Chance of a lifetime Can India show the developing world a unique path to net zero?

January 2024

Authors

Can India show the developing world a unique path to net zero?

India’s global profile is soaring. It already boasts the world’s largest population and is forecast to be the fastest-growing major economy over the coming decades. By 2032, it will be the world’s third-largest economy, up from fifth today.

Somewhat surprisingly for a services-led economy, India aims to achieve this expansion by increasing its industrial output. Such growth will be challenging, however, without a massive increase in carbon emissions. And with a fossil-fuel-dominated energy system, India is already the world’s third-largest emitter.

Here, we think the country has a unique opportunity to take a different path, to transform itself into a low-carbon economic powerhouse and avoid the mistakes of others. This will take more than investment in clean energy: it will require a radical redesign of India’s economy and its relationship with energy as both its population and manufacturing capacity expand.

We are under no illusions as to how difficult this will be. Our analysis of how India can reach net zero by 2050 – two decades ahead of its current pledge – is highly ambitious, extremely challenging and without precedent. But it is possible.

It will require trillions of dollars in clean energy investment, but achieving net zero by 2050 would also bolster India’s climate and global leadership credentials – and benefit all.

How India can reach net zero by 2050

India pledged to reach net zero by 2070 at the COP26 climate conference in Glasgow in 2021, but its current emissions pathway is wildly off target. Our base case sees emissions almost double by 2040 and fall only marginally by 2070; India’s strong economic growth depends on fossil fuels.

Our Net Zero 2050 scenario sets out an entirely different outcome. Requiring a complete economic rethink, this scenario is built around huge investment in clean energy, decarbonising India’s rapidly expanding industrial and infrastructure sectors, and maximising its unique human talent.

Given India’s rising population, it is essential that our Net Zero 2050 scenario does not come at the expense of economic growth. Indeed, India should view it as a US$13 trillion investment opportunity.

Figure 1: India’s energy sector net CO2 emissions pathways

Wood Mackenzie’s global energy transition outlook report (part of our Energy Transition Service) maps three different routes through the energy transition with increasing levels of ambition – but also difficulty and investment. They are our independent assessment of what it would take to deliver on countries’ announced net zero pledges and potential outcomes for the planet.

Electrifying India: policymakers hold the key

Rapid growth in renewables is essential to electrify India’s future economy. Globally, the country already ranks fourth in terms of installed renewable capacity, with a fourfold increase since 2014 meaning renewables now account for around 43% of the country’s total power generation capacity (including hydro).

This is a positive start, but far more is needed. As with all areas of the Indian economy, policy is critical. The government’s Panchamrit initiative – its climate targets first set out at COP26 in 2021 – laid the foundations for rapid growth in renewables. This will require India to almost triple its non-fossil-fuel capacity in just six years.

What is more, the initiative aims to meet 50% of India's energy requirements through non-fossil fuel sources. If successful, this could lead to a cumulative reduction of 1 billion tonnes of carbon emissions by 2030, resulting in a carbon intensity of GDP less than 45% and net zero emissions by 2070.

The initiative also aims to showcase India as an emerging economy committed to decarbonising its power sector and supporting a new industrial era through massive domestic and foreign public and private financing for renewable energy initiatives. By delivering on this, India can offer a model for other developing economies.

