Get Ed Crooks' Energy Pulse in your inbox every week

Making low-carbon hydrogen a reality

A new report from the National Petroleum Council spells out the opportunities and challenges for hydrogen in the US

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Emissions rules for US power pose some difficult questions

-

Opinion

Is there an energy transition?

-

Opinion

Making low-carbon hydrogen a reality

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

The hydrogen revolution in energy has been a long time coming. The first World Hydrogen Energy Conference was held in Miami Beach in 1976. I recently stumbled across an old article from the New York Times headlined ‘Hydrogen – a way out of the energy crisis?’. It was published almost exactly 50 years ago, in May 1974. Many of the issues covered in the piece, such as the debate over the limits of electrification, are still relevant today, half a century later.

But although it may seem as though the world has made dispiritingly little progress in understanding the real potential for hydrogen in our energy system, that downbeat assessment would be misleading. A new report on the opportunities and challenges in low-carbon hydrogen from the US National Petroleum Council (NPC), published this week, makes clear that the industry now knows a lot more about the practical realities of using hydrogen as an energy carrier.

The world has moved on from the days when an entire “hydrogen economy” could be seen as a realistic prospect. Many possible uses of hydrogen, such as domestic heating and cooking, discussed in that article in 1974, now seem unlikely ever to be widely adopted, for technical, safety and economic reasons. But for industries including refining, chemicals and steel, for fueling heavy trucks, ships and aircraft, and for energy storage and dispatchable power generation, low-carbon hydrogen increasingly looks like a viable solution. It may often be the best available solution for achieving deep reductions in emissions.

The NPC report, titled ‘Harnessing hydrogen: A key element of the US energy future’, concludes that hydrogen could play an important role in getting the US to net zero emissions at the lowest cost to society. Modelling for the report, on platforms run by the Massachusetts Institute of Technology (MIT), suggests that the cost of achieving net zero emissions by 2050 for the US, using the most efficient methods available, would be about 3% of gross domestic product (GDP). Trying to get there without using any low-carbon hydrogen would add about 0.5% to 1% of GDP to that cost.

The modelling suggests that hydrogen could account for about 8% of the emissions reductions needed for the US to reach net zero. So while it may not be the dreamed-of silver bullet for decarbonisation, it can still play a material role.

However, the report also argues that current policy support for low-carbon hydrogen falls well short of what would be needed to deliver that contribution. To reach the scale required in that net zero scenario, total hydrogen demand in the US would have to increase more than seven-fold by 2050, the modelling suggests. But the current policy framework, including the 45V tax credit for low-carbon hydrogen, puts the US on course for only a doubling in demand.

At the meeting in Washington this week where the report was formally delivered to Jennifer Granholm, the US energy secretary, she described its conclusions as “a bit sobering”. The report suggests that to put the US on course for that seven-fold increase, there will have to be “significant and immediate action to support the growth and scale-up of all aspects of the hydrogen market: supply, infrastructure, and demand”.

Wood Mackenzie, and specifically Melany Vargas, our head of hydrogen consulting, was extensively involved in the analysis for the report. She led the task group for the chapter on integrated supply chain economics and carbon intensity, and also led the modelling work using the MIT platform. I served on the report’s Steering Committee.

All the conclusions and recommendations are those of the NPC, and do not necessarily reflect Wood Mackenzie’s views. But Wood Mackenzie’s Vargas says one of the critical parts of the report is its focus on the costs of electrolytic, often known as “green”, hydrogen, made from water using renewable energy.

“Green hydrogen is not as mature as blue hydrogen made from natural gas,” she says. “But it is really important for getting to net zero.”

The NPC study found that to get on course for reaching net zero by 2050, US$1.9 trillion in investment would be needed in the top three regions for low-carbon hydrogen development: the Gulf Coast, the western US and the Great Lakes. The vast majority of that investment, US$1.8 trillion of it, would be needed for green hydrogen.

Delivering the amount of green hydrogen envisaged in the net zero scenario would require more than 2 terawatts of additional renewable generation capacity. That is well over the entire generation capacity of the US today. Production facilities would also require investment in high-capacity storage to back up variable renewables, and extensive pipeline infrastructure to connect the areas with good renewable energy resources to the main demand centres for hydrogen.

