Discuss your challenges with our solutions experts

How does the Inflation Reduction Act impact renewables project planning?

Choices regarding incentives can have significant consequences for overall profitability

5 minute read

Erin Carroll

Senior Vice President, Supply Chain Consulting

Erin Carroll

Senior Vice President, Supply Chain Consulting

Latest articles by Erin

-

Opinion

How to choose the right renewables project model

-

Opinion

Factors to consider when choosing OEMs for renewables projects

-

Opinion

How does the Inflation Reduction Act impact renewables project planning?

-

Opinion

How to manage renewables supply chain issues

The US Federal Government’s Inflation Reduction Act (IRA) was specifically designed to offer the structured incentives and stable environment needed to jumpstart the previously sluggish US renewables sector. The promise of the Act is phenomenal, with tax credits in place for at least ten years, and potentially much longer. This generous timeframe lends vital solidity to the market.

A key element of the act is that it makes available a choice of Investment Tax Credits or Production Tax Credits for eligible renewables projects including solar, wind, clean hydrogen, carbon capture and storage (CCUS), and standalone battery storage. It also provides manufacturing tax credits to build a renewable domestic supply chain.

The IRA is structured so that projects can receive varying degrees of tax credits based on multiple factors. These include the level of domestic content and the prevailing wage for labour, as well as the potential location of the project in an ‘energy community’ as defined by the Act.

The state of play

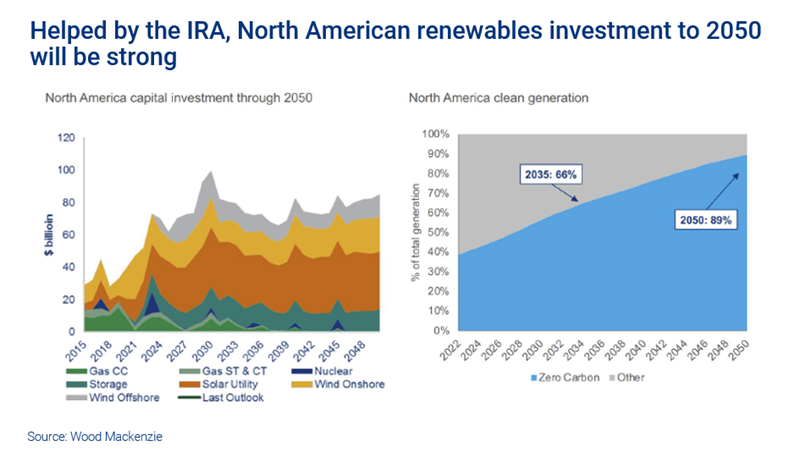

With the IRA providing the certainty developers need, the pipeline for renewables projects in the US is looking robust and healthy. As a result, investment in solar and onshore wind in North America is booming (see chart below); based on our analysis, the US utility-scale solar market will add 437 gigawatts (GW) by 2032, while an average 20 GW of wind power should be added annually over the same period. At the same time, the energy storage market is expanding rapidly, with installations expected to reach almost 75 gigawatts (GW) by 2027.

This growing pipeline is driving a huge increase in demand for equipment and labour in the renewables sector. The downside, at least in the short term, is that supply is struggling to keep up.

With details of the IRA’s Domestic Content Requirement now clarified, investment into US renewables equipment manufacturing should be strong. However, scaling the sector will take time. In the meantime, the lack of a robust domestic supply chain for solar and energy storage project resourcing is a significant stumbling block for companies to be able to leverage the bonus adder for domestic content.

The situation is compounded by problems with the external supply chain for renewables. In particular, concerns around the alleged dodging of US Customs anti-dumping and countervailing duties by Chinese firms caused major disruption to equipment supplies in 2022. Adding to the issues, a flood of projects that had been put on hold awaiting confirmation of the IRA have since been greenlighted, putting even more pressure on the supply chain.

In the short term, these factors are pushing up capital costs and affecting the availability of both equipment and labour. As a result, while project developers and owners can take advantage of Investment Tax Credits, hoped for reductions in capital costs for renewables projects have yet to materialise.

Overall, the situation is far from straightforward. Stakeholders need to understand the issues and take the full range of factors into account when making decisions. Most important to consider is whether to opt for Investment Tax Credits (ITC) or Production Tax Credits (PTC), and if the tax credit bonus available under the Domestic Content Requirement (DCR) is enough to offset the additional cost incurred by procuring domestic components.

Investment tax credit versus production tax credit

As an owner or developer, deciding between ITCs and PTCs is an important decision that should constitute a separate layer to your project planning and analysis. While both ITCs and PTCs offer the same basic system of tax credits for projects, there is a key difference in when and how these credits are applied. ITCs offers the credit upfront, whereas PTCs provide the tax credit annually over the first ten years of the project’s life, based on its output.

PTCs therefore put a bigger burden on a project to meet its planned output requirements, since any shortfall in actual output – compared to the capacity factor the asset was designed for – will reduce the tax credits received.

With this in mind, developers and owners should take the following factors into consideration when making a decision:

- Plant capacity: Generally, the higher the capacity of a plant, the more likely it is to benefit from PTC over ITC

- Financing and capital investment costs: Currently, higher equipment prices due to supply chain constraints – coupled with high borrowing costs – tend to favour ITCs

- DCR eligibility: Projects using domestically sourced materials and equipment receive an additional 10% domestic content bonus; however, the lack of a mature domestic supply chain means meeting the DCR is complex and difficult for solar and battery energy storage systems (wind is better positioned to take advantage of the current DCR requirements)

- Energy Communities Bonus eligibility: Projects located on ‘brownfield sites’, in areas of high unemployment or in areas where coal mines or coalfired power stations were historically sited are eligible for an additional 10% bonus

- Impact of delays or curtailment: Uncertainty, particularly in terms of supply chain issues, means developers and owners need to take great care in managing potential delays and disruptions to projects; this is an even bigger issue when opting for PTCs, as any delay or reduction in scope will create a corresponding delay in receiving tax credits or a reduction in the amount received

In general, ITCs involve less risk as well as offering immediate access to capital – under ITC rules, a project that meets labour requirements can receive 30% of total build costs upfront. Unsurprisingly, then, developers are currently tending to favour the ITC route.

However, it’s essential to deal with each project on its own merits. If a project has strong resource availability and anticipated production levels are high, the benefits of being able to realise tax credits over a 10-year time horizon may ultimately be more compelling.

Decision makers should also keep in mind that the dynamics between the factors involved, including materials, equipment and financing costs, are constantly changing. It’s therefore important to keep checking the pulse of the market right up to the point at which a final decision is made.

Conclusion

The incentives on offer for renewables projects under the IRA provide an important boost to the sector. However, assessing the opportunities and risks involved to ensure you make the best choice for a particular project is complex. Wood Mackenzie’s Supply Chain Intelligence team can leverage a vast array of information and expertise, from renewables project spend data to commodity cost forecasting, to advise and support you in making the right decision.

Learn more

Find out more about the insight and analysis available from Supply Chain Intelligence by filling out the form at the top of the page.