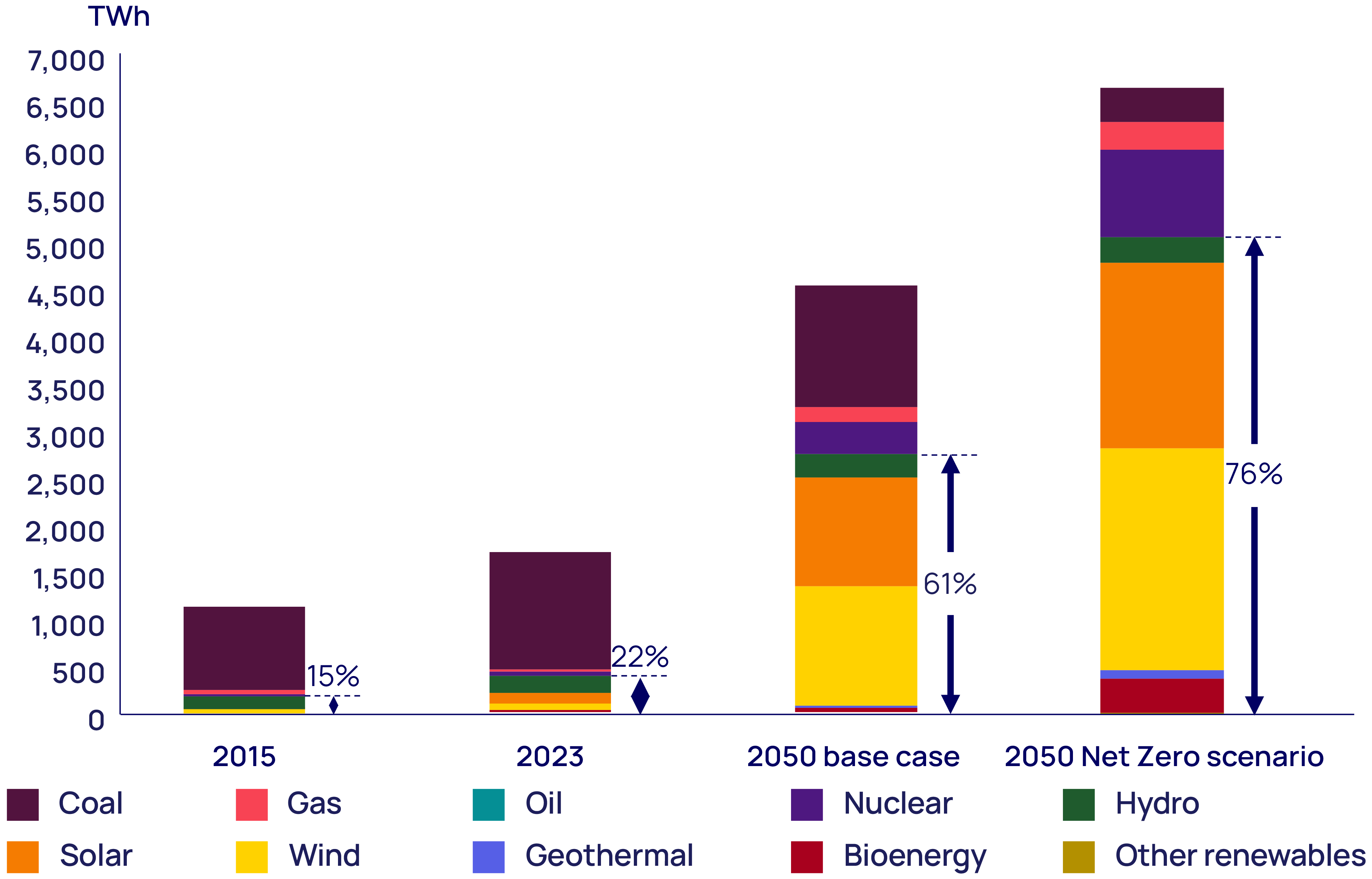

Figure 2: Renewables share of electricity output

Building Indian renewable supply chains is now essential

Progress so far has been admirable, but India must keep upping its game to realise our scenario of non-fossil-fuel electricity output reaching almost 80% by 2050. By doing so, India can strengthen domestic supply chains and boost energy security, cost control and job creation.

The country’s lack of solar wafer production capacity, for example, is hindering India’s manufacturing ambitions and net zero goals. Policy initiatives to foster growth in the domestic photovoltaic (PV) supply chain have accelerated, but the sector continues to rely on imports, particularly for polysilicon, ingots/wafers, ancillaries and PV machinery.

Battery storage is critical to India’s net zero ambition, with a massive increase in renewables to be supported by extensive additions to grid and storage capacity. There are government incentives for capital investment projects, with a mandate to install battery storage in variable renewable energy projects over 5 MW. But as renewable capacity rises, investment in storage is lagging.

India will need gigawatt-scale battery manufacturing to reduce production costs and ensure energy security. Access to the critical minerals required to build domestic battery capacity poses another challenge. Government support through the production-linked incentive scheme to develop battery manufacturing capacity of around 50 GWh of production units falls far short of the 208 GWh battery energy storage system capacity target required by the end of this decade.

