What would it take for India to reach net zero emissions?

Achieving India’s decarbonisation target by 2070 is possible, but renewables and emerging technologies must scale rapidly

4 minute read

Roshna N

Research Analyst, Energy Transition

Roshna N

Research Analyst, Energy Transition

Roshna N specialises in integrated energy and emission models for Asia-Pacific and African markets.

Latest articles by Roshna

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

How the world gets onto a 1.5 °C pathway

-

Opinion

What would it take for India to reach net zero emissions?

Having pledged to decarbonise its economy by 2070 in the run-up to COP26, India is currently pushing its Net Zero Bill through parliament. India is one of the largest importers of energy and commodities, so its aims to decarbonise rapidly mean the impact could be swift and significant. And given its G20 presidency this year, its energy transition strategy will be firmly in the spotlight.

So, what challenges need to be overcome to meet net zero ambitions, and what opportunities does it offer the private sector?

A new report from our Energy Transition Service explores how India can fulfil its net zero ambitions, with scenario modelling drawn from our recent Global Net Zero Pledges report. Fill out the form to download a complimentary extract from India energy transition pathways 2070 and read on for a quick introduction to some of the key themes.

What does net zero in 2070 look like for India?

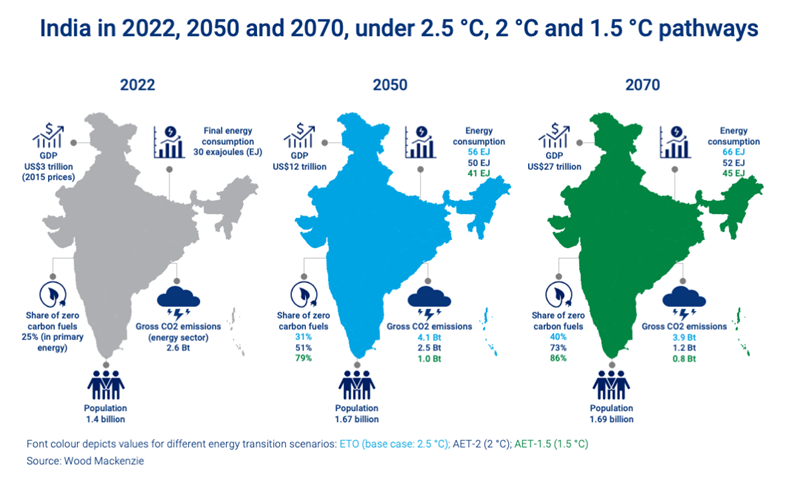

With 1.4 billion people, India is already the world’s most populous country. By 2070 it will add another quarter of a billion. At the same time, the country’s GDP will soar from US$3 trillion to around US$27 trillion.

Under our AET-2 scenario, a shift towards renewables, electrification, hydrogen and carbon removal will see India align with a 2 °C global warming trajectory and hit net zero by 2070. Final energy demand would grow from 30 exajoules (EJ) to 52 EJ. Nevertheless, there is a positive outlook as the CO2 emissions would start to decouple from GDP in early 2030s and would fall from 2037 onwards reaching to gross emission of 1.2 billion tonnes by 2070.

How India can get to net zero

Reaching net zero by 2070 will require a radical transformation of India’s energy landscape. Zero-carbon fuels currently account for around a quarter of primary energy generation – that would have to leap to 73%. Electricity generation would increase by five times to provide half of all primary energy, with 93% of generation powered by non-fossil sources. Low-carbon hydrogen would cover a further 11% of energy demand, with bioenergy making up the remaining 12% of energy accounted for by non-fossil fuels.

In tandem, fossil fuel’s share of final energy demand would need to fall from 60% today to 27%. Oil demand would peak in the 2030s before halving from six million barrels per day (mb/d) to 3 billon mb/d between 2050 and 2070. Coal demand would peak even earlier and fall to 25% of current levels by 2070. Natural gas would act as a transition fuel, with demand growing into the 2040s before falling to 128 bcm in 2070.

Ensuring India’s energy security

Like many countries, India is rethinking its approach to energy security in the wake of Russia’s invasion of Ukraine and record coal and gas prices. India’s strategy is dual-pronged. It combines the necessary rapid deployment of low-carbon technologies at scale with a new focus on domestic production to meet ongoing oil and gas needs.

However, even if enhanced fiscal terms manage to attract the necessary investment to exploit India’s domestic resources, it will remain a net importer of oil and gas.

Electric vehicles (EVs) and the materials transition in India

EVs will play a vital role in decarbonising India’s economy, accounting for 50% of road transport by 2070 under our AET-2 scenario. Most of the required EV manufacturing and renewable energy generation capacity has yet to be built, representing a significant investment opportunity.

Lithium iron phosphate is likely to be the preferred battery chemistry for EVs in India in the long term. Massive lithium deposits found recently in the Jammu and Kashmir region could help India become self-reliant in battery raw materials, if they are commercially exploitable. However, overall, demand will be largely met by imports.

Hydrogen and carbon capture

The low-carbon hydrogen and carbon capture are important to deliver the last mile on emissions reduction by enabling the decarbonisation of hard-to-abate sectors including steel and cement. Clean hydrogen could also become a key source of flexible and dispatchable power generation.

To contribute to net zero, low-carbon hydrogen supply would need to reach 30-40 million tonnes in 2050, and 85-90 million tonnes by 2070. However, current project announcements to 2030 represent just 0.5% of global production.

Carbon capture, utilisation and storage (CCUS) would also play its part. Under our net zero scenario, cumulative CCUS capacity would reach 10 billion tonnes by 2070. Captured CO2 could be put to various end uses in the cement and petrochemicals sectors. However, so far only one CO2 storage project has been announced.

New industries and business models on the path to net zero in India

Other niche and emerging technologies including nuclear (in the form of small modular reactors, or SMRs), geothermal and offshore wind would become mainstream as part of India’s pathway to net zero. The country’s recent Energy Conservation (Amendment) Act 2022, Carbon Credit Trading Scheme 2023 and subsidy schemes for various low-carbon fuel production should act as drivers, initiating the mandate for using low-emissions energy sources, such as low-carbon hydrogen.

The full insight, India energy transition pathways 2070, is available to subscribers to our Energy Transition Service. It includes a wide range of charts and data for both AET-2 and more ambitious AET-1.5 scenarios, together with macroeconomic analysis and sectoral implications.