What is carbon-neutral LNG?

Buyers in Asia are calling for more scrutiny of LNG’s carbon footprint

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

View Gavin Thompson's full profileLNG ranks among the most emission-intensive resource themes across the oil and gas sector. Significant emissions are released through the combustion of gas to drive the liquefaction process and any CO2 removed prior to entering the plant is often vented into the atmosphere.

This is leading LNG buyers in Asia to place the carbon footprint of LNG under greater scrutiny, with growing calls for carbon emissions to be detailed in tenders. We have also now seen the delivery of the world’s first carbon-neutral cargoes into several Asian markets.

But what exactly is carbon-neutral LNG? Why are buyers in Asia showing an appetite for green cargoes? And how are suppliers responding? To understand more, I spoke to Lucy Cullen, Principal Analyst in our Asia Pacific Gas & LNG team.

What exactly is carbon-neutral LNG?

It’s a good question as there remains a fair amount of misunderstanding about just what is meant by carbon neutral – or green – LNG.

To begin with, ‘carbon neutral’ does not mean the LNG cargo creates zero emissions. Instead, the carbon emissions associated with the upstream production, liquefaction, transportation and, if required, combustion of the gas is measured, certified and offset through the purchase and use of carbon credits, which support reforestation, afforestation or other renewable projects.

Measuring emissions is a major challenge, with no consistent definition, methodology or reporting structure in place. And while emissions can be offset in different ways, what’s more critical is the carbon that is measured and included in the first place: deals that have been agreed to date have not applied a consistent approach and have not considered emissions or offset these emissions in the same way.

How quickly is this taking off?

These are early days. So far, seven carbon-neutral cargoes have been delivered or agreed, all to buyers in Asia, with more understood to be under discussion. In addition, Singapore’s Pavilion Energy issued a tender in March for 2 mmtpa of LNG with specific environmental criteria and requirements around the carbon footprint. QP won the contract to supply most of this volume through its commitments to implementing CCS and reduced carbon.

But I am in no doubt that demand for cleaner LNG will only grow, with the carbon footprint of LNG cargoes set to become an important differentiator for buyers and sellers alike.

How much carbon are we talking about and how is this offset?

If we break down life-cycle emissions of an LNG cargo, regardless of the cargo’s source or where it is finally consumed, combustion dominates the emissions footprint. The second-largest components – upstream and liquefaction – are much more dependent on project and location.

Over an average cargo life cycle, approximately 270,000 tonnes of CO2 equivalent is produced, requiring something like 240,000 trees to offset the emissions. This is achievable for a small number of cargoes and currently the cost of these offsetting projects is relatively cheap.

But is this achievable across the entire LNG industry? 2019 saw around 5,500 LNG cargoes sold, which would require around 1.5 billion trees or carbon credit equivalent. That’s just for a single year’s cargoes: as LNG demand grows, so the number of cargoes, carbon offsets and trees required will also grow.

For suppliers, a more focused approach that targets reducing emissions in upstream and liquefaction may be more achievable. This will also align with efforts already under way from suppliers as they come under greater public and investor pressure to manage their carbon footprints.

Why the difference across LNG projects?

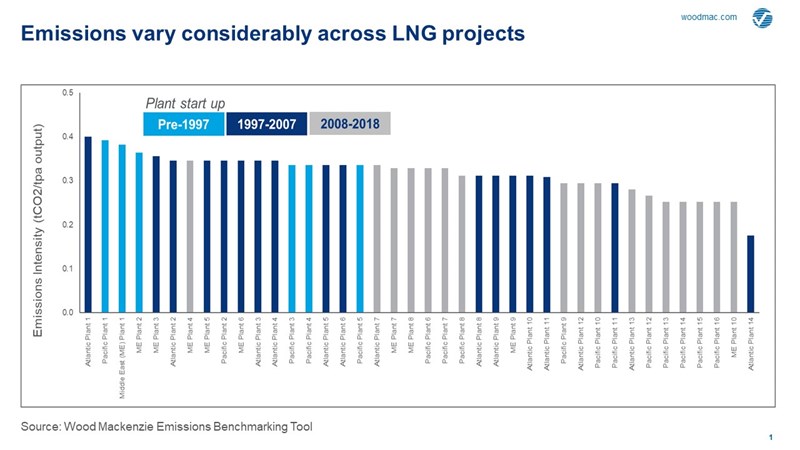

Using data from our Carbon Emissions Benchmarking Tool, we have looked at 40 LNG projects around the world and the liquefaction emissions created for each tonne of LNG output. It’s clear that not all LNG projects emit equally. Here, we only show emissions from the liquefaction segment. If you were to add upstream emissions to this chart then the variance would be even greater due to the wide range of CO2 concentrations in reservoirs.

The biggest opportunity to reduce liquefaction emissions lies with feedgas. Around 8-12% of feedgas (and at times more) is used to generate electricity to run the plant and fuel the liquefaction process. Higher efficiency plant designs or using renewable energy to replace feedgas can help to reduce emissions.

For upstream, the biggest opportunity lies in reducing CO2 venting, creating an opportunity for carbon capture and storage, which could cut emissions by as much as 25%. Several projects, including Snøhvit, Gorgon and Qatar, are exploring this option, though it remains high cost.

Read also: Renewable energy could reduce Asia Pacific LNG plant emissions by 8%

What is motivating buyers in Asia to request carbon-neutral cargoes?

It’s interesting that while carbon-neutral LNG is sold at a premium, all cargoes so far have been bought by companies in Asia, a region where carbon policies and investor pressure are relatively weak. I think there are several reasons for this.

Demand for LNG in Asia continues to boom and the region is set to be the engine room for global LNG demand growth. And as concerns with air quality rises in many Asian countries, attention is turning to emissions and cleaner burning fuels.

There’s no doubt that positive headlines are motivating deals. For a modest premium, companies have been rewarded with widespread coverage of their green credentials. An easy win. But beyond this, deals have also allowed buyers early experience with carbon-neutral transactions and marketing, valuable experience for what lies ahead.

But economics also play a part. Innovative ways of reducing costs and an affordable market for forestation projects right now have helped create competitively priced volumes in the current market. But looking forward, any significant cost premium could see a divergence in buyer attitudes – those that are carbon conscious and those whose primary concern is price.

What is the future for green LNG?

This is just the beginning of the journey, but what’s certain is that carbon consciousness is not going away. As LNG demand continues to grow, so will demand for greener LNG and I expect that future legislation, shareholder obligations and project financing terms will likely require that all LNG cargoes come with detailed information about the emissions associated with their production and delivery.

Targeting full life-cycle emissions across the entire LNG industry is a big ask, but progress towards emissions reduction in the upstream, liquefaction and transportation of LNG is coming into focus and at the very least, proof or visibility of supplier carbon credentials will become the norm. I expect this will lead to greater buyer scrutiny and differentiation between projects, with impacts for pricing.

How can I assess carbon emissions along the LNG value chain?

Evolving emissions policies and changing corporate positioning is leading to increased emphasis on the emissions associated with the production and supply of LNG into the global market.

As buyers/regulators/traders become more focussed on the carbon footprint of LNG supplies, there is an increasing desire to understand the competitive positioning of projects based on their carbon intensity, and the potential impact on value of possible carbon costs

The LNG Carbon Emissions Tool provides a transparent, independent and comprehensive assessment of carbon emissions along the LNG value chain. To find out more, please follow this link.

Join our Asia Pacific upstream webinar: forecasting the future on Thursday 19 November | 11:00am SGT | 2:00pm AEDT as we debate the themes that will have the biggest impact on the region’s upstream sector in 2021.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.