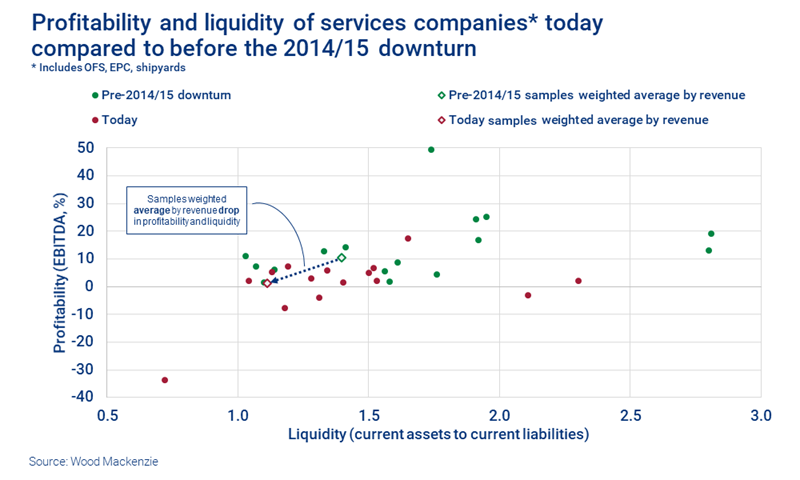

This is bad news for suppliers. Just when they were beginning to see a recovery from the last downturn, this 2020 cycle starts with supply companies already financially stretched. Our analysis of some of the largest service companies in the oil and gas industry shows that on average these companies have declined since 2014/15 on both profitability and liquidity bases.

Cutbacks in activity and rate deflation will represent a real financial challenge for the supply chain. We anticipate that there will be significant restructuring and capacity reduction in the sector, with the very real risk of significant insolvencies.

Operators face the real risk of medium-term supply disruption if this process happens in a disorderly manner. Longer term, there is the risk of supply constraints and rate spikes as activity and demand recovers.

Understanding the financial health of the critical suppliers, how their order books and financials will be impacted by operators’ actions and development of appropriate contingency plans will be critical for supply chain leaders.

Fill out the form to download the report 'Exposing and managing the risks in oil and gas supply chains'.