Forget the lack of a GDP target, China is ready to go it alone

Economic recovery is paramount as China drops its 2020 GDP target and looks to reset the economy for a deglobalised world

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

The Edge

Re-thinking energy transition supply chains

-

The Edge

Diverging views on the role of gas in the energy transition

-

The Edge

COP28 preview: five things to look for

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

This year’s joint meeting of the National People’s Congress and Chinese People’s Political Consultative Conference – referred to as the ‘Two Sessions’ – was never going to be ordinary. Already delayed by the coronavirus outbreak, the more than 5,000 attendees were all first tested for Covid-19 and placed in isolation ahead of the event. Media presence was stripped back to a bare minimum.

China’s most important annual political meetings lay out targets and goals for the next 12 months and this year gives the world a glimpse of the direction the country’s leaders are likely to be taking with the upcoming 14th five-year plan (2021-2025). Politics aside, headlines were all about the lack of a GDP target for 2020. Premier Li Keqiang made the point succinctly during his opening address: a target wasn’t required given “big uncertainties about the economy and trade”.

Quite right. Growth targets are pretty pointless right now anyway and China’s leaders know this. So, let’s not worry about the GDP number and concentrate on what the Two Sessions was about, which was a reset of how China’s economy will look in the future. Energy is critical to this, and with a renewed focus on energy security, the implications are huge.

Rethinking the economy and energy for a post-pandemic world

Inevitably, China’s economy was top of the agenda at the Two Sessions. But this will be a different economy post pandemic. Global export markets are in pain and unlikely to recover quickly. Deglobalisation rhetoric is everywhere and friction with major trading partners, most notably the US, continues to rise. The risk of shorter and more secure supply chains threatens China’s export supremacy and, while this is unlikely to happen quickly, exporters need government support to maintain competitiveness. Domestic consumption is the great hope, offsetting lost demand overseas. The government needs to create jobs. No growth in jobs, no growth in consumption.

Energy security – back to the future

Energy security is firmly back on the agenda. China’s domestic media has been picking up on this over the past few months – and if geopolitics is the cause, then coronavirus is the accelerant. Official coverage is more prominent and the language of energy security is changing, reverting to the focus seen during the 12th five-year plan and away from a more pragmatic approach seen during the 13th five-year plan. Clearly, this has major implications for energy supply.

Increased energy security is also a factor behind government support for new technology. The Two Sessions indicated a strong and rising opinion that China should invest more in hydrogen. I expect that hydrogen will feature prominently in next year’s 14th five-year plan, with investment in innovative technology and domestic supply chains.

The government has also reaffirmed commitments to environmental targets, but we are seeing some variation at the provincial level. Those provinces that have met or exceeded clean sky targets are facing less stringent targets. Economic growth is once again the mantra. But for other provinces where air pollution remains chronic, policies will be accelerated.

But this doesn’t mean that China is simply going to fall back on more coal, and where coal-fired power is approved it will have to be ‘clean coal’ technology. The outlook for coal demand is relatively stable as prices remain low and demand recovers. Current Qinhuangdao traded prices are around RMB520/tonne and are in line with the government target of around RMB500/tonne, meaning limited fresh policy support.

You might be interested in: What does China's thermal coal import restriction mean for Australian producers?

Energy security is also advancing electrification

In line with rising energy security, investment in power generation is a key focus as China continues to electrify its economy. Coal capacity will continue to rise and is critical to keeping electricity prices low (as coal remains around 65% of the generation mix). So, new capacity will move ahead. We see up to 130 GW of new capacity being approved over the next five years, with capacity peaking around 2025 at about 1,200 GW. This is lower than the China Electricity Council’s forecast of 1,300 GW, in part because greater environmental scrutiny will be applied and emissions regulations tightened.

Subsidies for renewables are unwinding but State Grid is planning for higher capacity additions than we had been anticipating, with plans for 29 GW of wind and 39 GW of solar this year. Energy security is at play again, and with so much of the manufacturing localised, renewables offer no supply chain risk and zero fuel supply risk.

Under China’s ‘blue sky’ action plan, the government had actively promoted gas-fired combined heat and power (CHP) projects. The preference now appears to be towards dedicated gas-fired peaking plants in coastal areas. This should support gas demand in the power sector. While peakers consume less gas per MW than CHP plants, with low gas prices and a lack of storage to support intermittency of renewables, gas demand will grow. But energy security will put the spotlight on rising imports and domestic production will remain incentivised.

Read also: The outlook for renewable generation across Asia Pacific remains bright

Oil demand is recovering, but without specific government support for transport

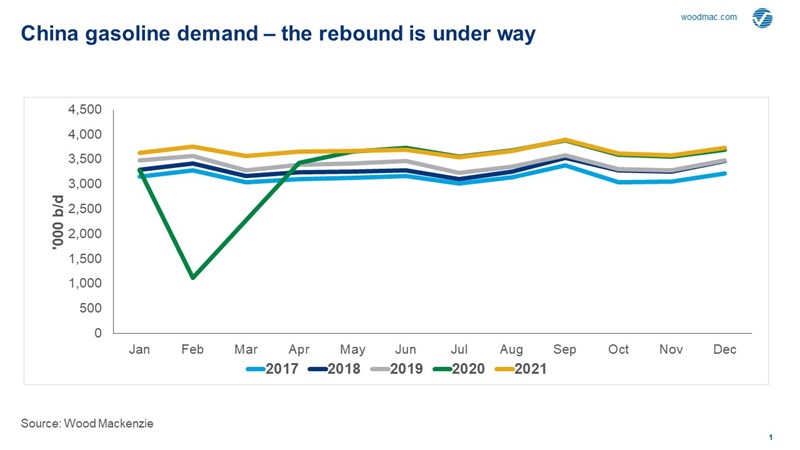

We now expect China’s oil demand will recover to 13 million barrels a day in Q2, a 16.3% jump compared to Q1 this year. But this is despite no specific policies to support oil demand. In fact, electric vehicle subsidies have been extended by two years to 2022. Environmental policies introduced in 2019 to support the move to China 5 and China 6 emissions standards have hurt car sales and a quick bounce-back is unlikely. I expect that rolling out China 6 will be a lower priority as a result.

With this year’s extraordinary Two Sessions now concluded, attention will turn to the 14th five-year plan. I think this will be one of the most important political documents of our time. This is no exaggeration. The direction China takes over the next five years will, in many ways, help define the post-pandemic future. The Two Sessions has given us a glimpse of what China’s leaders are currently thinking. Global trade has taken a hammering, the world is more divisive and China may be preparing itself to go it alone.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.