Hoegh Galleon helps Egypt’s gas crunch but delays Australian LNG imports

Egyptian LNG import capacity will arrive ahead of peak summer demand

3 minute read

Fraser Carson

Principal Research Analyst, Global LNG

Fraser Carson

Principal Research Analyst, Global LNG

Fraser has extensive research and project management experience across the LNG value chain.

Latest articles by Fraser

-

Opinion

Video | Lens Gas & LNG: Golar and partners' FID set to revive Argentina's LNG export ambitions

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

The US broadens sanctions against Arctic LNG-2

-

Opinion

Hoegh Galleon helps Egypt’s gas crunch but delays Australian LNG imports

-

Opinion

LNG trade disrupted as Suez Canal transits stop

-

Opinion

Floating LNG is back in vogue

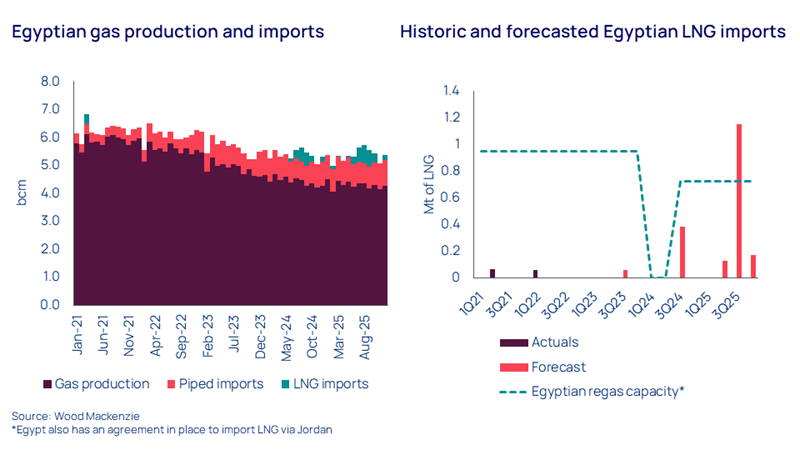

The Hoegh Galleon floating, storage and regasification unit (FSRU) is reported to have been contracted by the Egyptian Natural Gas Holding Company (EGAS) on an 18-month charter agreement, beginning in June 2024. The FSRU is likely to be deployed at the Ain Sokhna port, replacing BW’s Singapore FSRU, which departed late last year to be deployed in Italy from Q4 2024. Read on for a summary of the key takeaway messages from this latest LNG movement in Egypt.

Australian LNG imports are unlikely to start before 2027

Australia’s East Coast market will be short of gas in the second half of this decade. Supply from the Gippsland Basin will fall sharply. Due to under investment, this hasn’t been replaced with new supply. Exploration targets haven’t been drilled and gas fields haven’t been appraised.

Yet gas demand remains robust. Whilst it will decline, it won’t fall fast. Gas is required to firm renewables as coal power plants are phased out. With cost-of-living challenges, residential substitution will be slower than expected and there are limited substitutes for industrial demand. Some industrial players may move overseas due to high prices.

As a result, local supply is set to decline faster than demand. LNG imports are one of the solutions and Port Kembla is the leading project. With other projects moving sideways and the Hoegh Galleon heading to Egypt, Australian LNG imports are unlikely to begin before 2026. And realistically, 2027–2028 is more likely. For the project to start up, a company needs to take on the commodity risk and the pipeline operator must spend significant capital to underpin LNG imports.

Australia’s East Coast market will be finely balanced over the next few winters. Without LNG imports the risk of outages and power blackouts is real. Keep an eye out for our East Coast gas report that will be published in H2.

Egyptian LNG imports arrive ahead of the summer crunch

Egypt began experiencing gas shortfalls in 2022. The giant Zohr field, which contributes around 35% of the country’s total gas production, experienced water breakthrough earlier than expected, reducing its output well below daily contracted quantities (DCQ) of 2.7 bcfd. Gas from other increasingly mature Nile Delta fields continues to decline and exploration since Zohr has mostly disappointed.

Egypt became a net gas importer in H1 2023 and has become increasingly reliant on piped Israeli imports to balance its market. It also contractually obligated to continue exporting LNG from the Damietta LNG facility – despite the gas shortfall - but this could be restricted to only a handful of cargoes during the winter.

Following the Hamas attacks in Southern Israel in October 2023, Israel’s Ministry of Energy and Infrastructure ordered a shut-down of operations at the Tamar gas processing platform. Tamar’s outage had a significant impact on the region’s gas flows, not least for Egypt. With Israel prioritising its domestic gas market, exports to Egypt briefly dropped from 800 mmcfd to below 200 mmcfd. But even with Tamar back onstream, gas availability and infrastructure constraints limit Egypt’s ability to balance its market with piped imports alone.

Longer term, we expect Egypt to import more piped gas from Israel. We also expect Cypriot gas to supply Egypt but not until late this decade. Egypt will also develop renewables and nuclear to reduce dependency on gas. But in the meantime, LNG will help to mitigate the deficit. Cargoes are more affordable than one year ago; the “risk premium” attached to pricing has largely disappeared due to the diminishing threat of supply disruption. European gas storage is well stocked for the time of year and Asian LNG inventories remain close to the five-year average. The LNG shipping market is long and is expected to remain so until the end of 2025. Additionally, Egypt has secured over US$50 billion in funding from banks, international institutions, and regional allies, which will support the Galleon’s charter cost and facilitate the immediate procurement of LNG supplies.

In summary, by subcontracting Galleon Egypt has taken action to address potential gas shortages in its domestic market. Galleon also allows Egypt to import LNG by paying market price, making it is less reliant on other imports markets for gas.