Discuss your challenges with our solutions experts

Global economy proves robust – but risks remain skewed to the downside

Our latest outlook finds a remarkably robust global economy, with the US and China both beating expectations in Q3 – but it’s a far from universal story and clouds remain on the horizon

3 minute read

Peter Martin

Head of Economics, Macroeconomics

Peter Martin

Head of Economics, Macroeconomics

Peter is responsible for producing our macroeconomic outlook to 2050.

Latest articles by Peter

-

Opinion

Global economy maintains momentum after upside surprise

-

Opinion

Global economy proves robust – but risks remain skewed to the downside

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

COP26: The economics of the energy transition

-

Opinion

Three signs that a global recession is imminent

-

Opinion

5 factors that will determine the economic impact of coronavirus

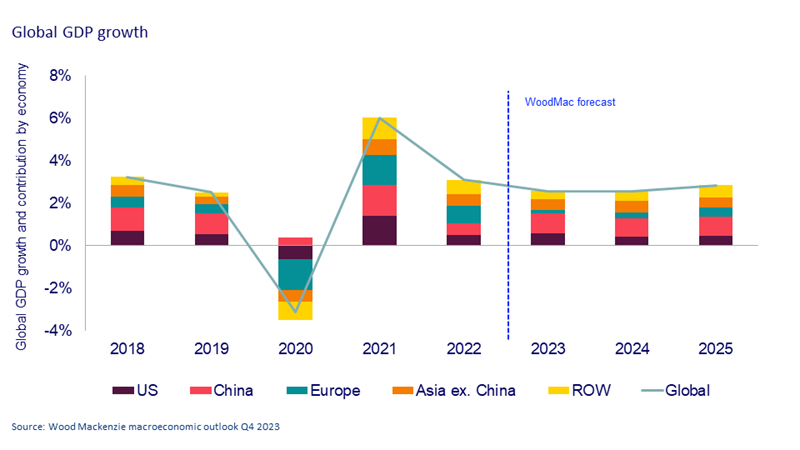

Despite the drags of elevated inflation and rising interest rates, the global economy has performed remarkably well this year. In our Q4 outlook we have revised our GDP forecast for 2023 up to 2.6% from 2.4% in the Q3 update.

So, what are the key changes driving this revision and can growth momentum be sustained? Visit the store to get the Global economic outlook in full, or read on for a few highlights.

The interest rate hiking cycle may yet have some bite – but global recession avoided

The world's two biggest economies, the US and China , beat expectations in the third quarter. However, while our global growth forecast for 2023 is revised up, we have downgraded the outlook for 2024 to 2.6% from 2.8% in the Q3 update. Global leading indicators point to a soft six months ahead. The rally in global services is running out of steam and some of the lagged effects of the interest rate hiking cycle are yet to bite.

Crucially, we continue to hold the view that a synchronised global recession will be avoided.

The industrial sector has been harder hit

The global economy may have escaped a downturn in 2023, but the same cannot be said for the industrial sector. The impact of inflation and consumers' post-Covid preference for services over goods means that we forecast global industrial production will grow just 1.3% in 2023.

However, we expect momentum to be regained in 2024.

China is downgraded in 2024 despite the recent infrastructure package

The Chinese economy did see some recovery in industrial production and demand for goods in Q3. This puts China on track to achieve our forecast of 5.2% growth for 2023.

We believe the industrial sector will be the main growth engine for 2024 as a restocking cycle begins and infrastructure stimulus trickles through. However, challenges remain for the property sector and private sector confidence is ailing.

US economic momentum will be hard to sustain

Just as the US economy looked to be on the verge of stagnating, GDP accelerated in Q3. This was supported by strong employment gains, but with low unemployment this is unlikely to be sustained.

Therefore, the momentum of 2023 will be difficult to keep up, and we have adjusted down growth for 2024.

Asian economies have been on divergent paths in 2023

Pakistan and Sri Lanka are in economic recessions. And trade-orientated economies – Singapore, South Korea, Taiwan, and Vietnam – have all felt the lacklustre global demand for goods.

India and Indonesia are the outperformers. Meanwhile, the Japanese economy has been choppy.

Europe is the worst-performing region in the global economy

Our forecast for Europe has been downgraded for both 2023 and 2024. We do expect growth to pick up next year, but remain soft.

Germany's economy took a dip in the third quarter and is only just bigger than it was pre-pandemic. Furthermore, the outlook remains stagnant.

Meanwhile, we have improved our forecast for the UK economy marginally. Due to its relatively large service sector, France has outperformed the UK and Germany this year. However, of the ‘Big 5’ economies it is Spain that has topped the class.

Risks remain skewed to the downside and have intensified with the Israel-Hamas war

To date, the impact the Israel-Hamas war on oil prices has been muted. However, an escalation is a downside risk to our forecast which could stoke energy prices, push inflation upwards again and prolong high interest rates.

The Chinese economy still bears significant downside risks with its troubled property sector and elevated local government debt.

This article draws on our Global economic outlook Q4 report. To read it in full visit the store.