Taking emerging technologies mainstream, the Indian way

Achieving net zero by 2050 hinges on India mainstreaming emerging technologies by the end of this decade. With substantial growth in energy-intensive industries, India faces the unique challenge of decarbonising far more new and early-life production units than other major economies. But this also presents an opportunity to stimulate industrial growth through low-carbon technology manufacturing and supply-chain development far earlier in the investment cycle.

Unlocking India’s internal potential

Its scale, population and levels of economic development offer India a range of unique opportunities to decarbonise. With around 750 million tonnes per annum (Mtpa) of biomass residue, its bioenergy potential is largely untapped. Shifting bioenergy usage from the residential to the industrial and transport sectors would help reduce both oil imports and air pollution from stubble burning.

India is already a global leader in compressed biogas, biomass pelleting and bioenergy use in road transport and thermal power plants. Its significant potential in sustainable aviation fuel (SAF) is demonstrated by its abundant bio-feedstocks and progress on in-house solutions. Approval for an indigenous SAF production process is expected this year, with Mangalore Refinery's SAF plant set to be operational by early 2025. To further these advancements, India must expand regulation to ensure biomass supply-chain development and provide federal funding support for modern biofuel production units using local resources. Biofuels displace 0.5 million barrels of oil demand a day under our Net Zero 2050 scenario.

India could also lead in small modular reactors (SMRs) of 300 MW or less, given its scientific capabilities and experience in indigenous pressurised heavy water and submarine reactors. The recent partnership between the Nuclear Power Corporation of India and the National Thermal Power Corporation to accelerate nuclear deployment could fast-track SMR development. But private-sector investment will also be required, and the Atomic Energy Act of 1962 is under review to enable broader participation.

Even so, we recognise the huge challenge for India to deliver on its nuclear potential. Under our Net Zero 2050 scenario, we estimate that 120 GW of nuclear is needed, well above the 50 GW in our base case.

Realising India’s green hydrogen

Low-carbon hydrogen is pivotal to decarbonising India’s most challenging sectors. With a relatively high solar irradiance (1,200-2,300 KWh/m2/year) and wind speeds (4-6 m/s), we estimate that India’s levelised cost of hydrogen (LCOH) produced from renewables offers a cost-effective, round-the-clock option when combined with battery storage. Hybrid onshore wind and solar could cut the LCOH to US$4.3/kg H2 by 2030, the second lowest in Asia after China. To incentivise this, the government has allocated US$2.1 billion through a three-year incentive scheme to reduce electrolytic hydrogen production costs by 10%. India’s hydrogen policy also allows developers to purchase renewable power from the grid with no transmission costs for 25 years.

This will not be achievable unless India continues to ramp up its delivery of wind and solar power, however. Alongside decarbonisation, renewables must deliver 125 GW of clean power for India to hit its 5 Mt green hydrogen production target by 2030. We forecast that around 4 Mt of low-carbon hydrogen is likely to be operational by 2030, accounting for around 5% of global production.

Much more will be required: India needs 55 Mt of hydrogen to reach net zero by 2050. Of this, we believe India has the potential to produce up to 35 Mtpa domestically, with the remaining supply met through imports.

Carbon capture and storage requires urgent support

While the combination of policy support and cost efficiency positions India favourably in low-carbon hydrogen, the government must go further to stimulate other sectors, for example, carbon capture, utilisation and storage (CCUS).

Though the government recognises the importance of CCUS, its approach remains overly cautious. NITI Aayog, the Indian government’s influential think tank, has identified a substantial of CCUS potential, yet the country lacks a defined timeline and financial support. India’s upcoming carbon pricing regime, due to be operational by 2026, will help, but more initiatives are imperative. Using captured CO2 to produce urea for India’s mammoth fertiliser sector and methanol to be used by India’s road fleet, diesel generators and tractors should all act as incentives.

With more than 1 gigatonne of CCUS capacity required in our Net Zero 2050 scenario, the lack of progress is a concern.

Figure 3: The potential of India's emerging technologies

Tackling India’s hard-to-abate sectors

Unique among the world’s major economies, India’s development combines its service-led economy with a growing emphasis on manufacturing. This has been underpinned by a strategic shift in policymaking to focus on industrial growth: the 'Make in India’ initiative, production-linked incentive (PLI) programmes and policies to purchase locally made products are driving investment.

