Get Ed Crooks' Energy Pulse in your inbox every week

A rough road for electric cars in the US

The share of the US vehicle market taken by EVs has fallen sharply this year, underlining the challenges the industry faces. Support from the federal government will be essential for the electrification of road transport to make real progress.

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

The world may still be battling the coronavirus pandemic, but since late March stock markets have been on a tear. The most conspicuous surfer on this wave of exuberance has been Nikola Corporation, a manufacturer of electric and hydrogen fuel cell trucks. It joined the Nasdaq market last week, through a merger with a special purpose acquisition company, and on Monday of this week its shares doubled.

The shares have since fallen back, but are still up about 70% from where they were seven days ago. At the share price of $60.50 on Friday morning, Nikola has a market capitalisation of $22bn, not far off the Ford Motor Company’s $26 billion.

The comparison is startling. Ford sold about 5.39 million vehicles worldwide last year, but Nikola has not yet started commercial production. It is making prototypes at an Iveco plant in Germany, and plans to begin production there in 2021. It is also working on a new plant in Arizona, aiming to start production in 2022. But investors have not worried about that too much. The stock market halo effect from Tesla, which this week briefly surpassed Toyota in market capitalisation, appears to be very powerful.

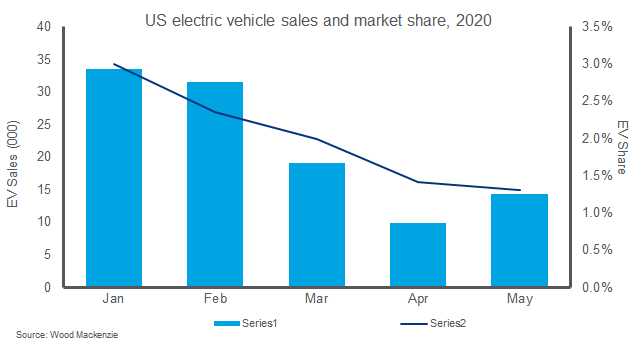

The excitement over Nikola on the Nasdaq made for a sharp contrast with the latest reports on US auto sales this week, which showed electric vehicles face a tough market. In Europe the market share taken by electric and hybrid cars has been rising, but in the US last month it dropped sharply. Electric and plug-in hybrid cars accounted for just 1.3% of US light vehicle sales in May, when they have typically been running in a range of 1.6%-2.4%.

There seem to be a couple of reasons why EV sales were particularly weak, according to Ram Chandrasekaran, Wood Mackenzie’s global lead for transportation. The higher sticker prices of EVs compared to internal combustion engine vehicles make them a classic discretionary purchase, and as the sharpest recession since the 1930s hit employment and incomes, buyers appear to have decided that they don’t want to pay the additional up-front cost. In turbulent and uncertain times, fewer customers may also have been prepared to take a chance on an unfamiliar technology.

One factor that was probably not particularly significant was low fuel prices, even though average retail gasoline prices dipped below $1.80 a [US] gallon in April to their lowest level in four years. At the moment, with fuel prices relatively subdued in the US for years, and electric cars still only a niche market, fluctuations in gasoline do not make much of a difference to customers’ decisions on whether or not to buy an EV, Chandrasekaran says. It will probably only be when EVs are priced at parity with their ICE counterparts, and become more of a mass market product, that gasoline prices are likely to have a significant impact on sales of electric cars.

Although the weakness of EV sales in May was in part a result of factors that will pass, it was a warning sign of the challenge the industry still faces in the US. The crucial policy driving manufacturers to increase EV sales was the Corporate Average Fuel Economy (CAFEstandards agreed with the industry under the Obama administration, and President Donald Trump has been working to make those requirements less demanding.

The administration’s plans are the subject of a legal battle, and the US auto industry is divided over whether to support or oppose them. But whatever the outcome, the clear direction provided by the previous set of CAFE standards has gone. Nor is there any support from the federal government for charging infrastructure, meaning that efforts to build out charging networks are piecemeal and fall short of demand in some areas.

If the US EV industry is to overcome these challenges and start taking a significantly higher market share, it will need sustained support from federal policy. In that respect, the results of the elections in November are likely to be critical. Joe Biden, the presumptive Democratic presidential nominee, has pledged in his climate plan to introduce a new set of fuel economy standards that “goes beyond” the Obama administration’s regulations, and to work with states and cities to “support the deployment of more than 500,000 new public charging outlets by the end of 2030.” Unless there is that sort of shift in policy, “the US is going to lag behind the EU and China in EV adoption for at least five years,” Chandrasekaran says.

