Has the Lower 48 got the financial strength to ride out the storm?

From revised capex to distressed debt, we track the health of the sector in the wake of the oil price crash

1 minute read

What does sub-US$30/bbl mean for tight oil operators? Demand destruction, combined with increasing supply, has left the oil market in turmoil. Ever nimble, US independents have moved quickly in response. But Lower 48 operators were already under pressure before the oil price crashed. The situation appears dire for many and the market is changing fast.

Which tight oil operators are the most vulnerable? And what strategic choices are available to distressed companies?

The response to the crisis so far

Most companies have revised down capex and production guidance. And if low prices persist, we can expect more of the same.

Operators have also moved to cut dividends and curtail buyback. We can expect companies to continue to explore all options to cut costs and preserve liquidity. Some have already monetised hedges, or asked service companies for a reduction in costs.

If sub-US$30/bbl oil lasts for long, operators and lenders could be in for a bumpy ride.

Brandon Davis, Head of Americas Corporate

Which operators are in the greatest distress?

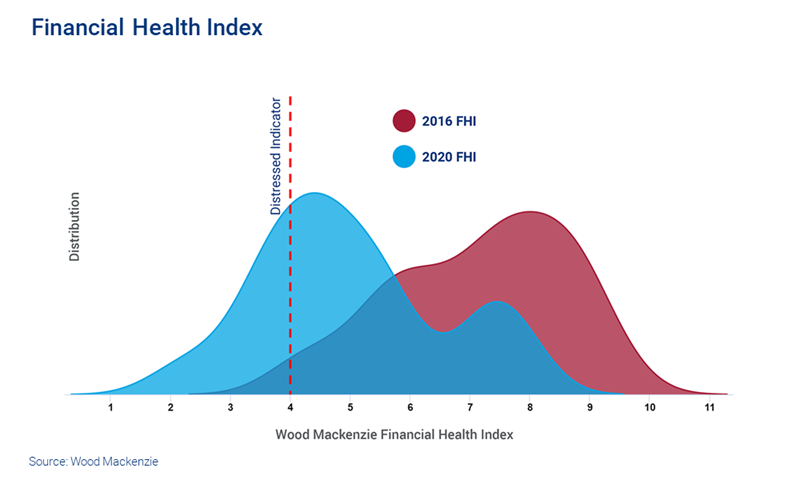

We’ve used our Financial Health Index to rank company performance over time. We explored our findings in a recent webinar, 'Energy credit markets – which companies are at risk?'. For a complimentary copy of our slide pack, fill in the form at the top of this page.

What will we be watching in the coming months?

The oil price drop makes it harder for the operators to refinance debt, especially those with maturities due in 2020 and 2021. We expect to see operators make defensive draws on their revolving credit facilities to preserve liquidity.

At US$20/bbl oil, every operator will be in distress eventually. It's just a matter of time – and who has the longest runway.

Robert Polk, Principal Analyst

How could banks respond?

The biggest risk to the sector is the next round of semi-annual borrowing base redeterminations, which typically occur in April. Banks are expected to revise price decks significantly lower. That will negatively impact the available credit extended to borrowers.

But banks will want to manage their exposure without sending a large portion of the industry into default. There’s a risk that debt covenants will be violated.

Most operators aren’t hedged until 2021. Several will be forced to restructure their debt, whether in or out of bankruptcy court.

As companies shift their focus to survival, what options are available?

Asset sales are the obvious option for operators that need to reduce debt. Valuations are likely to be low. But companies may be forced to sell assets if low oil prices persist.

Companies could choose to shut off drilling entirely. And with limited capital available for investment, wells that can generate cash quickest will become the focus of activity.

We’ve been through this before. Will it be worse this time?

Since we last updated our Financial Health Index in 2016, the financial health of the Lower 48 has worsened significantly. Over the last four years, there’s been a lack of investment in the space from equity.

And since the last oil price crash in 2015, banks have put several measures in place to protect themselves.

Several operators have levers to pull that will see them through a rocky 2020. But from 2021 onwards, it doesn’t look quite as positive. If sub-US$30/bbl of oil lasts for long, operators and lenders could be in for a bumpy ride.

Find out more about energy credit markets

Our recent webinar, 'Energy credit markets – which companies are at risk?' explored this topic in detail. Fill in the form at the top of this page for a complimentary copy of the webinar slide pack.

Ask us a question about how Lower 48 operators will weather the oil price crash

Our Institutional Investor Service provides flexible access to research, specialised analysts and unique data tools to support oil and gas decisions in every region. We provide comprehensive coverage of the US oil and gas sector.

Ask us a question, or find out more about the service.