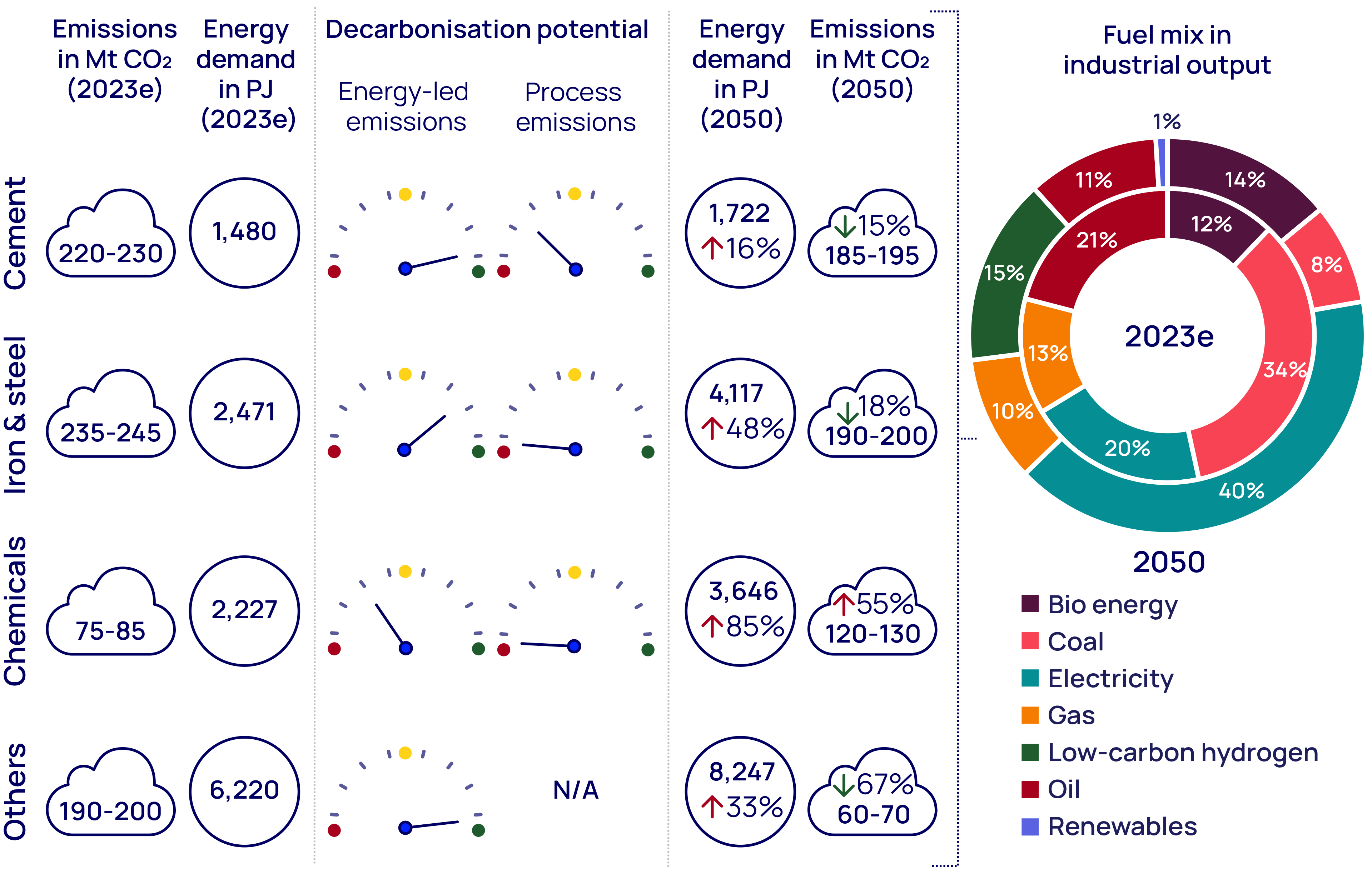

With this strategy, India risks exacerbating a worsening emissions profile. Our Net Zero 2050 scenario calls for economic growth to be tied to sustainability, especially in hard-to-abate manufacturing sectors – including cement, iron and steel, and chemicals – which combined emit three-quarters of India’s total industrial emissions.

