Sign up today to get the best of our expert insight in your inbox.

How the war is shaping Big Oil’s transition strategy

Has peak ESG passed?

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profileThe pace the transition unfolds continues to be the biggest uncertainty for strategic planning in the oil and gas industry. After the signing of the Paris Agreement in 2015, it was easy enough to target net zero by 2050 and depict a smooth 1.5 °C pathway on paper.

In reality, the road to a 21st-century energy mix was always going to be bumpy, as a black swan event such as Russia’s invasion of Ukraine has proved.

Tom ElIacott and Luke Parker, senior Corporate analysts, shared the team’s latest thoughts on how Big Oil’s strategies are adapting.

First, there was strategic divergence

The Majors’ initial approach to decarbonisation after Paris was shaped by stakeholders, not least government policy. At the time, Washington was indifferent to the Paris goals, tacitly giving US Majors freedom to stick to what they knew best. They focused on oil and gas.

The Euro Majors, in contrast, mirrored the much more proactive and aggressive European policy response to pursue net zero. Investors were also highly influential in pushing for a decarbonisation agenda as they responded to the burgeoning appetite for ESG investment.

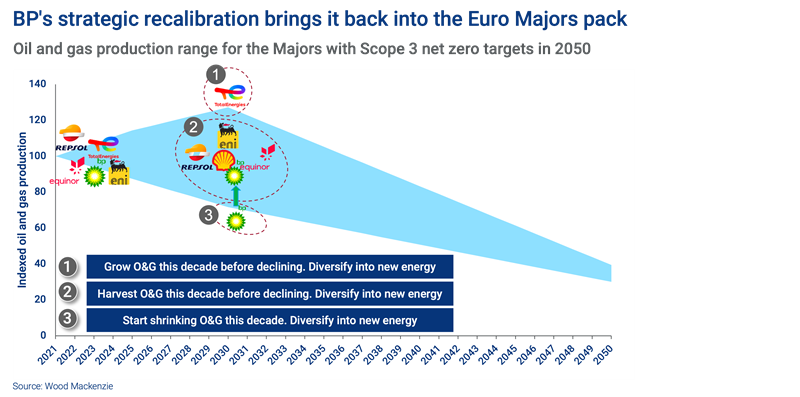

Setting net zero Scope 3 targets by 2050 implied a massive reduction for Euro Majors’ oil and gas production and refining output from current levels. Individual corporate strategies varied. Shell set the initial corporate template for net zero ambition that acted as a guide for the rest of the sector. BP positioned as fast mover, more aggressive on committing to low-carbon investment, and more aggressive in committing to cut exposure to oil and gas.

At the other end of the range, TotalEnergies has pursued a dual-pronged approach aiming to grow both, at least through 2030 – regarded as a key way marker on the global path to net zero and as an inflection point for many oil and gas companies.

Second, strategies have begun to converge

The war has been a major factor, if not the only one. Governments have been forced to put energy security at the top of the agenda, above sustainability. The only way to keep the lights and heating on in the short run is more oil, gas and coal. Investors have aligned – ‘peak ESG’ was 2021, and the pressure on oil and gas companies has, for the time being, eased.

Another reason for investors’ more positive stance, of course, is that oil and gas companies are generating cash flow from upstream beyond their wildest dreams. Capital investment in oil and gas projects looks more attractive, albeit tempered by the still very real threat of declining oil and gas demand next decade and beyond. Any incremental investment in oil and gas will continue to be in low-cost, short-cycle, fast-payback projects with a below-average emissions footprint.

The typically more modest returns from renewables and other low-carbon technologies haven’t necessarily deteriorated, but the relative risk/return gap between upstream and renewables has widened, in the near term, at least.

It’s logical that, while this lasts, capital allocation should shift towards upstream. Industry guidance for upstream capital investment in 2023 is up 15% year-on-year. BP dialled back its aims to reduce oil and gas production and Scope 3 emissions to 2030 in an ad-hoc strategy update last month. It’s moved from being an outlier to having an outlook closer to its Euro Major peers.

US Majors have continued to steer clear of committing to Scope 3 emissions reductions, giving them more room for manoeuvre – perhaps even to grow upstream. They have, though, begun to dip their toe into low-carbon technology focusing on CCUS, renewable hydrogen and low-emissions fuels. Some Euro Majors have throttled back from the breakneck accumulation of the renewables pipeline.

Third, the future is more convergence

In the long run, the world is still headed towards net zero and so is Big Oil. By the next decade, energy security will be much more aligned with sustainability goals, shifting away from fossil fuels to domestically produced low-carbon energy and the supporting supply chains.

Policy initiatives in 2022 reinforce rather than undermine strategic positioning towards lower carbon business models beyond 2030. Key among these are Europe’s more aggressive targets and the game-changing tax incentives in the US Inflation Reduction Act. The US Majors could significantly accelerate investment along the low-carbon technology value chain.

Finally, what might strategic convergence mean for divergent stock market ratings?

The Euro Majors’ share price ratings have stubbornly traded at a big discount to their US peers, even those that have successfully demonstrated value creation in their initial renewables investments.

Convergence may help Euro Majors narrow the valuation gap. BP’s sector-beating 15% share price jump on its Q4 strategic update is a sign of changing investor sentiment.