Discuss your challenges with our Power & Renewables experts

Wind turbine technology evolution is diverging quickly between China and the rest of the world

Western OEMs reduce the pace of NPI and focus on product standardisation while Chinese peers continue the frenetic pace of new turbine introduction

4 minute read

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Latest articles by Endri

-

Opinion

Wind turbine technology evolution is diverging quickly between China and the rest of the world

-

Opinion

Western wind turbine manufacturers are prioritising profit over volume, opening the door for Chinese market share growth

-

Opinion

Goldwind captures the top spot for global wind turbine supply

-

Opinion

The wind energy industry paradox: short-term headwinds and long-term optimism

-

Opinion

Wind industry faces a perfect storm of profit pressures

Financial pressures have forced Western OEMs to slow, while Chinese OEMs gain strength

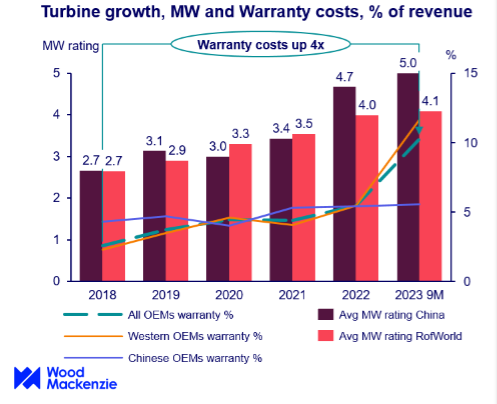

Quality issues threaten the financial recovery of Western OEMs. The global wind supply chain has experienced negative profitability for years, due to supply chain disruptions, geopolitical tensions, inflationary pressure and delays on project execution. Most wind turbine manufacturers (OEMs) and suppliers have imposed severe measures to recover from heavy financial losses. 2023 brought some improvement in financial performance, but quality and reliability issues have stalled this progress, as warranty provisions now account for 10% of OEMs revenues globally.

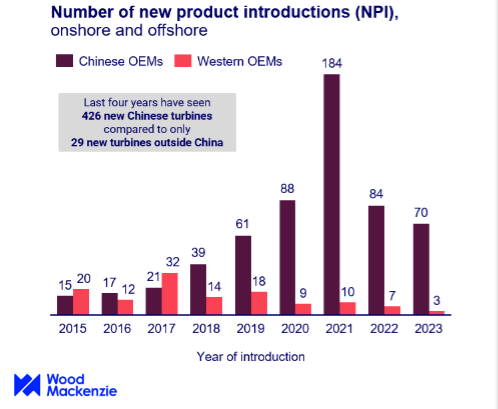

China continues to turn a profit while accelerating new product introductions. The financial pressure is not being felt evenly across all global markets. Western peers have been forced to slow down the pace of new product introduction (NPI), simplify their portfolios and extend commercial lifecycle of products. Meanwhile, Chinese OEMs have flooded the domestic and international markets with an unprecedented number of new turbines, achieving the global lead in average turbine size. Average offshore turbine ratings in China surpass Europe in 2023 with 9.5 MW and 9.4 MW, respectively, while in onshore Chinese OEMs leapfrogged western peers by installing 5.4 MW and 5.1 MW, respectively.

Wood Mackenzie’s Global wind turbine technology trends 2023 report explores the global and regional onshore and offshore turbine technology and component evolution, helping the industry understand the technology and product strategies employed by turbine OEMs and component suppliers. In this article, we will summarise a few of the key findings.

Western supply chain will simplify to avoid major turbine design changes

New turbine designs require economies of scale to deliver value. Many new and larger turbine designs were introduced by Western OEMs over the past five years, and these new turbines have struggled to reach manufacturing economies of scale in a depressed market. While larger turbines promise substantial cost reduction through more efficient material use and reduced turbine counts, these massive turbines are exposed to higher logistics expenses and require significant new supply chain investment for larger components. In addition, the increased size and complexity of the components also increase the risk of quality issues. Ultimately, the innovation arms race has led to shorter product lifecycles, inadequate testing periods, and complex product portfolios. The perfect storm that hit wind supply chain since the beginning of the 2020 is forcing Western wind OEMs and suppliers to slow down the introduction of new products and reduced the appetite for radical design changes.

The arms race continues in China, while the West slows down. Since 2020, when the Chinese Feed-in-Tariff (FIT) phased out, more than 400 different turbine models have been launched by nearly a dozen competing OEMs. Nine Chinese wind OEMs have revealed plans for 10 MW + onshore wind turbine platforms, a turbine scale that is unheard of in other markets. Similar trends exist in offshore, where the announcements of the first 20 MW + platforms took place in China. Turbine growth is driven by fierce competition in China, as the market is expected to grow by 6.2% annually in the next ten years. Furthermore, the additional cost pressure in the post-subsidy era is favouring larger turbines to reduce CAPEX. The development of GW-scale wind bases also favours the development of gigantic turbines.

Aggressive turbine growth in China may prove unsustainable. Turbine growth in China is remarkable but may be subject to the same pressures faced by the West in recent years. Chinese turbine prices dropped by over 30% in the course of 2023, indicating that a profit crunch may be looming for Chinese wind companies. Goldwind registered a financial loss on their manufacturing divisions for the first half of 2023, profitability was only maintained through their O&M division and project development arm. Quality and reliability issues are also growing within Chinese OEMs, with increasing warranty expenses and further repair costs expected as the latest generation of turbines move to serial production.

Standardisation does not need to reduce innovation. Technology advancement has always been pivotal to wind energy industry progress, but the current environment requires a streamlined industrial approach to technology, not radical technological change. We expect that the decade ahead will focus on six key themes to help the industry return to profitability:

- Slow down the turbine arms race – Slowing the pace of new product will extend the lifecycle of turbines and realise a return on R&D.

- Cap offshore MW ratings - We suggest a turbine cap of 25 MW to allow the supply chain to develop and standardise.

- Product portfolio simplification – Reduce turbine variants by globalising products and avoiding customisation will enable economies of scale and industrialisation.

- Automation is key – Automation of factory processes and repetitive production of identical components will enable the economies of scale necessary to reduce costs.

- Collaborate while competing – OEMs should work together to standardise processes for non-strategic components and processes. Strategic components like blades and drivetrains may never be shared or commoditised, due to significant IP barriers and competitive advantages.

Learn more

For more detail and insights, you can purchase the full Global wind turbine technology trends 2023 report here.

You can also click here to read our 2024 predictions for onshore and offshore wind. Or, learn more about our Global Wind Markets Service.