Energy transition outlook: Americas

Highlights from this year’s updated report, including North America’s potential as an energy export powerhouse, implications of Trump 2.0 and Brazil’s low-carbon investment ambitions

3 minute read

David Brown

Director, Energy Transition Practice

David Brown

Director, Energy Transition Practice

David is a key author of our Energy Transition Outlook and Accelerated Energy Transition Scenarios.

Latest articles by David

-

Opinion

Energy priorities of House Republicans come out in full force

-

Opinion

The new landscape for gas-fired power: turbocharged or turbo lag?

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Americas

-

Opinion

The federal government steps up support for nuclear power

-

Opinion

The impact of Republican control on US energy policy and the IRA

Diverse and nuanced energy transition pathways are increasingly apparent across the Americas. The Inflation Reduction Act (IRA), Canada's net zero goal and multiple sub-national policies have made the US and Canada global leaders in decarbonisation policy. But uncertainty associated with carbon pricing, policy support for emerging technologies, and infrastructure permitting are increasing the risk that the region is on a delayed transition pathway.

In Latin America, the pace of decarbonisation varies. For instance, in Brazil, President Lula approved the ‘Future Fuel Law’ in 2024, which aims to attract US$45 billion in new investments for low-carbon supply. In Argentina, higher production from the Vaca Muerta shale formation supports a larger role for natural gas through 2040. Chile has some of the world's best solar resources, but future growth will hinge on infrastructure expansion and incentives for energy storage technologies.

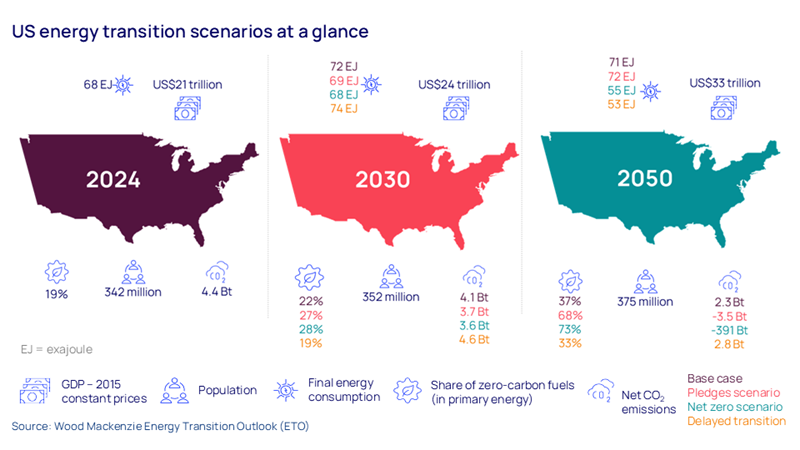

Our energy transition outlook (ETO) – updated for 2024/25 – explores the progress made against renewable power targets. The report, from our Energy Transition Service, maps out four energy transition scenarios – with increasing levels of ambition and investment – while the regional updates delve into the detail at country level.

You can access a complimentary extract from the Americas edition by filling in the form at the top of this page. And read on to a short introduction to just a few of its key themes.

All eyes on the US for Trump 2.0 implications

In the US, the return of President Trump is dominating headlines. The Republican trifecta that emerged in the 2024 election cycle will pivot US energy policy away from net zero.

President Trump has stated that he will challenge policy support for low-carbon energy. However, roadblocks include Republican support for the IRA in Congress, the competitive economics of renewable power and private-sector net zero targets.

North America: an energy export powerhouse

With low-cost resources, innovative horizontal drilling technologies, and global commodity demand growth, North America will be an energy export powerhouse in our base case. LNG exports will reach 410 bcm by 2050 driven by project expansions from Cheniere, Venture Global, Sempra, LNG Canada and NextDecade.

Due to electrification of the transport sector, North American liquids production will peak in the early 2030s.

Brazil: investment clashes paint a mixed picture for the COP30 hosts

As the largest energy market in Latin America, Brazil’s ambitious policies set an example in the energy transition for a developing economy. The ‘Future Fuel Law’ introduced late last year aims to promote sustainable mobility, foster biofuels and sustainable aviation fuels and attract an estimated US$45 billion in new investments. This however clashes with other planned investments in the energy sector. We expect Brazil to be the seventh-largest crude oil producer by 2030.

With Brazil taking centre stage as host of COP30, we expect that access to finance, improved planning for energy mix diversification and carbon capture strategies will feature high on the agenda. Brazil’s updated Nationally Determined Contributions (NDC) states an emissions reduction goal of 43% below 2005 levels by 2030, a goal that is not on track in any of our scenarios.

Get a closer look at Americas energy transition scenarios

The full report explores the outlook for the US, Canada, Mexico, Brazil, Chile, Argentina and Andean markets in much more detail. Themes include:

- Mexico's outlook for natural gas demand across four energy transition pathways

- Our outlook for Brazil's CCUS and low-carbon hydrogen sectors

- How renewables can spur Chile to become a low-carbon hydrogen exporter

- The future of gas in Argentina as cost declines for renewables continue

- Power reliability constraints in Andean markets.