Figure 4: Industrial emissions and energy demand outlook in our Net Zero 2050 scenario

Cement

Cement production accounts for nearly a quarter of India’s total industrial emissions. The fast-paced construction sector should help major cement players invest in a low-carbon value chain. For example, JSW Cement plans to source agricultural waste for use as biomass fuel at its manufacturing plants in a bid to curb its carbon emissions.

Newer technologies, such as using waste heat from industry and agriculture, the electrification of kilns, co-firing hydrogen and CCUS, can support decarbonisation initiatives for Indian cement producers in the long term. Projects can also draw on India’s bioenergy supply to decarbonise.

Iron and steel

India’s steel output is the fastest growing globally, but also its largest contributor to industrial emissions. Steelmakers must first reduce their dependence on coal-fired direct-reduction furnaces and highly polluting induction furnaces. Shifting to low-carbon electric arc furnaces (s) and the linked rise in the share of green metallics, such as scrap, and gas- or hydrogen-based direct reduced iron (DRI) offers a route to decarbonisation.

With Indian steelmaking capacity expected to rise threefold to 510 Mt by 2050, our Net Zero 2050 scenario requires India's EAF steel production share of total emissions to reach 60% of total output versus 35% in our base case. Unlike cement, process emissions in steel make up a lower proportion of total emissions, so steelmakers will focus on energy-efficient processes and cleaner steelmaking technologies.

Petrochemicals

India’s rapid demand growth for petrochemicals should be supported with decarbonisation investments. Ethylene production is an essential sector for India to decarbonise, as it is both energy- and emissions-intensive. Key steps in our Net Zero 2050 scenario include expanding the circular economy for plastics to reduce demand by 10% by 2050 versus our base case, electrification of crackers and a shift to low-carbon feedstocks and hydrogen co-firing furnaces.

Increasing energy efficiency, the Indian way

Indians are already among the lowest per capita emitters globally. To reach net zero by 2050, this needs to be maintained, as final energy consumption must fall by more than 30% by 2050 versus our base case. Achieving this will be challenging, but a range of uniquely Indian approaches is already paying dividends.

Building an Indian carbon market

India is currently a compliance carbon market and plans to simultaneously introduce a voluntary mechanism. Net Zero 2050 requires India’s carbon price to reach US$154/tonne of CO2 – a major ask for a country infamously price-sensitive. Carbon market development should encourage companies to monetise their investments in CCUS, green hydrogen, renewables and bioenergy, which might otherwise seem unviable due to high upfront capital costs.

National policies with local impact

The Unnat Jeevan by Affordable LEDs and Appliances for All (UJALA) programme is the world's largest zero-subsidy LED bulb initiative for residential consumers and an example of the type of national policy with local impact at which India excels. Beyond reducing energy consumption by 35 TWh annually (an impressive 3% of India's total electrivity demand), UJALA sparked substantial investments in LED bulb manufacturing, slashing retail prices.

In the industrial sector, the Perform, Achieve and Trade scheme has been pivotal in driving efficiency gains across energy-intensive industries. By assigning individual energy-saving targets to designated consumers, certificates earned by surpassing these targets can be traded, providing a unique incentive for implementing energy efficiency measures.

Addressing energy efficiency in the building sector, particularly cooling, is an urgent area for action. Full implementation of national building codes and better appliance standards and labelling are pivotal.

Can India sustain the political will needed for Net Zero 2050?

Our India Net Zero 2050 scenario requires unwavering political leadership for decades to come. Prime Minister Narendra Modi has immense political capital at home, supporting his strategy of rapid deployment at scale of low-carbon technologies, though fossil-fuel demand continues to rise.

Future leaders will need to embrace Prime Minister Modi’s vision and push harder to win support for clean energy and the economic transformation this can deliver. As India looks to introduce a domestic carbon price, politicians must ensure consumers understand the motivation.

India must also flex its diplomatic muscle and soft power. India has long maintained it is unreasonable for developing countries to make the same commitments to decarbonisation as those most responsible for historical emissions. This is a valid point, but inconsistent with our India Net Zero 2050 scenario. However, there is a clear and compelling argument for richer countries to actively support India in its efforts to decarbonise, providing both financial and technological support. India should capitalise on its blossoming political and trade relationships with the West.

Explore the energy transition outlook for your region

Our ETO includes regional and global reports outlining four scenarios: base case, net zero by 2025, country pledges and – new for the 2025 update – a delayed transition.

Explore our past issues of Horizons

Loading...