Sign up today to get the best of our expert insight in your inbox.

Permitting reform could help ease US grid bottlenecks

Proposals to expedite infrastructure projects are back on the agenda in Congress. They could be part of the solution to the strains created by rapid growth in renewables

10 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Google’s demanding goals for decarbonisation

-

Opinion

Reducing the emissions from natural gas

-

Opinion

Jigar Shah returns to the Energy Gang

-

Opinion

Emissions rules for US power pose some difficult questions

-

Opinion

Is there an energy transition?

-

Opinion

Making low-carbon hydrogen a reality

When the French aristocrat Alexis de Tocqueville visited the US in 1831-32, he was very struck by the country’s strong commitment to property rights. “In no other country in the world is the love of property keener or more alert than in the United States,” he wrote. “And nowhere else does the majority display less inclination toward doctrines which in any way threaten the way property is owned.”

Although the US has changed radically in many ways since then, frameworks of strong property rights, extended to include consideration of environmental impacts, remain central features of the political and legal landscape. In recent years there has been a growing swell of people questioning whether national policy goals, including energy security and the fight against climate change, are being impeded by overlapping obstructions to investment in infrastructure that can be raised by federal, state and local governments, by regulators, and by the public.

In particular, the difficulty of building new grid infrastructure is emerging as a critical threat to the surge in investment in wind and solar generation and battery storage planned as a result of the Inflation Reduction Act passed last year.

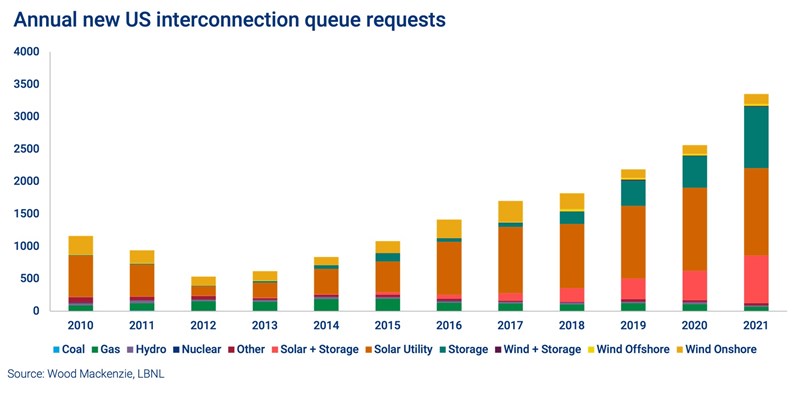

Even before the act was signed into law, the number of projects waiting for grid connections has been soaring. As shown in this chart, using data from the Lawrence Berkeley National Laboratory, the number of new requests for interconnection rose every year from 2013 to 2021. The great majority of the projects are solar generation, battery storage, or hybrid solar-plus-storage.

As of the end of 2021, there were 8,133 projects waiting in interconnection queues in the US, with total generation capacity of over 1,000 GW and output from storage of 420 GW. More than 90% of that generation capacity was in low-carbon energy. The typical time between a request and an agreement for interconnection has also been rising sharply, from about 18 months in 2015 to over three years in 2021.

The Inflation Reduction Act, by expanding and extending tax credits for wind, solar and storage, seems set to make those congestion problems worse, because there will be more projects that are economically viable and aiming to get connected to the grid. Wood Mackenzie analysts have estimated that to reach the goals of the IRA, the US will need $80 billion - $100 billion in transmission investment. But the act’s provisions relating to transmission do not guarantee that those investments will be made.

Ryan Sweezey, Wood Mackenzie’s principal analyst for North America power and renewables, comments: “You can see the IRA as the latest step in a long tradition of Congress ignoring everything except generation.”

There was money for the grid in both the IRA and the infrastructure bill passed with bipartisan support in 2021. However, Sweezey says: “Money is not the problem. There is clearly an economic rationale for more transmission. The real issue is the legal and regulatory structure we have that is antithetical to long-term transmission planning.