The OPEC+ group extends its production cut

After stormy sessions debating production cuts in March and April, the online meetings of OPEC and the OPEC+ group on Saturday went comparatively smoothly, although there had been tensions in the run-up to the talks.

The main sticking point was the fact that some countries, most notably Iraq and Nigeria, had in May produced significantly more than the maximum they had agreed to under the April deal. The new agreement signed on Saturday addressed that issue by including a commitment to “compensation”: countries that over-produced in May and June will have to under-produce to work off the excess in July, August and September.

Saudi Arabia had been determined to secure that pledge, and once the other countries had agreed to it, the meetings on Saturday swiftly agreed to confirm the one-month extension of the OPEC+ group’s 9.7 million barrel per day production cut into July. The agreement in April was that the cut should be reduced to 7.7 million b/d for July and the remainder of the year. Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, said after the Saturday meeting that there was “no room whatsoever for lack of conformity” with the agreement in future.

Ann-Louise Hittle, Wood Mackenzie’s head of Macro Oils, said that even if compliance was not perfect, extending the larger cut of nearly 10 million b/d through July would accelerate the tightening of world oil markets expected in the second half of the year, as oil demand continues to recover.

Oil prices have been volatile this year, however, and this week was no exception. As a wave of concern about the global economic outlook swept through world stock markets on Thursday, oil prices slumped, with Brent crude dropping more than 7% on the day. At $38.50 a barrel on Friday morning, Brent was down 10% from its recent peak above $43 on Monday.

How steep is the fall in gas demand?

The International Energy Agency this week published its Gas 2020 report, giving its view of the outlook over the next five years. The conclusion that grabbed the headlines was that global gas demand is heading for the biggest fall on record this year: a drop of 150 billion cubic metres or 4%, driven by the economic downturn resulting from the Covid-19 pandemic, and by an unusually mild winter in the Northern Hemisphere.

Wood Mackenzie analysts, however, think the decline in gas demand this year will turn out to be significantly less steep than that. An assessment of the impact of the coronavirus pandemic, published at the end of May, suggested that the drop in global gas demand this year might be only about 0.5%.

One of the crucial differences is in estimates of gas demand in Europe, where the IEA has forecast a much sharper fall than Wood Mackenzie, and some of the latest data so far supports our relatively optimistic view, according to Murray Douglas, research director for the Europe gas team. Over the past couple of weeks, the recovery in some EU markets has been coming in even more strongly than in Wood Mackenzie’s projections, and the risks to our European demand outlook are weighted to the upside rather than downside, Douglas said.

“Gas demand has held up remarkably well in Europe, and has pushed a huge amount of coal out of the power generation mix,” he added.

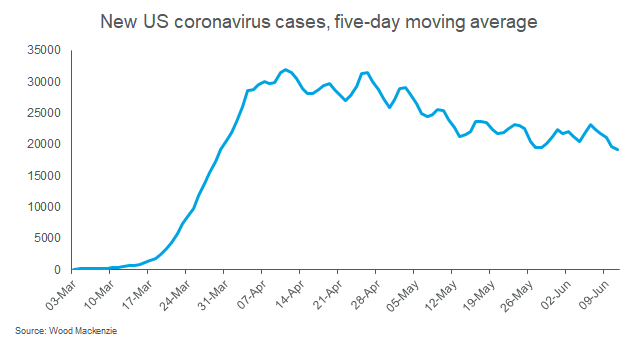

The disturbing trend of coronavirus cases continues in Texas

Every week I have been checking the data for new coronavirus cases in three of the US states that were among the leaders in opening up after the lockdowns of March and April. The news is mixed: Georgia still looks pretty good, with no sustained rise in new cases; Florida is less good, with a sustained increase in recent weeks, and Texas looks quite worrying. The number of new positive cases being reported in Texas hit a new record high on Wednesday. Some of the growth seems to be a result of increased testing, but the proportion of test results coming back positive also appears to have been on a rising trend since late May. The city of Houston is considering issuing new stay at home orders in response to the rise in cases, and is looking at reopening the temporary hospital that was set up in the NRG Stadium.

Across the US as a whole, the number of new cases still seems to be on a declining trend. The picture varies widely across states. In New York, which has been the state hit hardest by Covid-19, there were just 674 new coronavirus cases recorded on Wednesday, compared to more than 10,000 a day on several days when the outbreak was at its peak.

In brief

The Trump administration is preparing to open up the eastern Gulf of Mexico for oil and gas development, but will not announce its plans until after the elections on November 3, Politico reported.

US states have received “a wave” of requests for temporary exemptions from enforcement of environmental regulations during the coronavirus pandemic, under a policy announced by the Environmental Protection Agency in March.

