Has Norway’s oil and gas tax stimulus been a success?

Norway is monetising as much oil and gas as it can, while it still can. Other countries with challenged pre-FID resources may look to do something similar

3 minute read

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan is a research director with particular expertise in North Sea development costs, exploration and M&A.

Latest articles by Neivan

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

-

Opinion

ADNOC acquires 10.1% stake in CCUS player Storegga

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

The future of European upstream oil and gas

Greg Roddick

Principal Analyst, Upstream

Greg Roddick

Principal Analyst, Upstream

Greg has almost 15 years of industry experience, focused on corporate strategy, fiscal modelling and economic analysis.

Latest articles by Greg

-

Opinion

Benchmarking 2023’s upstream FIDs

-

Opinion

Has Norway’s oil and gas tax stimulus been a success?

-

Opinion

UK energy exports and fracking: aspiration or pipe dream?

Norway responded to the 2020 upstream downturn with radical, temporary fiscal measures designed to protect and stimulate investment in the Norwegian Continental Shelf. The terms included immediate capital deduction and an increase to the special tax uplift for projects sanctioned by the end of 2022. That tax window has now ended. So, have the measures been a success?

At first glance, yes. The government's objectives to secure planned activity, protect employment and skills, and stimulate new investment has been achieved. In total, 35 new projects have been sanctioned, which will deliver over NKr 400 billion – US$50 billion – of investment and more than 2.5 billion boe of reserves, split roughly equally between oil and gas.

The projects will produce 800,000 boe/d at peak, helping to offset natural decline. Several were previously considered marginal.

We drew on insight from Lens upstream to explore the pros and cons of Norway’s tax incentives in a new report: Norway’s tax package ends with a bang – but was it a success? Fill in the form on the page to read it in full or read on for an introduction.

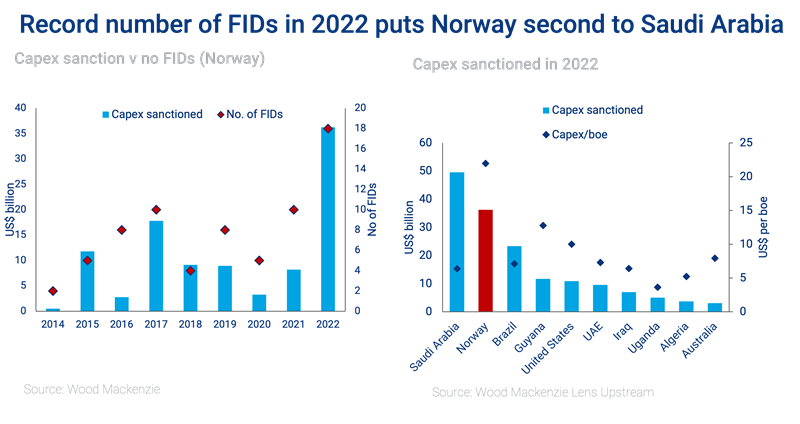

Record number of final investment decisions in 2022

In 2022 alone, Norway sanctioned its highest level of investment in a single year behind only Saudi Arabia globally. The attractive fiscal terms have helped to stimulate investment that might have otherwise been lost had projects been scrapped or delayed. This is a big deal.

But the rush to take advantage of the attractive terms has pushed up costs and created supply chain pressures. A dozen projects have been postponed – and may now never be developed.

The supply chain will be stretched with the unprecedented surge in investment

More than 40 projects are now under development on the Norwegian Continental Shelf, which has put the supply chain under significant pressure. Norway’s upstream sector is heavily reliant on local supply chains—and the unprecedented wave of activity prompted by the tax incentives has created various pinch points. Longer lead-times and increased cost estimates are the result.

On average, costs are up 30% from the planning stage through to FID across all projects, and costs are nearly 50% higher for projects sanctioned in 2022. Capex per boe is more than double the global average.

Winners and losers

There have been some casualties. Faced with rising cost inflation and execution risks, a dozen projects – Equinor’s Wisting and Shell’s Linnorm among them – have been postponed, equating to 1 billion boe of resources and US$15 billion (in 2022 terms) of future investment.

The biggest winners were the operators that reached FID earlier, rather than towards the end, of the tax window. These were typically ‘sanction ready’ projects that have been able to lock in lower costs and tier one suppliers under attractive fiscal terms.

Aker BP and Equinor will operate 26 of the 35 projects that qualify for the temporary tax package. Read our report for more to understand which other companies are in the game and which balance sheets stand to benefit most from the tax incentives.

Was Norway’s tax package a success?

The early signs are good, but successful delivery, project performance and enhanced government revenues will provide the answer. Norway is monetising as much oil and gas as it can, while it still can.

But there are questions about the future of Norway’s upstream sector beyond 2030. Our full report considers whether Norway can retain its place as a major European energy provider. Read our extract for more detail on what’s next for the country, as well as our analysis of:

- The impact of tax changes on profits

- Why high-profile projects Wisting and Linnorm were canned

- Net capex and production profiles for each company that will benefit from the tax incentives