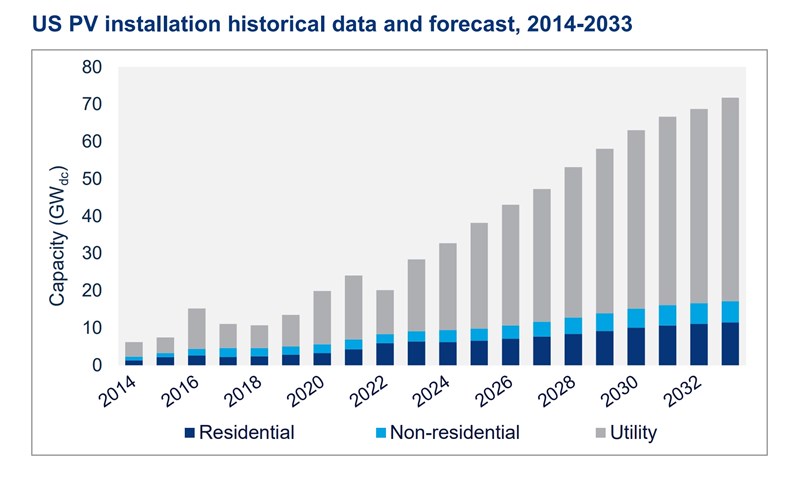

To project how grid constraints could affect the impact of the Inflation Reduction Act, Wood Mackenzie analysts have modelled a “decarbonisation headwinds” scenario, reflecting a future in which obstacles to transmission development and growing interconnection queue bottlenecks raise costs for new generation and limit the pace of decarbonisation in the electricity sector. In that headwinds scenario, the US has about 330 GW of utility-scale solar generation capacity in 2033. That would still represent very rapid growth from about 63 GW in 2022, but it is well short of the figure of about 420 GW that we forecast in our base case last year, based on projections of some easing in those grid constraints.

Now there is again movement in Congress that could help. Attempts to reform the federal law on permitting for infrastructure, including power transmission as well as other projects such as pipelines and LNG terminals, foundered in Congress last year, despite support from President Joe Biden.

But in a new Congress with Republican control of the House of Representatives, fresh attempts at reform are being launched. A window is opening for possible legislation, with support from both parties, that could reset the balance between developers seeking to build infrastructure projects, and those seeking to stop them.

House Republicans have put energy at the heart of their policy programme, proposing about 20 separate pieces of legislation intended to boost domestic production and strengthen security of supply. With a Democratic majority in the Senate and a Democratic president, much of this agenda is likely to make little progress. Permitting reform could be the exception.

Two bills have been proposed in recent weeks: the Building United States Infrastructure Through Limited Delays and Efficient Reviews (BUILDER) Act, and the Transparency, Accountability, Permitting and Production of (TAPP) American Resources Act. The bills differ in scope. The BUILDER Act is focused on reform of the 1970 National Environmental Policy Act, to streamline and accelerate environmental reviews and limit subsequent legal challenges. The TAPP Act includes those provisions, as well as a list of other measures covering issues such as federal leases for oil and gas development, royalty rates and drilling permits.

Both have significant differences from the proposals put forward last year by Senator Joe Manchin, a centrist Democrat from West Virginia. That package included measures aimed specifically at expediting electricity grid investment, which the Republican plans do not have. But the core principles of streamlining reviews and limiting challenges are the same.

“Reform” can be a slippery concept. It is usually easier to get people to agree that reform in general is needed than to agree on which specific reforms should be adopted. Still, there is a real chance that some kind of compromise can be reached that will win sufficient support from both Republicans and Democrats, and be signed into law by President Biden.

That kind of compromise reform plan can be expected to face opposition from environmental groups. The Natural Resources Defense Council argued recently that the Ten West Link, a 125-mile transmission connection running from Arizona into California, which broke ground in January, was “a success story”, showing how critical infrastructure could be expedited without abandoning environmental protections.

The Ten West project has not moved rapidly. The consortium was selected in 2015, and the line is expected to enter service in 2024. But the NRDC argues that by being “smart from the start” about its environmental impact, the project could have won support from environmental groups sooner. Cullen Howe of the NRDC argued: “There is… a call to gut our most basic environmental laws and safeguards with the supposed aim of getting new transmission lines built quickly. This is not a tradeoff we should be willing to make, nor do we have to.”

If permitting reform does pass, it could help smooth the path for power transmission investments and hence the growth of renewables in the US. But it is not a magic wand. Wood Mackenzie’s Ryan Sweezey cautions: “Permitting reform will certainly make a difference. But it is just one of the many issues that need to be addressed. Independent system operators, the Federal Energy Regulatory Commission, state regulators, inter-regional planning, and cost allocation: all of these will need reforms to realise the full potential of renewable energy in the US.”

