This report is currently unavailable

What’s the key takeaway in our latest quarterly aluminium outlook report?

A sharp slowdown in global economic activity, escalating trade tensions and rising geopolitical risks will keep annual average LME aluminium prices below US$1900/t out to 2023. Out to 2030, we expect prices to trend upwards.

Why buy this report?

Get answers to all your questions about the global aluminium market, including:

- How will global warming and decarbonisation impact the aluminium industry?

- Will rising scrap availability affect the level of investment in new smelting capacity?

- Are Chinese semis exports here to stay, or will they go away?

- As the dynamic between the China and rest of the world changes, where are the other emerging aluminium production hotspots?

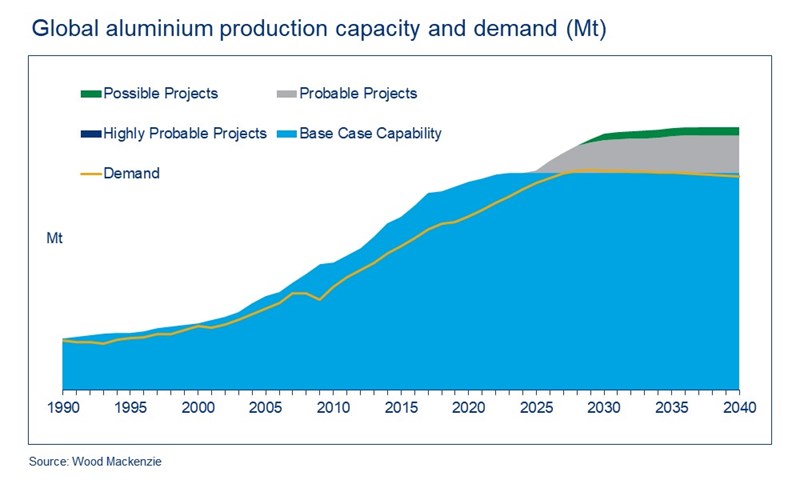

The report includes a full set of data and charts, including this one, tracking changes in aluminium production capacity and demand for the last 30 years, and providing forecasts out to 2040. Scroll down to see the complete table of contents.

Report summary

Table of contents

- Aluminium market outlook

- Alumina market outlook

-

Seaborne bauxite market outlook

- Main risks around our base case aluminium market outlook

- Long term aluminium prices

-

Long-term alumina prices

- Changes to consumption forecasts since Q2 2019

-

Forecasts by region

- Asia

- China

- Asia ex-China

-

Europe

- North America

- United States

- Project Classification

-

Smelter production and capacity

- Summary

- Global smelter production and capacity 2018-2040

- Africa

- North America

- Latin America

- Middle East

- Asia

- Europe

- Russia and Caspian

- Oceania

- Project Classification

-

Refinery production and capacity

- Summary

- Global refinery production and capacity 2018-2040

- Africa

- North America

- Latin America and the Caribbean

- Middle East

- Asia

- India

- Indonesia

- China

- Europe

- Russia and Caspian

- Oceania

-

Bauxite production

- Regional focus

- Africa

- Latin America

- North America

- Middle East

- Asia

- Other Asia

- Europe

- Russia and Caspian

- Oceania

Tables and charts

This report includes 80 images and tables including:

- Global supply-demand balance, LME cash prices and stocks in days of consumption

- China swings into deficit in 2019

- Elevated days of consumption in world ex-China points to lower requirement for new capacity over the medium term

- Global aluminium balance, 2018-2023, 2025, 2035, 2040

- World ex-China alumina capacity and demand (Mt)

- Long-term alumina market balance and price forecast

- Atlantic Seaborne supply & demand, 2010-2035, Mt

- Indo-Pacific Seaborne supply & demand, 2010-2035, Mt

- Bunker fuel mix assumptions

- Indicative freight rates, Atlantic to Yantai (China), 2015-2025, US$/t bauxite

- Global seaborne bauxite balance and prices, 2018-2023, 2025, 2035, 2040

- Metal prices, cash costs and aluminium stocks

- Aluminium: the required aluminium incentive price is lower than the historical average at US$2250/t

