Future energy – electric vehicles

Mapping the path to king of the road

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

Electric vehicles sales have cruised through the pandemic. With travel restrictions the world over, much of the personal transport sector was brought to a standstill, and global sales of passenger vehicles fell by 20%. Yet EV sales surged 38% compared to 2019.

Does the outperformance suggest the shift to EVs from ICE vehicles is speeding up? I asked Ram Chandrasekaran, Principal Analyst for the transport sector.

How did EV sales buck the trend?

New policy was a big factor. Lower emissions targets were introduced in Western Europe on 1 January 2020, resulting in EVs’ share of total sales jumping from 7.5% in 2019 to 15%. China’s resurgent economy in the latter months of the year also helped. But let’s keep things in perspective – 2.8 million EVs were sold globally, taking the total on the road to just under 10 million. That’s a 3.5% niche in today’s light vehicle stock of 1.2 billion.

What’s the growth outlook?

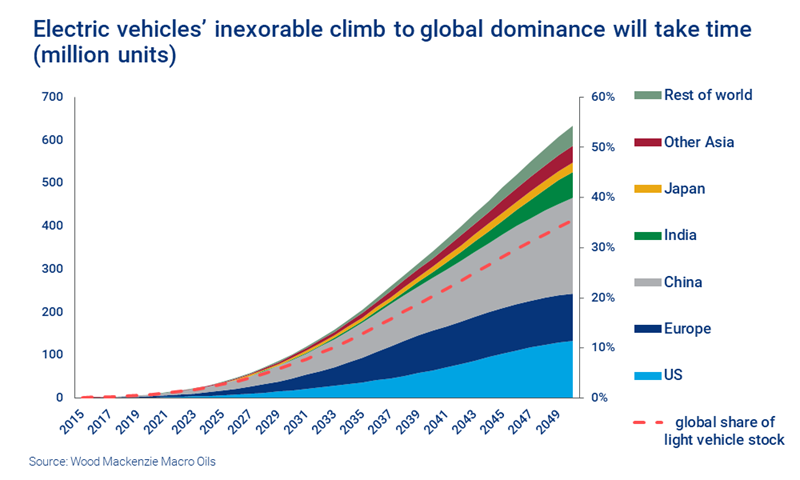

2021 is shaping to be EVs’ best yet with 1 in 20 passenger car sales electric. We forecast EV sales will grow by 25% compound this decade. Even so, there will only be 100 million EVs on the road by 2030, just 7% of the growing vehicle stock.

By then, though, the paradigm shift is underway: the ICE and diesel stock will have peaked and started its decline. Annual sales of EVs and autonomous EVs will have eclipsed those of ICE and diesel vehicles by the late 2030s.

Why does it take so long?

Any disruptive technology has to win over consumers on two fronts – is it better and is it cheaper than what they already use? EV producers have proved that EVs can match or exceed on safety and performance. The quality of products on the market today, though, is a mixed bag, and some models suffer from high depreciation and low resale values, which puts consumers off. That will improve as more automakers deliver a wider range of more desirable models.

Early buyers of EVs aren’t driven by price – for them, it’s a lifestyle choice. But cost will become a big issue when EVs go mass market. Today, the purchase cost is higher than for ICE vehicles, though our modelling shows that lifetime costs over 10 years can favour EVs, depending on how future gasoline prices develop. Few consumers, however, think about lifetime costs when they buy. The purchase cost will have to come down.

How quickly could range and charging times improve?

These two consumer anxieties vary by region. US drivers demand a 400-mile range versus the 250 miles average that batteries do today (which is more than the 150 miles drivers in Europe and Asia expect). We think it will take 10 to 15 years to deliver commercial batteries with higher ranges at an acceptable price and weight.

Charging an EV presents a similar challenge. It takes on average 45 minutes to fast charge a battery to 80% capacity today, while consumers want to wait no more than 10 minutes.

What are battery makers doing?

The big challenge is increasing energy density, a proxy for range, without counter-productive additional weight. Tesla, among others, is super-bullish that it can improve battery technology, develop new chemistries and innovate with vehicle structure to redress the weight problem. The company’s soaring market value suggests investors are betting on it finding solutions, and gives Tesla access to the capital to make it happen.

We are more cautious, and reckon it’ll be a decade or more before mass-market automakers confront the irreversible decision to shift assembly lines from legacy ICE power trains – the systems that propel the vehicles – to new, electric ones.

Where can policy help EVs?

It can make a massive difference, even as the relatively modest change showed last year in European sales. Norway is the poster child, having achieved 74% market penetration of EVs by the end of 2020. Its strategy for over a decade has involved equalising purchase prices (emissions-related taxes on new ICE car sales, zero VAT on EV sales); discounts for EVs on ferries, parking and toll roads; and, crucially, rolling out a nationwide fast-charging network.

Many countries have aggressive targets to phase out ICE vehicles, among them Norway (2025), UK, Ireland, Denmark and Sweden (2030), and China by 2040. Most, though, have yet to flesh out clear policy that sufficiently incentivises EVs to meet their plans.

We expect the Biden administration to be supportive of EVs, starting by reversing the Trump case against California’s ability to set its own emissions regulation, opening the door to banning ICE vehicle sales from 2035.