Discuss your challenges with our solutions experts

Can the supply chain cope with Norway’s upstream investment surge?

The race is on for operators to reach FID within the tax window

1 minute read

Erin Moffat

Principal Analyst, Upstream Supply Chain

Erin Moffat

Principal Analyst, Upstream Supply Chain

Erin brings 15 years of industry experience to her role in our Upstream Supply Chain team.

Latest articles by Erin

-

Featured

Upstream supply chain 2024 outlook

-

Featured

A new roadmap for the upstream supply chain in 2022? | 2022 Outlook

-

Opinion

Can the supply chain cope with Norway’s upstream investment surge?

When Covid-19 and the oil price crash sent shockwaves through the upstream industry in 2020, Norway responded with radical, temporary fiscal measures designed to incentivise development activity on the Norwegian shelf. Now, as activity ramps up and operators strive to reach FID within the tax window, can the supply chain deliver?

We explored this topic in detail in a recent report, drawing on insight from Wood Mackenzie Lens Upstream. Visit the store to access the full report, or read on for a brief introduction.

Offshore investment activity is ramping up in Norway

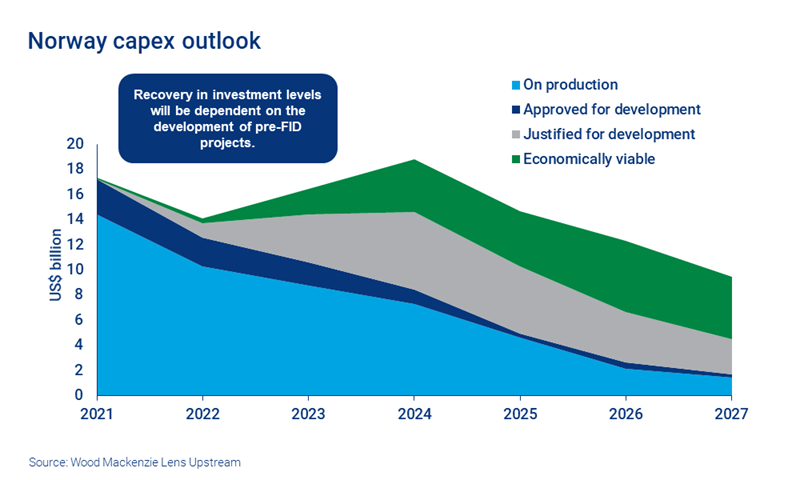

Norway’s temporary tax terms, introduced in June 2020, have successfully maintained its position as a hotspot for global offshore investment. However, companies must sanction projects by the end of 2022 to benefit. Now, with around 30 projects slated for FID within the tax window, the supply chain could be under significant pressure.

Norway’s upstream supply chain faces distinct pinch points

On a global basis, utilisation rates for vessels, subsea equipment and floating rigs have increased since the oil price crash but remain relatively low. There are, however, regional pinch points – notably in Norway.

Why? For one thing, Norway’s upstream sector has an insular dynamic, reliant on local supply chains. Meanwhile, the global supply profile has changed – regional capacity has been cut and demand for Norwegian capacity has increased as a result. Add to this the niche nature of the harsh environment rig market and the pressure begins to mount. In our view, increasing demand for such rigs will see utilisation rates soar to over 90% – driving rig day rates up. Longer lead times and cost inflation are also real possibilities for some subsea suppliers.

E&Ps could feel the pinch of a tight supply chain in Norway

So, which companies will be most impacted by Norway’s tightening supply chain? Equinor and Aker BP dominate the picture, operating half of all projects aiming for sanction within the tax window. They have the advantage of existing supply chain alliances and larger project scopes. Nonetheless, given the sheer number of projects involved there is a risk that not all will be delivered by the deadline.

Independents with one or two small projects, on the other hand, could struggle to access capacity at the right time and price. That risk could potentially be mitigated with a flexible approach to procurement and opting for standardised equipment.

During this spike in activity operators will also need to keep a watchful eye on the execution windows of others to avoid installation bottlenecks.

Read the full report for a closer look at:

- The project pipeline in Norway

- The impact of supply chain pinch points on costs and lead times

- Beyond the current surge – what’s next for the supply chain?