This report is currently unavailable

What's the key takeaway of this year's report?

A change of course is likely as FLNG players take a second look at financials. Questions remain over cost and project economics.

What's inside this report?

Get answers to all your questions about FLNG including:

- What do I need to know about FLNG?

- How does FLNG stack up against LNG?

- What's the FLNG industry doing to overcome challenges such as the reduction in exploration expenditure and the poor economies of scale?

Report summary

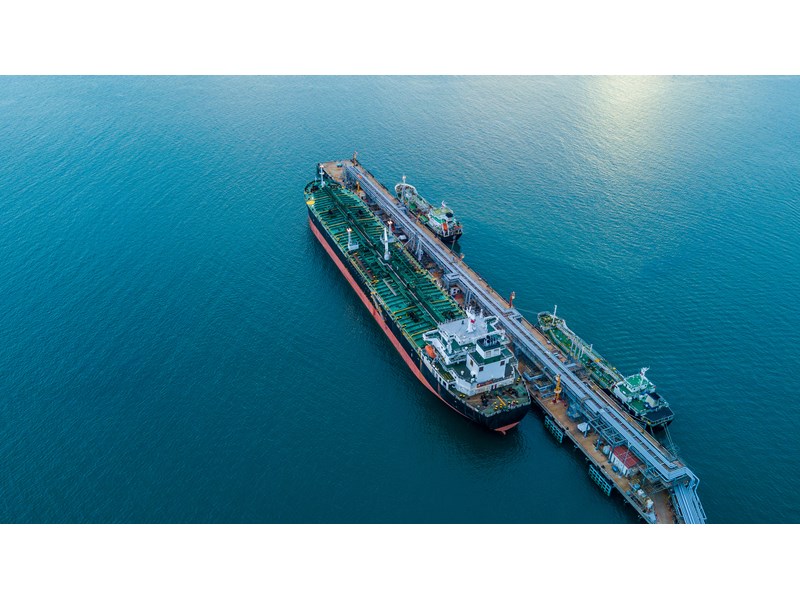

The lack of economy of scale is likely to limit FLNG projects to small-scale and remote developments as it competes for buyers, financing and partners in a busy LNG marketplace.

Liam Kelleher, global LNG research analyst, quoted by oilprice.com

Sample data point

What do I need to know about capital expenditure of FLNG projects? And how does this compare to LNG?

In this report, we present the CAPEX of all LNG and FLNG projects worldwide, illustrated in the graph above by year of which they took Final Investment Decision (FID). Since the year 2000 to date, the average cost of LNG projects sanctioned has been $1000/tonne. However from 2009 to date, the cost of LNG projects rose to an average $1,400 per tonne. The sustained high oil price between 2008 and 2014 – which peaked at $147/bbl (Brent) – caused a major escalation in project costs of both oil and gas projects. A number of high cost Australian projects were also sanctioned, with an average cost of $2,400/tonne.

Table of contents

- Global FLNG Overview 2021: Cost cutting increases interest in FLNG

- Near-shore Developments

- Open-Sea developments

- Economics

-

Capital Expenditure (CAPEX)

- Location and CAPEX

- Operating Expenditure (OPEX)

-

Breakeven Costs

- Construction Time

- Financing and Commercial Structure

- Commercial structure

- Cost Risks - Escalation and Deflation

- Supply and Demand

-

FID Outlook

- Exploration - a dwindling number of new gas finds

- Project Cancellations and Postponements

-

Advantages and Disadvantages of FLNG

- Advantages

- Disadvantages:

-

Remaining Issues

- Fiscal requirements and local content

- Economy of scale in a competitive market

- FLNG gravitating towards a fixed offshore concept

- Liquids Processing and Storage

- LNG Offloading & Transfer

- Liquefaction processes and capacity constraints

- Vessel life

- LNG storage and containment type

- Capacity

- Utilisation

- Safety

-

Key players

- Upstream companies

- Majors

- Asian NOCs and IOCs

- Mid and Large-Caps

- Other

- Mid-stream operators

- Golar

- Exmar

- SBM Offshore

- Hoegh

- Excelerate Energy

- New Fortress Energy

-

EPC contractors and shipbuilders

- EPC/Technology Companies

- Shipbuilders

-

Key Projects

- Australia

- Prelude

- Malaysia

- PETRONAS FLNG 1 (Satu) - Operational

- PETRONAS FLNG 2 (Dua) – Operational

- Cameroon

- Cameroon GoFLNG – Operational

- Mozambique

- Coral FLNG – Under Construction

- Mauritania/Senegal

- Tortue FLNG - Under Construction

-

Americas

- US Gulf Coast

- Canada

- Colombia

- Caribbean FLNG – Cancelled

- Argentina

- Tango FLNG

Tables and charts

This report includes 26 images and tables including:

- Project Details

- CAPEX ($/tonne) of LNG projects by FID Date

- CAPEX ($/tonne) and OPEX ($/mmbtu) for selected projects

- FOB Breakeven Prices for selection of projects

- CAPEX for FLNG Projects

- OPEX for FLNG Projects

- LNG Supply and Demand - History and Forecast

- Capacity Sanctioned per year

- No of projects sanctioned per year

- Annual CAPEX - History and Forecast

- Upstream vs Midstream processing requirements

- Example LNG Specifications and Process Equipment Required

- Floating Liquefaction Technologies

- Vessel Life and Allocated Capacity

- Vessel Sizing

- CAPEX ($/tonne) of selected LNG and FLNG plants

- Construction Times and Overruns of FLNG and Onshore LNG

- EPC Companies and Project Slate

- Shipbuilders and Project Slate

- Prelude Project Details

- PFLNG 1 Project Details

- PFLNG 2 Project Details

- Cameroon GoFLNG Project Details

- Coral FLNG Project Details

- Tortue FLNG Project Details

- Tango FLNG Project Details

What's included

This report contains:

Other reports you may be interested in

LNG short-term analytics: Supply tracker

Weekly short-term LNG supply tracker by liquefaction plant

$4,000Global products market weekly: Distillate markets ease despite ongoing global maintenance

Weekly review of global refining margins across NW Europe, the Med, US Gulf Coast, New York Harbour, Singapore and the Middle East Gulf.

$1,050LNG short-term analytics: Data download

Weekly updated data download for LNG Short-Term Analytics Service

$4,000