BP is cutting close to 10,000 jobs and freezing senior salaries. It has also told staff it is “very unlikely” it will pay cash bonuses for this year.

The downfall of Chesapeake Energy “marks the end of the shale model that changed the world”, Bloomberg reported.

There was a dismal indicator of the health of Venezuela’s oil industry published last week. The country, which has the world’s largest oil reserves, had just two active rigs working there in May, down from 83 in August 2014, according to Baker Hughes data. One of the rigs is drilling for oil and the other for gas, Bloomberg reported.

The US International Development Finance Corporation, a new government agency that provides financing for investment projects in developing countries, plans to lift restrictions on support for exports of advanced nuclear power technology. The aim is to help US suppliers compete against Russian and Chinese nuclear technology providers in world markets.

The new all-electric Maid of the Mist boats that will give tourists a close-up view of the Niagara Falls have arrived at the river and will start testing soon.

Australia’s National Electricity Market plans to introduce wholesale demand response, paying large users such as factories and smelters to cut their consumption at peak times to avoid excessive strain on the grid.

Renewable energy and nuclear power could by 2035 provide 90% of annual US electricity generation, with gas-fired plants providing the remainder, according to a new study published by the Goldman School of Public Policy at the University of California Berkeley.

Ian Taylor, who built Vitol into one of the world’s largest oil traders, has died at the age of 64. He is remembered as “a founding father of the modern commodity trading industry”.

And finally: have you ever wondered how you would get on running your own refinery? The game SimRefinery, developed for Chevron in the early 1990s, gave people a chance to find out. It was developed by Maxis, the company that produced the popular SimCity series of games, and was intended to show staff how the complex operations of a refinery fit together. As an article on The Obscuritory explains, the idea was to give operators a sense of the bigger picture beyond their particular specialism, and to help non-technical staff in areas such as HR and accounting understand the basic principles of how a refinery worked.

The game was available as a free download from the Internet Archive. Unfortunately, it has now disappeared, but if you keep your eyes open there may be a download still available.

Other views

Simon Flowers — Why the oil price recovery has further to run

David Low and others — Who is investing in hydrogen, and why?

Julian Kettle — A global economic slump: what will it mean for metals and mining?

Maarten Wetselaar — Why the European Green Deal needs strong methane regulations

Quote of the week

“The value proposition in this business does need to change. Growth for growth’s sake is something that investors aren’t in our opinion going to be rewarding going forward. So giving a fair amount to the shareholder, having a portfolio that allows you to grow your company on 70% of your cash, giving some of that back to the shareholder, and really running these for returns, and not for growth for growth’s sake, is going to be something that our industry is going to have to grapple with from top to bottom, in order to attract investors back into this space. We’ve destroyed a lot of value, frankly, over the past decade. And we’ve got to do something about that.” — Ryan Lance, chief executive of ConocoPhillips, told a webinar organised by the Independent Petroleum Association of America that there would have to be a fundamental change in the business model of many US exploration and production companies.

He also said he had been surprised by how quickly oil prices had rebounded, and warned of the risk of a drop back into a “double trough” if supply growth outpaced the revival in demand. It was a viewpoint that looks particularly prescient when crude plunged the day after the webinar.

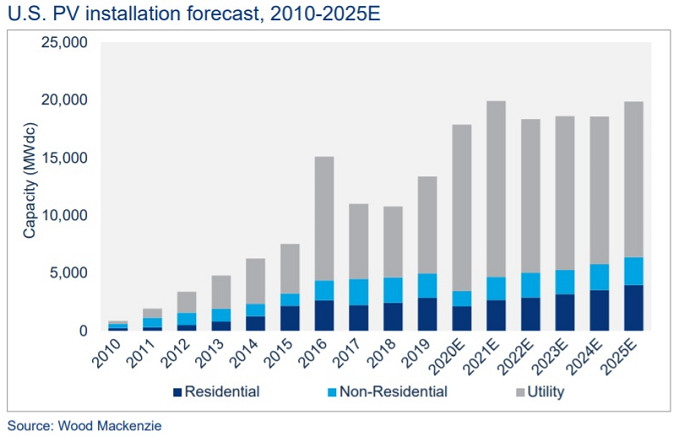

Chart of the week

This comes from a fascinating and highly detailed report on the state of the US solar power industry. The point that struck me was that this is still going to be a good year for solar capacity additions, even though new residential installations have slumped because of the coronavirus lockdowns. Wood Mackenzie’s analysts expect total installations to remain robust over the next few years, despite the phased reduction in the value of the Investment Tax Credit for solar power.