Green hydrogen also faces challenges because of the cost of electrolysers. Early industry estimates suggested that electrolysers for hydrogen production would typically cost around US$1,000 per kilowatt of capacity. Mounting evidence suggests that that estimate is too low, however, and the NPC study assumed capital spending of about US$2,000/kW.

However, Wood Mackenzie research and consulting industry discussions indicate that in many cases even that number may be too low, with projects in development receiving estimates closer to an installed cost of US$3,000/kW from vendors and engineering, procurement and construction (EPC) companies.

Costs are coming in higher than expected for a variety of reasons. As in many energy sectors, supply chain constraints are a global issue, and strong demand is driving up the cost of equipment. And project developers and EPC contractors working on first-of-a-kind projects are facing unfamiliar challenges.

“This is the first time that EPCs are doing this and there is a lot to learn,” Wood Mackenzie’s Vargas says. “And there is not a lot of competition across the EPCs or incentive to come in with a competitive offer. Just a few companies can do this, and that creates an environment where premiums can be charged.”

The NPC report estimates that in the Gulf Coast, where conditions are most favourable, green hydrogen will cost about US$1.60 per kilogram in 2030, including tax credits. But blue hydrogen, made from natural gas with its carbon dioxide emissions captured, looks likely to be substantially lower cost, at about US$1.10/kg, again including tax credits.

That means the administration needs to make sure that the policy framework for green hydrogen, including the rules for eligibility for the 45V tax credit, is supportive enough to get the industry off the ground, Vargas argues. “Green hydrogen is really important,” she says. “So don’t over-burden it from the start.”

The full NPC report, including summary and appendices, is about 1,200 pages long. Probably not many people will sit down and read the whole thing cover to cover, but if you have any interest in the hydrogen industry at all, it is well worth at least reading the 68-page summary, and then using the full report to drill down into specific topics. The depth and detail of the analysis is impressive.

“Sobering” is a good word for its impact. As the rose-tinted dreams of a hydrogen economy get swept away, a clear view of the real challenges facing the industry make the development of a significant low-carbon hydrogen sector a more realistic prospect.

New emissions rules for the US power sector

The US Environmental Protection Agency has published the final version of its new regulations for greenhouse gas emissions from power plants. The most stringent requirements are being imposed on coal-fired power plants, which will be required to install carbon capture technology by 2032 to remain in operation after 2039. The United Mine Workers of America union said the new rule “looks to set the funeral date for thermal coal mining in America for 2032 – just seven and a half years away – along with the hundreds of thousands of jobs that are directly and indirectly associated with it.”

New gas-fired plants to be operated as baseload generation – defined as a capacity factor of 40% or greater – will similarly have to have carbon capture by 2032. Gas-fired plants with lower capacity factors will have less onerous requirements.

For existing gas-fired plants, the new regulations have been deferred for the time being. The EPA said in February that the additional time would allow it to achieve greater emissions reductions, while also taking into account the flexibility needed to support power grids, and the availability of a wide range of technologies for decarbonisation.

The new regulations will face legal challenges before they can be implemented. An earlier iteration of EPA rules for power plants, the Obama administration’s Clean Power Plan, was struck down by the Supreme Court in 2022.

In brief

BHP has proposed a US$38.8 billion deal to buy Anglo American, potentially creating the world’s largest copper miner. The deal would represent the biggest shakeup of the global mining industry in more than a decade. James Whiteside, metals and mining corporate research director at Wood Mackenzie, said: “This deal is all about copper, and when greenfield options look limited and expensive, it makes sense for [BHP] to look for more workable solutions.” The deal would also reinforce BHP’s leading position in iron ore and metallurgical coal.

However, Whiteside added: “Anglo American shareholders may consider fair value closer to the share price before operational issues emerged, and other suitors may be compelled to act at this price.” Even after rising 16% after the proposed bid was revealed on Thursday, Anglo American shares were still down about 40% from their peak in April 2022.

US fund managers have suffered their worst-ever quarter for ESG-focused products, Bloomberg reported.

