Discuss your challenges with our Power & Renewables experts

Elevated subsidies enable offshore wind to end 2023 on a high note

Ørsted's final investment decision on the Hornsea 3 project reveals the intricate dynamics of competitive tenders, pricing strategies, and regulatory advantages, showcasing how higher subsidies is shaping the success of offshore wind projects and emphasising the pivotal role of policy in overcoming industry challenges and fostering renewable energy growth

6 minute read

Søren Lassen

Head of Offshore Wind Research

Søren Lassen

Head of Offshore Wind Research

Søren tracks, analyses and forecasts value chain dynamics, technological advancements and the market outlook.

Latest articles by Søren

-

Opinion

Offshore wind energy: what to look for in 2024

-

Featured

Wind 2024 outlook

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Opinion

How reversible are the recent setbacks of the offshore wind sector?

-

Opinion

Net zero offshore wind bids in UK’s latest tender: the outcome the sector needed?

-

Opinion

Offshore wind: German auction wins show Big Oil has not left the party

Srinivasan Santhakumar

Senior Research Analyst, Offshore Wind

Srinivasan Santhakumar

Senior Research Analyst, Offshore Wind

Srinivasan is a senior analyst with a particular focus on asset valuation, LCOE forecasts and market research.

Latest articles by Srinivasan

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Opinion

Offshore wind: policy frameworks decide who wins – but not when

Rishab Shrestha

Principal Analyst, Europe Power

Rishab Shrestha

Principal Analyst, Europe Power

Rishab is a principal analyst at Wood Mackenzie, focusing on European power and renewables markets.

Latest articles by Rishab

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Opinion

Abundant, low-cost renewables will transform Nordic power markets

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

Renewable energy costs continue to fall across Europe

Akif Chaudhry

Research Director, Corporate Strategy and Analytics

Akif Chaudhry

Research Director, Corporate Strategy and Analytics

Akif focuses on strategy, benchmarking and valuation analysis related to power and renewables within company portfolios.

Latest articles by Akif

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Featured

Mixed signals for power and renewables in 2023

-

Opinion

Big Oil set to cash in on the trillion-dollar offshore wind prize

-

Featured

Power and renewables companies face merging headwinds in 2022 | 2022 Outlook

-

Opinion

Natural gas: friend or foe in Europe’s 2030 emissions target?

-

Opinion

Could the Majors take a fast-track route to lower emissions intensity?

Ørsted has announced a final investment decision (FID) on its 2.9 GW Hornsea 3 (H3) offshore wind project in the UK. There are multiple factors that enabled the final investment decision (FID). With the FID signed, the key risk for Ørsted now sits with execution and avoiding significant delays. Ørsted’s suppliers for this project include vessels and factories that are not yet operational. This offer downsides in the form of potential delays which have been a big theme of 2023. However, H3 also holds multiple upsides. Below, we list the factors and their impact on H3’s project IRRs:

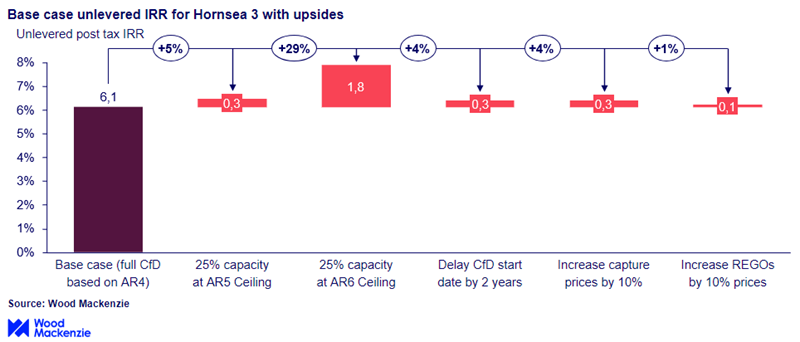

We estimate the H3 IRR is 6.1% in our base case without any of the upsides. The base case comes from Wood Mackenzie’s Lens Power Valuations platform. Here the base case is estimated based on our in-house analysis of costs, capture prices and support schemes. We estimate the current base as if the full revenue will come from the contract for differences (CfD) levels awarded in AR4.

1. H3 can bid into the upcoming AR6 with 25% of its capacity where ceiling prices are double that of its existing strike price

The AR4 rules allow the winners to reduce the final capacity awarded at this price by up to 25% (713 MW in the case of H3). Ørsted stated it will use this mechanism to bid a portion of the Hornsea 3 capacity in next year’s tender, AR6, as the administrative strike price for AR6 is set at £73/MWh (in 2012 prices) which is almost double the AR4 awarded price of £37.35/MWh.

As it will be a competitive tender - and the government has not revealed all the details of the tender - it is challenging to know where the prices will land. However, Ørsted does not need all the details to make an FID because R6 is held on a pay-as-cleared basis for the same delivery year. That means that all successful bidders do not get what they bid, but the highest awarded price. Ørsted can bid conservatively, knowing they will get a higher clearing price.

