Brazilian Day of Forgiveness allows power plant developers to withdraw from existing contracts without penalties

In 2023, the publication of Normative Resolution 1,065 (also known as the “Day of Forgiveness”) allowed power plant developers to withdraw from existing contracts without penalties, primarily impacting renewable assets

2 minute read

Marina Azevedo

Senior Power Analyst

Marina Azevedo

Senior Power Analyst

Marina focuses on market developments, business strategies, energy modelling, and scenario forecasting.

Latest articles by Marina

View Marina Azevedo's full profileDue to its rich resources and great production potential, Brazil has been a desirable market for renewable developers over the last two decades. Our internal assumptions indicate that the Brazilian power sector will still expand by 685% and attract the lion’s share of the southern cone investments, worth around US$ 58 billion in new transmission infrastructure and supply in the upcoming decade.

However, intense competition for new license requests following the announcement of an expiring date for transmission tariffs’ subsidies created a long queue of projects waiting for a permit to connect the grid.

In an attempt to eliminate speculative projects and reduce congestion in the interconnection queue, the publication of Normative Resolution 1,065/2023 aimed to regularise the situation of power generation projects with defaulted contracts. This resolution allowed power plant developers to withdraw from existing contracts without penalties, aiming to free up space in the queue’s backlog and to prioritise well-structured projects with a greater probability of competition. Was this proposal enough to address the country’s growing oversupply issues, and who captured the most benefits from it?

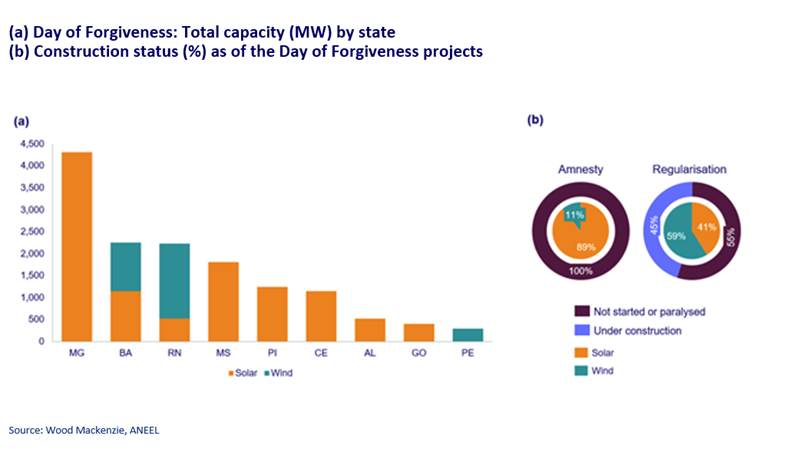

As of October 2023, the interconnection queue had about 71 GW of generating units with a valid Contract to Use the Transmission System (CUST), from which 21% adhered to the Day of Forgiveness

The majority of participants were speculative projects that saw a window of opportunity to enjoy tariff discounts but did not have the required financial strength to get projects to completion and now benefited from the norm.

A poorly planned transition period for the end of the subsidies opened loopholes in the law that allowed new licence requests to be approved without prior consent from the national system operator. In addition, the increase in logistical costs following the pandemic and the difficulty of closing favourable PPAs in a scenario of good hydrology have jeopardised the feasibility of many projects.

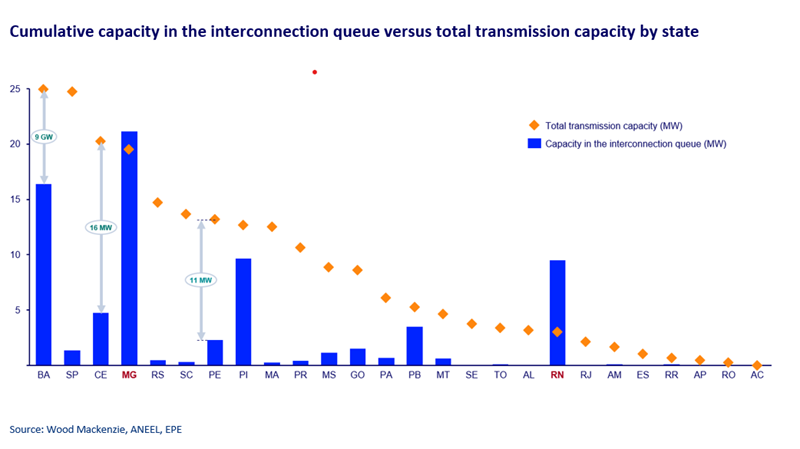

As expected, the states with the highest contracted capacity in the transmission system were also the regions with the highest number of projects adhering to the Day of Forgiveness. The four states with the most substantial project volumes (Minas Gerais - MG, Bahia - BA, Rio Grande do Norte - RN and Piaui - PI) experienced a significant 16% decrease in capacity within the interconnection queue.

The Day of Forgiveness was not enough to reduce the backlog of projects in the interconnection queue of the Brazilian states with the most critical situation

In general, most states have sufficient grid capacity to allocate future projects. However, MG and RN face a more critical situation, with RN transmission system unable to accommodate even half of the power within the interconnection queue. A positive sign for future supply contracts in states heavily pursued by developers within the Northeast region, such as BA, Ceará (CE) and Pernambuco (PE). New projects should continue to be driven by the free market.

Ideally, the Day of Forgiveness will remain isolated, as its normalisation sets a dangerous precedent for encouraging new speculative projects. Other measures will be needed to adjust the course from now on. Notably, as the power system continues to be oversupplied and new demand forecasts for the next two to three years, when projects are expected to come online, continue to be lower to the baseline at which such capacity was procured in the long term, renewables expansion will be supported by the rise of new loads, such as green hydrogen and electric vehicles.

Learn more

To find out more about our Southern Cone Gas, Power and Renewables Service, please click here.