In brief

The European Commission has agreed an amendment to the EU’s state aid rules to make it easier for member states to support key industries for the energy transition. The move follows mounting concern in the EU about the Inflation Reduction Act, which has sharply increased the attractiveness of the US as a location for investment in low-carbon energy technologies.

Those concerns were highlighted this week by a report in the Financial Times that Volkswagen had told the EU it was “putting on hold a planned battery plant in eastern Europe and prioritising a similar facility in North America, after estimating it could receive €10bn in US incentives”.

A new crop of theories has emerged about the sabotage on the Nord Stream pipeline system in September last year. The New York Times reported that US officials had seen evidence suggesting that “a pro-Ukrainian group” had carried out the attack. Die Zeit reported that the German authorities had apparently made a breakthrough in their investigation, identifying the boat that was used and reconstructing how and when the explosive charges were placed on the pipeline. However, the story added: “Investigators have not yet found any evidence as to who ordered the destruction.”

A new method for direct air capture of carbon dioxide from the atmosphere has been proposed by a group of academics working at LeHigh University in Pennsylvania and the Georgia Tech Shenzhen Institute. The team has developed a new “hybrid sorbent” for capturing carbon dioxide even at the very low levels of concentration found in the atmosphere, and say it is “chemically stable and mechanically strong, and its sorption capacity is reproducible for multiple cycles of operation”. A scientist not involved in the project said the idea “stands a good chance of transforming CO2 capture efforts”.

Another potentially huge scientific breakthrough was reported this week: a claim that a material that is superconductive at room temperature had been fabricated by a team working in Rochester, New York. The discovery would have huge implications for energy if the material works and can be deployed at scale, but some of the initial reaction was sceptical.

The geothermal startup Fervo may be able to produce dispatchable power and act as energy storage, its chief executive told the MIT Technology Review.

The worst air quality in the US, in terms of fine particle pollution, is around Bakersfield, California, according to an analysis by The Guardian. Other areas of high pollution included parts of Los Angeles, Chicago, Indianapolis and Houston.

Other views

Simon Flowers — How the war is shaping Big Oil’s transition strategy

Michelle Davis — The US solar industry looks ahead after a volatile year

China drives global wind turbine orders to new record in 2022

Gavin Thompson — Can Japan deliver its offshore wind potential?

Rishab Shrestha and Ahmed Jameel Abdullah — Renewable energy costs continue to fall across Europe

Collin Eaton and Benoit Morenne — US shale boom shows signs of peaking as big oil wells disappear

Bill Scher — Joe Biden broke his 2020 pledge on fracking. Good

Gloria Li — China’s CATL cements position as world leader in battery market

Catherine McKenna — Companies need to stop greenwashing and get serious with net-zero pledges

Quote of the week

“Let me remind you – this is the largest nuclear power station in Europe. What are we doing? How can we sit here in this room this morning and allow this to happen? This cannot go on. I am astonished by the complacency – what are we doing to prevent this happening?... We are the IAEA, we are meant to care about nuclear safety. Each time we are rolling a dice. And if we allow this to continue time after time then one day our luck will run out.” — Rafael Grossi, director-general of the International Atomic Energy Agency, sounded the alarm about the Zaporizhzhia nuclear power plant in Ukraine, which has been disconnected from its external electricity supply and been forced to use back-up generators six times since the Russian invasion. Loss of all power at the site would mean the plant’s cooling systems could no longer function, threatening a very serious incident. Grossi called for an international commitment to protect the safety and security of the plant.

Chart of the week

This comes from Wood Mackenzie’s latest US Solar Market Insight report, created in collaboration with the Solar Energy Industries Association. For utility-scale solar in the US, 2022 was the worst year since 2017, with a 31% fall in installations. For residential solar, it was another record-breaking year with 40% growth. But in total, including all solar market segments, there was a 16% decline in generation capacity added. Uncertainty surrounding the anticircumvention investigation launched by the Department of Commerce, and numerous detentions of solar equipment by US Customs and Border Protection, constrained the industry’s growth. This year, however, we expect installations to rebound, growing by 41% over 2022’s level, assuming no further disruptions. And as you can see from the chart, we now expect annual capacity additions to be on a rising trend until at least the early 2030s, with utility-scale solar accounting for the majority of the installations.