Driven by net zero carbon commitments, the European Majors’ new energy strategies are evolving rapidly...

The European Majors have been under rising regulatory, investor and consumer pressures to embrace the energy transition and align their portfolios with Paris climate agreement goals. The European Union (EU), as well as the UK have committed to achieving net-zero carbon by 2050: corporates are expected to fall in line with national goals. This pressure will intensify in the post-Covid world, with the EU’s commitment to rebuild its economy on green principles. New policy and regulation will drive this shift.

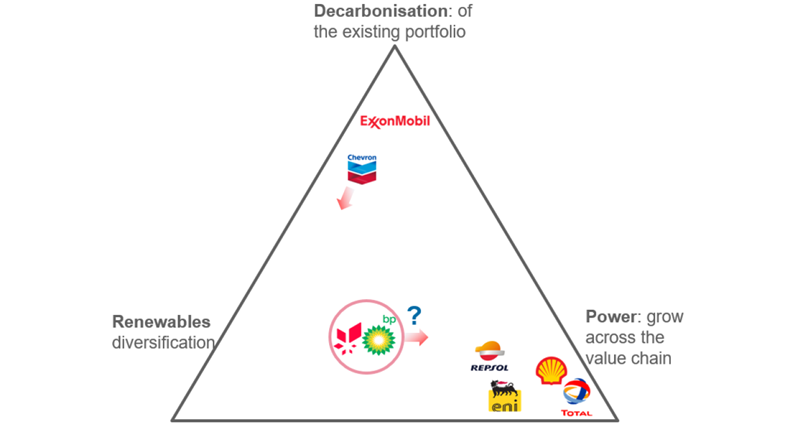

The European Majors’ strategies continue to evolve, with increasing commitment to both carbon reduction targets and deeper diversification into clean energies. Net-zero carbon ambitions and targets are now driving strategies of all European Majors. Methodologies for accounting for carbon emissions may differ across the companies, but the direction of travel is clear. All the Euro Majors are targeting net zero Scope 1 & 2 emissions by 2050, while the level of commitment on Scope 3 carbon reductions varies across the group.

Equally, on the diversification front, Total and Shell are leading with investment across the electricity value chain. Eni and Repsol are on a similar path, while BP and Equinor, which have initially focused on investment in renewables generation, are also expected to follow their European Major peers into supplying gas and power to residential customers.

…but the transatlantic gap is widening

On the other side of the Atlantic, ExxonMobil and Chevron are focusing on producing advantaged oil, betting on rising global oil and gas demand. The pressures felt by the European Majors are largely absent in the US, although investors are increasingly demanding more transparency on both the physical and transitional risks of climate change on the US Majors’ portfolios.

Chevron’s shareholders, including BlackRock, the world’s largest asset manager, recently voted in favour of reporting on corporate alignment with climate goals against the board recommendation. The US financial regulator is also taking tentative steps to require increased climate-related risk disclosures.

The US Majors’ carbon mitigation strategies have been limited, primarily focused on carbon sequestration and some procurement of renewable electricity for upstream operations. ExxonMobil holds the largest operational CCS capacity among the Majors, underpinned by its Shute Creek site in the US.

Fill in the form to learn more on the Majors’ new energy strategies, and how the Corporate New Energy Series can help you:

- Understand current strategic positioning of the O&G Majors in New Energy: strategies, business models, investment and future cashflows from renewable portfolios.

- Have clarity on the Majors carbon targets, ambitions and methodologies used to calculate carbon emissions. Understand challenges associated with carbon footprint measurements.

- Have a deeper understanding of key emerging technologies – solar, offshore wind, CCUS and hydrogen – including the state of the global market and the Majors’ positioning in each one of these themes.

You can also find out more about our Corporate New Energy Series here.