Tesla is still planning to launch new lower-cost models, the company has indicated. Elon Musk said on a call for the company’s first quarter earnings: “We’ve updated our future vehicle lineup to accelerate the launch of new models.” He added that the new vehicles could come in early 2025, or even this year.

CATL has unveiled what it says is the world's first mass-producible energy storage system with zero degradation in the first five years of use. Its new Tener lithium ferrophosphate (LFP) battery, capable of storing 6.25 megawatt hours in the volume of a standard shipping container, cuts the energy density per unit area by 30% compared to its previous containerised energy storage system.

Other views

Benchmarking the Middle East NOCs against the supermajors – Neivan Boroujerdi

Battery storage in Asia Pacific: 5 things to know – Kashish Shah

Africa’s energy hotspots: three trends that will shape the next decade of African energy – Ian Thom

EU carbon levy on primary aluminium will be ineffective and drive up prices

How to address risk from the intermittency of renewable energy in power markets – Brian McIntosh

What goes up must come down: the evolution of the lithium industry – Allan Pedersen

Chinese "overcapacity" is not the problem. underconsumption is – Matthew Klein

US energy loan chief wants “culture and norms” disrupted – Cat Clifford

Want less mining? Switch to clean energy – Casey Crownhart

Australia’s comparative advantage in climate transition – Stephen Grenville

Data centers want clean electricity. Can Georgia Power deliver it? – Jeff St John

A Golden Age of renewables is beginning, and California is leading the way – Mark Z. Jacobson

California’s exploding rooftop solar cost shift – Severin Borenstein

How green is your electric vehicle, really? – Schumpeter

Tesla is not the next Ford. It’s the next Con Ed – Matteo Wong

Quote of the week

“China really helped by reducing the cost of solar energy… A lot of what happened in solar panels is because of what China did in terms of reducing [prices]. We can see the same now in electric vehicles. Their cost is one-third to one-half the cost of other electric vehicles. So we need globalisation and collaboration if we are going to achieve our energy targets by 2050.”

Amin Nasser, chief executive of Saudi Aramco, made the case for China’s investment in manufacturing capacity in low-carbon energy technologies. The surge in Chinese capacity in sectors including solar equipment and EVs has raised alarms in the US and EU.

Chart of the week

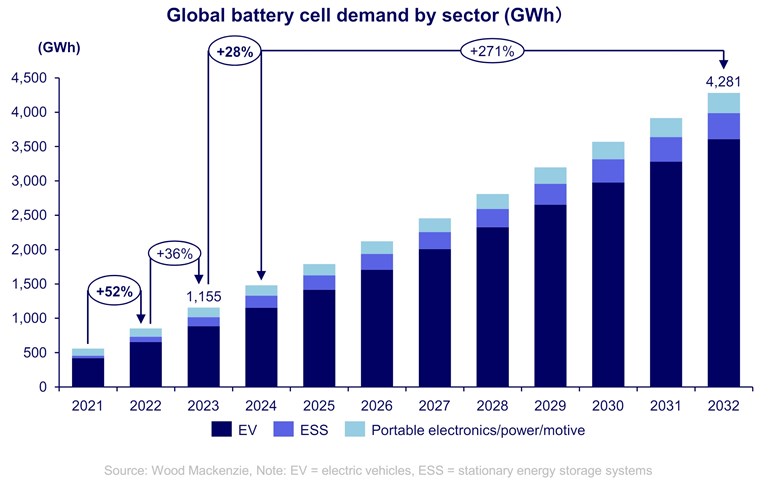

This comes from a fascinating presentation by Kashish Shah, Wood Mackenzie’s senior research analyst for energy storage in the APAC region, setting out five key things to know about the sector. This chart shows expected global battery demand from 2021 to 2032, and I think there are two points really worth noticing.

The first is just the spectacular pace of growth that has already been achieved in recent years, and the continued growth that we are forecasting into the 2030s. The second is that demand for electric vehicles absolutely dominates the global battery market, accounting for 77% of cell demand in 2023 and a projected 84% in 2032. Compared to the EV industry, stationary storage and other uses such as electronics are relatively minor segments.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.