Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

US climate bill to boost domestic annual renewables investment to nearly US$114 billion by 2031

The IRA set to reshape US renewables supply chain

3 minute read

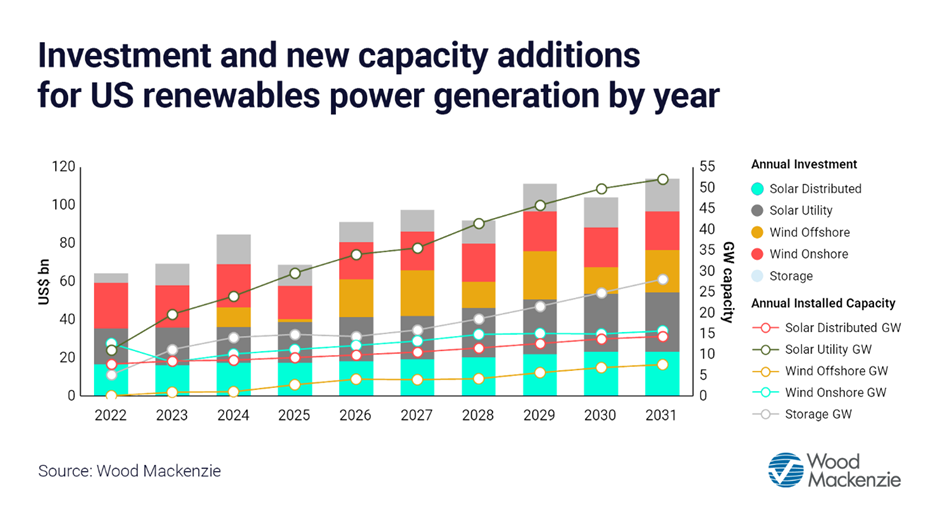

The Inflation Reduction Act (IRA), flagship legislation focused on accelerating decarbonisation in the US, will significantly boost annual investment into renewable energy deployment in the region. A rise from US$64 billion in 2022 to nearly US$114 billion is expected by 2031, according to Wood Mackenzie, a Verisk business (Nasdaq: VRSK).

Wood Mackenzie’s latest report, ‘Boom time: what the Inflation Reduction Act (Act) means for US renewables manufacturers’, provides an initial assessment of how the Act will greatly support the expansion of US renewables equipment manufacturing capacity, though specific opportunities will vary per segment and important, to be released guidance on implementation of the IRA will influence the scale of growth in the sector.

Daniel Liu, principal analyst at Wood Mackenzie, and lead author of the report said: “The IRA will completely reshape the renewables supply chain in the US, incentivising the reopening of shuttered facilities as well as provide opportunities to build entire equipment supply chains from scratch.”

Two key provisions of the IRA are likely to be game-changing for renewables equipment manufacturers. First, the Act provides a tax credit, known as the advanced manufacturing production credits (AMPC), for US-made renewable equipment.

Second, the Act incentivises developers of US renewable projects to purchase domestically produced equipment by providing an additional tax credit if they meet domestic content requirement (DCR) thresholds. To qualify, 40% of all equipment must be US-manufactured on projects installed before 2025, 20% for offshore wind. This rises to 55% after 2026, 2027 for offshore wind.

“It’s high stakes for US equipment sales, as the IRA provides incentives that cut the manufacturing cost of solar panels, storage equipment and wind towers in the US by anywhere from 4% to 30%. This, along with tariffs on some imports, potentially puts domestic manufacturing on a cost-competitive footing with imported equipment,” Liu said.

Onshore wind: a fair wind is blowing for OEMs

“We expect the US onshore wind manufacturing community to take full advantage of the AMPC. The credits will help original equipment manufacturers (OEMs) reverse declining equipment sales margins in the short term and incentivise investment in manufacturing capacity,” Liu said.

The US has enough manufacturing capacity to supply most domestic demand for turbine equipment to 2031, though the industry faces a near-term shortage of US-produced equipment. This creates an opportune pricing environment for manufacturers, as not all developers will be able to meet DCR thresholds within the Act.

Developers can potentially meet pre-2025 DCR thresholds with US-manufactured wind turbine components, such as domestic foundations, towers, and balance-of-plant equipment. Turbine blades will help developers reach the 55% threshold after 2026.

Offshore wind: AMPC to fuel manufacturing capacity expansion

Despite the nascency of US offshore wind manufacturing, the country is one of the most attractive markets for offshore wind suppliers due to its ambitious targets, lack of existing supply chain, focus on local content in tenders and consolidated client base.

Liu said: “We expect manufacturers to capture the full value of the AMPC given the limited capacity of US manufacturing, the natural cost advantages versus imports and the need to invest in domestic manufacturing capacity.”

It’s not smooth sailing for solar

“Utility solar PV has a somewhat foggier outlook, however. With such a small solar manufacturing base currently in the region, juxtaposed against substantial forecasted growth in solar additions, fully meeting US solar needs with domestic equipment will be more challenging than other sectors,” Liu said.

PV panel manufacturers face considerable challenges when it comes to developing a self-sufficient domestic manufacturing capability. US manufacturing costs are 16-33% higher than imported equipment, but the AMPC will help close this gap.

Investment depends on further guidance, manufacturing costs and supply/demand

The Internal Revenue Service (IRS) will provide eligibility requirement guidance on how to access support in the form of tax credits, which will be a critical factor for investment decisions by the manufacturing community.

“The decision to invest in equipment manufacturing capacity expansion depends on the interplay of three factors. First, the cost of manufacturing equipment in the US compared with imports, taking into account the benefits the AMPC provides. Second, the expected supply/demand imbalance for renewables equipment, and finally, specific guidance from the IRS on what constitutes ‘domestically produced equipment’,” Liu concluded.

ENDS

EDITOR’S NOTES

2022 will be remembered as one of the most pivotal years of power generation and highlighted the folly of concentrated supply. The Inflation Reduction Act provides incentives that cut the cost of solar, wind, and storage equipment by anywhere from 20% to 60%. We break down everything you need to know in our latest Horizons issue, ‘Boom time: what the Inflation Reduction Act (Act) means for US renewables manufacturers’.