It is fair to assume Ørsted will be able to bid at the lower end as Orsted was able to lock in supply chain contracts ahead of the AR4 bid in 2022. Costs have since escalated and Ørsted’s contracts are therefore more competitive than had they signed the contracts today. Moreover, it is also fair to assume that prices will come in above GBP 44/MWh (2012 prices) as that was the administrative strike price of this year’s tender (AR5) where no offshore wind projects bid. It is still to be revealed if any of the remaining 4.2 GW of projects awarded in AR4 will pursue a similar route as H3 and bid in with 25% of their awarded capacity in AR6.

It is also important to understand the alternative, which would be to cancel its offtake, like Norfolk Boreas did earlier in the year. In this case, H3 would not be able to bid in the A6, which means it would most likely have had to cancel its supply chain contracts and bid in A7, where the administrative strike prices have not been defined.

2. Delaying CfD start date to optimise the merchant nose

We anticipate offshore wind capture price to be 25% higher on average in 2026-2030 than the original awarded strike price level of H3. Ørsted could defer the CfD start date by up to two years, which would improve and extend the merchant nose of the project from 2026/2027 to 2028/2030. Until November 2023, this was not possible, but a new ruling has exempted offshore wind projects and other renewables can avoid a 45% tax for revenues above GBP 75/MWh if the project is yet to secure a FID. This is a meaningful amount, with our hourly prices exceeding this threshold by more than 60% of the time in 2026 and 2027.

3. Bolstering the merchant tale with corporate PPAs

The project also has upsides to the merchant tail (the period after the 15-year CfD period has expired). This will be more than 5 years). With a corporate power purchase agreement (PPA) Ørsted could potentially improve revenues in this period. If the developer is unable to secure attractive PPAs and capture prices drop below current expectations, this does also represent a downside. To illustrate this upside, we have added a scenario where capture prices are 10% higher than our base case view.

4. Leveraging synergies from the other Hornsea projects

HR3 has synergies from the other Hornsea projects. The Hornsea Portfolio will be managed from Ørsted’s East Coast Hub at the port of Grimsby, bringing operational synergies and cost savings that we have not included in our base case cost estimates. Ørsted has stated that the opex/MW for Hornsea 3 will be more than 25% lower than Hornsea 2. This could also bring future synergy benefits to its planned Hornsea 4 project.

5. Farming down the asset at a premium

Ørsted has a good track record of farming down its other Hornsea projects at a premium. This project would have a largely fixed revenue stream for 15 years, which could make it attractive for many buyers, especially once the project is in more advanced stages of construction and the execution risk is further reduced.

6. Benefitting from higher REGOs

Renewable Energy Guarantees of Origin (REGO) offers an upside to the CfDs. REGOs have been volatile and high in 2023, owing to policy changes as well as increased demand. Prices reached above GBP 20/MWh temporarily and averaged GBP 10/MWh in 2023 vs historical years of below GBP 5/MWh. Due to the uncertainty of the REGOs, it is therefore fair to assume that Ørsted have taken a conservative view which means there could be upsides in the future if maintain similar levels to 2023.

Improving tender pricing and conditions is the most impactful lever policymakers can pull following recent cost escalations

Ørsted’s FID decision is not the only example of offshore wind projects moving forward despite high interest rates and cost escalation. In fact, a record 14 GW of offshore wind projects reached FID in 2023. H3 is an example of how higher subsidy levels are an important lever policymakers can use to help get these projects built.

With more than 40 GW of projects with an awarded support scheme but not a FID and a further 80 GW expected to be awarded over the coming two years, subsidy levels should be revisited as this is the most impactful lever policymakers can pull. It is important to not only acknowledge the capacity that will be awarded in the tender itself, but as H3 shows, it can also help get already awarded projects over the line. The higher more favorable conditions of AR6 have also helped get Vattenfall’s 4.2 GW Norfolk cluster back on track and allowed Vattenfall advance the projects and now sell the cluster for an enterprise value of £1 billion to RWE who is looking to connect these projects by 2030. Building these projects is key for the sector because it helps provide the certainty investors in supply chain companies need to get new factories and vessels built. HR3, for example, will use a new foundation factory and installation vessels and enable upgrades of existing factories.

From 2028, the demand for offshore wind equipment is forecast to surge, which will be challenging for the supply chain to accommodate. Therefore, getting projects online ahead of this timeframe effectively means that more renewables will get built in the 2020s. Ultimately, Ørsted’s decision demonstrates how policy can help reverse a lot of the setbacks that occurred in 2023. It will be interesting to see if the positive policy announcements of Q4 2023 will extend into 2024.

Learn more

Click here to learn more about our Wind Energy service, or discover our Power and Renewables offering.