The impact of the second wave of US LNG

Will the US become the world’s largest LNG exporter?

1 minute read

The first wave of US LNG projects, driven by shale production growth, was a game-changer. As the largest and fastest LNG capacity build out from a single country, it set the US on a course to be the world’s third largest LNG producer, after Australia and Qatar, by 2020.

And with demand for new supply projects increasing, the US now appears well positioned to catch a second rising wave – and its growth could revolutionise the wider LNG market.

The rise of the first LNG wave

US LNG wasn’t always an exports story. The first construction boom was aimed at imports. Six new LNG regas terminals started between 2008 and 2011, including five large facilities in the Gulf Coast region. However, even before the last of these projects came online it became evident that the rise of domestic unconventional gas production meant that there was little incentive to bring LNG to the US.

As the US shale revolution took hold and the spread between US and international gas prices continued to widen, proposals for US LNG export projects increased. By the end of 2012, export permit applications filed with the US Department of Energy reached 243 mmtpa (32 bcfd), encompassing both brownfield redevelopments of existing regas terminals and greenfield proposals.

Massimo Di Odoardo, Wood Mackenzie VP of global gas and LNG research, comments on LNG investment opportunities.

A stream of new LNG entrants

It’s notable that first wave facilities are largely owned by companies with no prior involvement in LNG exports. Cheniere and Freeport, for example, started as a US LNG pure-play, focusing first on developing US export infrastructure.

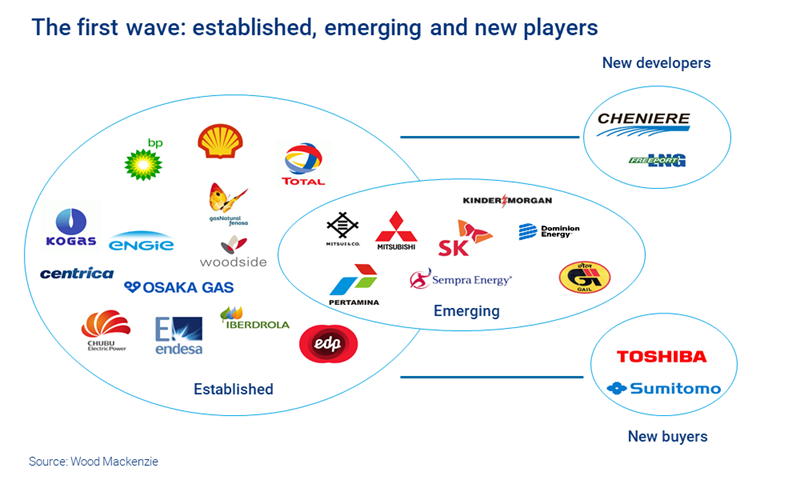

And on the buyer side, a mix of established, emerging, and new players were drawn to the opportunity.

First wave construction began in 2012. Two years after announcing plans for a liquefaction project Cheniere made a final investment decision (FID) for the first two liquefaction trains at Sabine Pass. By the end of 2015, the US had a total of 14 liquefaction trains under construction, with investment totalling around US$50 billion.

The market turns

The crash in oil prices from late 2014 had a significant impact. Buyers turned away from US LNG towards oil-indexed supply. A slowdown of the LNG market compounded the effect. The small-scale Elba Island project was the only US LNG project to start construction in 2016. In 2017, no further capacity was sanctioned.

Nonetheless, the first wave of US LNG projects put the US on course to become the world’s third largest LNG producer by 2020, with around 70 mmtpa of liquefaction capacity.

Positive sentiment returns

Uncertainty around further development of US LNG capacity did not last long. A China-led lift in demand, rising oil prices and low Henry Hub prices all helped to rekindle interest.

A second wave of US LNG began – like the first – with Cheniere. Full construction started on a third train at Corpus Christi in May 2018, and a sixth train at Sabine Pass in June 2019. Qatar Petroleum and ExxonMobil also made moves, reaching an FID at Golden Pass LNG in February 2019.

In July 2019, Venture Global announced that it had secured binding commitments of over $10 billion for its $5.8 billion Calcasieu Pass LNG construction financing. Initial construction had begun in advance of FID as Venture Global seeks to move quickly on implementing its modular design. Closing the debt financing is essentially the last hurdle before full construction.

Several more projects are at an advanced stage. Brownfield developments include Lake Charles, and expansions at Freeport, Cameron and Corpus Christi, in addition to a variety of greenfield projects that include floating LNG and modular technology.

Will China be a missed opportunity?

While the potential for demand growth in China and supply growth in the US is huge, LNG trade between the two nations is currently largely on hold.

In 2018 more than 50% of China’s imports were from just four countries: Australia, Indonesia, Malaysia and Qatar. The ongoing trade dispute is a real barrier to signing long-term deals with the US that would help diversify its supply.

And the US isn’t China’s only option for contracting new supply, as we’ve seen with CNOOC and CNPC’s entry into Arctic LNG-2 in Russia. So, while the profiles of Chinese demand and US supply may seem like an ideal fit, that may not push them to a resolution.

Which US projects will proceed and when?

Globally, there is no doubt that new capacity is needed to meet demand. In fact, we forecast that global LNG demand will grow from below 400 mmtpa in 2020 to around 550 mmtpa by 2030. And with fresh confidence in the strength of the market comes a rise in new projects worldwide.

US LNG does face competition from projects in Qatar, Mozambique and Russia and smaller incremental projects in West Africa, Papua New Guinea and Australia. So far, the US is attracting the strongest interest. Since the start of 2018, US LNG sellers have signed new contracts with buyers totalling more than 30 mmtpa.

In our forecasts we see a positive outcome for projects around the world, and the US leads the pack. By 2024 we predict that the US will eclipse Qatar and Australia and hold a position as the worlds’ largest LNG exporter – and that could have a radical effect on the wider market.

To find out more, fill out the form on this page to access our complimentary report: "The growing importance of North America in the global gas and LNG market".

You can also meet our experts at Gastech 2019, 17-19 September in Houston, to discuss the second wave of US LNG in more depth.