Are NOCs rising to the energy transition challenge?

National oil companies are still lagging the Majors on the decarbonisation journey – but a raft of incentives mean the pace is picking up

4 minute read

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

-

Opinion

How are global NOCs tackling the energy transition?

National Oil Companies (NOCs) produce more than half of the world’s oil and gas, making them one of the biggest global emitters of greenhouse gases. Yet they have historically avoided the scrutiny experienced by international oil companies (IOCs) around decarbonisation and emissions. Times are changing, though. Thanks to country-level obligations and increased pressure from a range of stakeholders, we are now seeing NOCs beginning to develop transition-ready plans.

Our report, National Oil Companies: strategies for the energy transition, explores the push and pull forces that will determine how NOCs navigate the road ahead, and the progress made to date. The 19 NOCs covered in this insight will produce 60 million boe/d in 2023 – around three times that of the Majors; their importance to the transition cannot be overstated.

Fill in the form to access a complimentary report extract, and read on for an introduction.

How is government policy influencing NOC energy transition strategies?

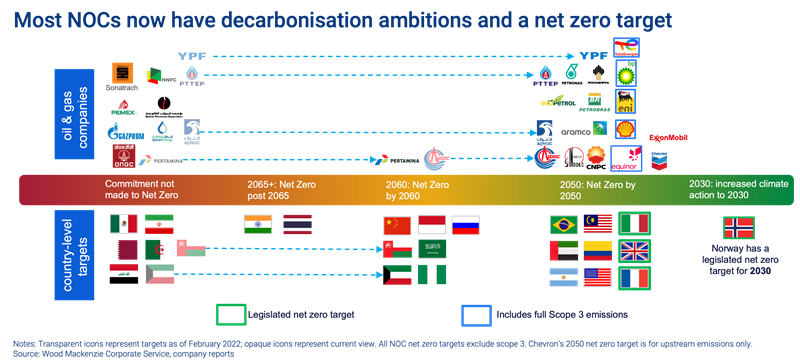

More countries and NOCs have been making emissions pledges since early 2022. Boosting production remains a priority, but most NOCs now have also ambitious decarbonisation goals.

Outside of Europe and the US, NOC transition strategies are being dictated by government climate policies, regulation and investment incentives, and some countries are now diversifying meaningfully into zero or low-carbon energies. In January 2023, for example, India pledged US$4.3 billion for green investments (such as hydrogen and battery technologies). And in March, Brazil increased its biodiesel blending mandate from 10% to 12%, with a target of 15% by 2026.

How does the picture vary between regions?

The NOCs leading the pack on energy transition strategies are generally net importers of hydrocarbons. They operate in high-cost basins, but enjoy highly integrated industrial complexes, with domestic supply chains driven by technology. The laggards, by contrast, tend to come from net exporting nations. These regions have low supply costs and are heavily dependent on outsourced technology.

Despite oil and gas profits surging, NOCs have ratcheted up their commitments to the energy transition. The most committed regions have sizable budgets dedicated to low/zero-carbon themes, some large-scale projects in construction or in operation and pilots underway.

Those at the other end of the spectrum have yet to set their net zero targets, with low or zero-carbon projects not past the ideation stage. These regions are often poor at measuring and reporting emissions and limit their capital allocation to oil and gas. In our analysis, the Middle East was clearly the most improved region, and Asia has solidified its leadership.

Are NOCs working together with IOCs on decarbonisation plans?

NOC-IOC cooperation is alive and well in the new age of energies. These partnerships are not a new idea in the world of oil and gas, and will be critical to develop riskier, long-dated businesses.

A flurry of NOC-IOC partnership agreements have been signed since 2022, with carbon capture, utilisation and storage projects as the most sought-after theme.

Can NOCs fast-track their energy transition plans?

The energy transition requires high levels of investment. And NOCs have the financial strength to invest, as record cash flows are allowing for a reset of balance sheets.

In the pursuit of growth, the group must determine how to split investments between legacy upstream and new businesses. A myriad of initiatives – including government-led funding, carbon regulation, tax incentives, emissions trading schemes, and biofuel mandates – point towards a more transition-ready trajectory in the long term.

When it comes to low-carbon capital commitments, few NOCs can compete with leading IOCs.

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

-

Opinion

How are global NOCs tackling the energy transition?

With NOCs stepping up their low-carbon initiatives, the gap between NOCs and IOCs has certainly narrowed. But our analysis finds the group is still playing catch-up, as IOCs pour a larger percentage of their total spend into low carbon. When it comes to low-carbon capital commitments, few NOCs can compete with leading IOCs.

How are NOCs derisking their legacy business?

Hydrocarbons remain important for energy security and affordability; NOCs must find ways to reduce the carbon risk on this key area of their business, while building cleaner energy systems. NOCs in this report will contribute around a third of global upstream and downstream emissions in 2023-2030; it’s clear that if they can achieve a successful reduction, the impact worldwide would be significant.

Most NOCs are advancing their decarbonisation plans, with companies exposed to higher carbon intensity assets tending towards more aggressive emissions targets. And decarbonisation spending is already having an impact – lowering carbon intensity and keeping portfolios sustainable in the long run. A portfolio shift to gas would help too, but despite good intentions, progress is slow.

Find out more about the NOCs' strategic response to the energy transition

The full report digs into the NOCs' energy transition strategies in more detail, including a look at burgeoning hydrogen projects, the role of natural gas as a bridging fuel, wind and solar projects and more.

Fill in the form at the top of the page for a complimentary extract.