What's new in global upstream

It remains important for upstream oil and gas to find advantaged growth opportunities. Pragmatic decisions feature as companies shift to adapt portfolios to keep pace with change

3 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Robert Clarke

Vice President, Upstream Research

Robert Clarke

Vice President, Upstream Research

Robert leads our US onshore research, with a particular focus on the evolution of the tight oil sector.

Latest articles by Robert

-

Opinion

Video | Tariff turmoil: how big a cost hit will US oil and gas operators take?

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

Global upstream update: oil supply questions and portfolio resets

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

What's new in global upstream

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

The Global Upstream Update is a regular insight produced for global subscribers to our Upstream Service. In this complimentary summary edition, we highlight of some of the most impactful recent changes and events, and what to expect next.

Fill in the form for your copy – or read on for a quick introduction to four key themes our team will be tracking closely this year.

Overcoming Argentina’s bottlenecks to growth

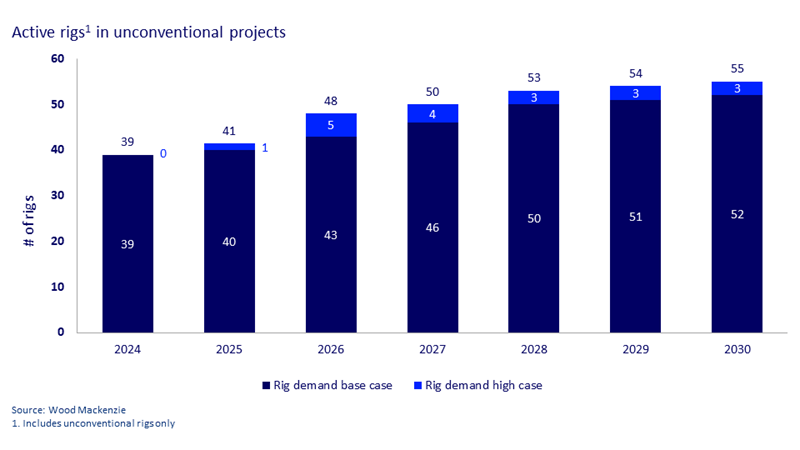

Argentina is targeting tight oil production of 1 million barrels of oil per day – but is this achievable? We forecast that goal can be met by 2030 but expanding oil pipelines and related OFS infrastructure will be key.

Argentina’s Neuquén Basin accounts for 71% of the country’s oil production and has not yet hit its peak. Large amounts of core tight oil acreage remain undeveloped, with well economics improving significantly over the past decade.

The lack of evacuation capacity has limited production growth though. Deploying additional pipeline capacity in 2024-2025 is necessary to ramp up Vaca Muerta output. A steady increase in rig count by the largest operators will also be needed to reach the oil production target too.

An increase in rig count of over 30% will be needed to match our base case; high demand case needed to reach 1 million b/d

Alongside these changes, an improved legal framework for investments is required, as well as more streamlined importing mechanisms– priorities which a new government administration is working to address.

Saudi Aramco abandons 13 million barrels per day capacity

Saudi Arabia’s move to trim back its production target to 12 million b/d is not expected to materially tighten global supply and demand balances. The decision is pragmatic. Saudi has continued to trim oil production since the pandemic and idle capacity in the region currently sits at nearly 6 million b/d.

Qatar, meanwhile, sees an opportunity to accelerate LNG growth via North Field West, as its major competitors in the US and Africa hit roadblocks: longer-dated US LNG export approvals are paused, Russian LNG is under sanction and progress in Mozambique remains slow. Qatar’s new 16 mmtpa North Field West plant will take its LNG production capacity to 142 mmtpa next decade.

But there are risks to the project: what will the impact on the LNG market be? Can existing infrastructure accommodate increases to production capacity? And what about rising costs? Fill in the form to read more.

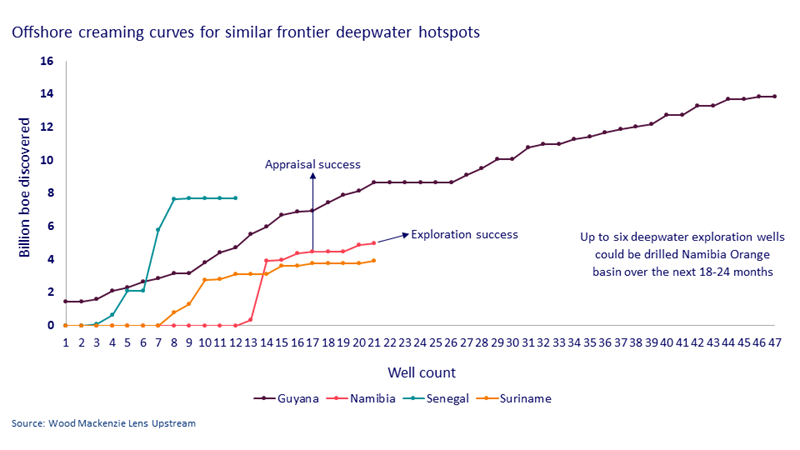

Namibia’s Orange sub-basin is world’s most exciting new exploration play

Recent deepwater oil discoveries off the coast of Namibia are causing great excitement in the industry. Two more oil finds have been identified this year – TotalEnergies’ Mangetti and Galp’s Mopane – bringing the total to seven major discoveries since 2022.

We estimate that 5 billion boe has been identified in nine exploration wells – and more results are expected this year.

So far, Namibia is on trend with results achieved from other frontier deepwater hotspots such as Guyana and Suriname.

Major moves in Asia-Pacific

Last year, Eni rapidly expanded its footprint in Indonesia with three significant announcements: the acquisition of Neptune and Chevron’s assets, acquiring the licencing for Peri Mahakam and the discovery of Geng North. Indonesia will become a core growth area, with the company’s production set to triple.

Meanwhile, TotalEnergies is back on the map in Malaysia, after acquiring 50% of SapuraOMV following a competitive bidding process. The deal solidifies the company’s commitment to Malaysia beyond its exploration push and strengthens its global relationship with PETRONAS.

In Australia, LNG buyer JERA – Japan’s largest power generation company – has expanded its Australian gas portfolio by purchasing 15.1 % of Woodside’s Scarborough. The deal confirms Japan’s demand for advantaged, low-emission LNG from Australia. In 2025, 45% of JERA’s total global contracted LNG offtake will come from the country.