- Aluminium incentive price, long run operating cost and capital intensity, US$/t

- Average LME aluminium cash prices, 1991-2040 and incentive price (US$/t)

- Primary aluminium cash prices, 1970-2040 (US$/t)

- Alumina: incentive price at US$380/t on transformation of geography and environmental landscape

- Alumina incentive price, long run operating cost and capital intensity, US$/t

- Global alumina balances and prices, 2018-2023, 2025, 2035, 2040

- Average one-year contract alumina prices, 1991-2040

- Alumina prices, 1970-2040 (US$/t)

- Global primary aluminium consumption (Mt)

- Global primary demand to hit peak at 86.4 Mt in 2029

- China's share of global primary demand set to peak at 60% in 2026

- China's primary aluminium intensive growth to end in mid-2020s

- Share of ICE car sales to slump from 83% in 2018 to 50% by 2040

- Europe primary aluminium consumption 2018-2023, 2025, 2035 and 2040 (kt)

- European consumption of primary aluminium

- Total bauxite supply and demand, Mt

- Global metallurgical bauxite requirement 2018-2023, 2025, 2035, 2040 (Mt)

- Base case global bauxite supply 2018-2023, 2025, 2035, 2040 (Mt)

- Main changes to primary aluminium consumption forecast Q2 2019 vs Q3 2019 (kt)

- Asia primary aluminium consumption kt

- Chinese primary aluminium consumption (Mt and year-on-year % growth)

- Aluminium demand growth tracking below industrial production from 2026

- Demand splits by end-use sectors

- Aluminium demand from construction set to peak in 2025 but driven by secondary metal

- Non-residential construction will support aluminium over the next five years

- Asia primary aluminium consumption 2018-2023, 2025, 2035 and 2040 (kt)

- North America primary aluminium consumption 2018-2023, 2025, 2035 and 2040 (kt)

- US consumption per end-use sector

- US consumption and production of automotive body sheet

- World ex-China market moves to a surplus

- Ex-China primary aluminium demand and capacity (@95% utilisation), 2016-2040, Mtpa

- China smelter technology making inroads in Asia

- China aluminium capacity buildout

- Global aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Africa aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- North America aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Latin America aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Middle East aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Asia aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Europe aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Russia and Caspian aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Oceania aluminium production 2018-2023, 2025, 2035 and 2040 (kt)

- Long-term alumina supply assured

- Global alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Africa alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- North America alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Latin America and the Caribbean alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Middle East alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Asia alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- China alumina production forecast by province, 2018-2023 (ktpa)

- Refining capacity booms in southern China, 2019 and 2023 (ktpa)

- Europe alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Russia and Caspian alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Oceania alumina production 2018-2023, 2025, 2035 and 2040 (kt)

- Monthly Guinean bauxite exports by destination country, 2013-2023 (projected potential from H2 2019)

- Africa bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Latin America and Caribbean bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- North America bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Middle East bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Central Chinese refinery costs using domestic and imported ore, 2016-present, US$/t

- China’s conversion to imported bauxite by processing method, 2019

- Chinese seaborne bauxite consumption by province, 2018, 2019, 2023

- Asia bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Major Montenegrin bauxite exports, 2015-2019 (annualised), Mt

- Europe bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Russia and Caspian bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

- Oceania bauxite production and demand, 2018-2023, 2025, 2035 and 2040 (Mt)

What's included

This report contains:

Other reports you may be interested in

Global fiscal terms database Q3 2019 (1)

In this easy-to-use Excel workbook we summarise over 150 countries’ fiscal terms for the latest exploration opportunities.

$1,350Global aluminium short-term outlook March 2024

Prices rally in late March on Yunnan supply concerns and bullish fund positioning.

$5,000Long-term Brent price maintained at US$65/bbl – oil and gas price assumptions versus forecasts

Defining our price assumptions and methodology, their use in our tools and services, and why these are independent of our price forecasts.

$1,350