Discuss your challenges with our solutions experts

Oilfield service giants Schlumberger and Halliburton reported Q4 earnings recently, closing off what some have described as the worst year for the service sector in decades. Both companies saw 2016 revenue decline by about a third, although Q4 showed some signs of growth. In our latest report, our analysts discuss whether the companies have turned a corner and what's in store in North America and internationally.

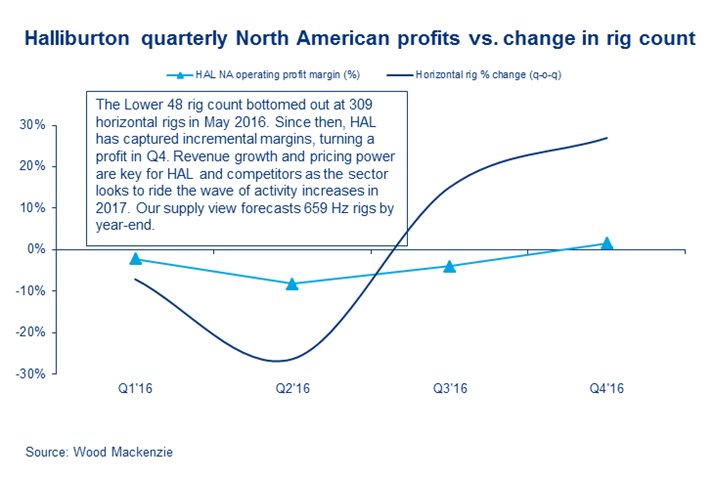

Although the losses posted have narrowed year-on-year, both companies have continued to struggle, particularly in the international and offshore markets. Halliburton posted its first operating profit in a year during Q4 after shifting its strategy from a focus on market share to margins. Despite losing some market share during Q4, Halliburton is confident that it will be able to win back orders even when working at a higher price point. Meanwhile, Schlumberger saw increases in hydraulic fracturing activity in North America and the Middle East but experienced continued losses and weakness in other regions.

Recovery for international and offshore markets — including expensive deepwater and mature oil fields — is not expected until 2018 at the earliest, but the outlook appears much rosier in the onshore North America space. North America has seen increasing rig count due to the revival of shale; US rig count increased by 35 last week alone, bringing the total to 694, after the count hit a multi-year low in May. Higher spending on exploration and drilling in this area may help boost profits for OFS companies, particularly for North America heavyweight Halliburton.

Both Schlumberger and Halliburton report price improvements in the pressure pumping market but are realistic that costs won't return to 2014 levels overnight. Our base case cost inflation assumption for the Lower 48 is 10%, with variability across the OFS business. 2017 will be a slow march to pricing recovery. The OFS sector has taken deep cuts during the downturn, and we expect the ensuing recovery to last for multiple years before the operating environment is stable again.

While US-focused upstream operators have guided towards more robust spending relative to 2016, capital markets may have already baked-in a more lofty expectation of future growth than is warranted. The critical question for OFS in 2017 will be "Is there enough work to go around?" For more information on our 2017 cost inflation view, listen to our podcast discussing that story.

Crude for Thought: What to watch for in US oil and gas in 2017

Jackson Sandeen and Ben Shattuck discuss the US production outlook, improving well results, higher costs and other risks to our 2017 assumptions. What should you watch for in 2017?