Chinese state-owned enterprises are the largest owners of solar assets

The largest solar portfolios in the world grew by a staggering 44% in 2022

3 minute read

Juan Monge

Principal Analyst, Distributed Solar, Europe

Juan Monge

Principal Analyst, Distributed Solar, Europe

Juan covers distributed solar market developments across Europe.

Latest articles by Juan

-

Opinion

Global solar PV installed capacity will more than triple in the next ten years

-

Opinion

Global solar forecast gets an upgrade

-

Opinion

Chinese state-owned enterprises are the largest owners of solar assets

-

Opinion

Western Europe will drive 46% of the continent’s solar in the next ten years

-

Opinion

Global solar capacity to increase 32% compared to 2022

-

Opinion

Record solar buildout expected in all regions this year

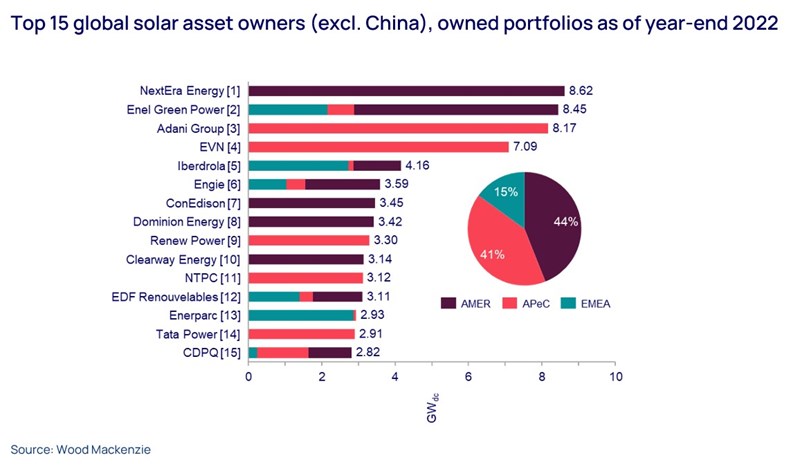

At 240 GWdc, 2022 was the biggest year on record for global solar installations. That relentless growth translated into unprecedented expansions of the operational portfolios of the largest global solar asset owners. Solar portfolios from the top global solar asset owners, including Chinese players, grew by a record-shattering 44% in 2022. This was driven mostly by aggressive 2025 solar targets set by Chinese authorities. Excluding Chinese state-owned enterprises like SPIC, China Huaneng Group and CHN Energy, the top 15 non-Chinese global asset owners grew their portfolios by 20% last year.

To account for these differences in operational asset portfolio sizes between China and the rest of the globe, Wood Mackenzie offers two separate rankings for global solar asset owners as part of the ‘Global solar PV asset ownership 2023’ report: one that excludes the largest Chinese solar asset owners and one that does not. Every year, we rank the top solar asset owners for owned operational portfolios, both at a global and a regional level.

Fill out the form at the top right of the page to download your complimentary extract from our ‘Global solar asset ownership 2023’ report. Or, read on for a short summary of some key takeaways.

NextEra Energy has become the largest solar asset owner outside China

NextEra Energy has jumped to the top of the global solar ownership ranking that excludes China as of year-end 2022. Vietnamese state-owned enterprise EVN has dropped from the top to the fourth position. Vietnam’s ban on new utility-scale solar projects due to extreme grid congestion translated into a flat year for EVN’s portfolio of owned solar projects in 2022.

NextEra Energy also remains the leading asset owner in the United States, having added 1.8 GWdc to its portfolio in 2022. Enel Green Power, Adani Group, Iberdrola and Engie also experienced some of the largest expansions in their asset portfolios.

Chinese entity SPIC tops the global solar asset ownership ranking for another year

Chinese state-owned entity SPIC continues to dominate the global solar asset ownership ranking that includes Chinese entities. The Chinese state-owned enterprise interconnected 12.5 GWdc in 2022, which amounts to more than the capacity installed by the top 15 non-Chinese asset owners combined.

China Huaneng Group and CHN Energy hold the second and third largest owned operational solar portfolios by year-end 2022. NextEra Energy, Enel Green Power, Adani Group and EVN were the only non-Chinese players that made it into the top 15 global solar asset ownership ranking that includes China.

67% of the top 2022 global solar asset owners outside China are IPPs

IPPs affiliated with a utility are the most common type of solar asset owner within non-Chinese players, representing 41% of ranked capacity. That share is even higher for certain regions, including the Americas (63%) and Europe (70%).

IPPs unaffiliated with a utility account for 26% of the entities represented in the global ranking excluding China, while state-owned enterprises make up 15%. In the case of Europe, this is in stark contrast to previous years, when most of the largest solar asset owners were infrastructure funds. But the region’s transition to a more projects with merchant market revenue is reshaping the profiles of top asset owners.

When it comes to the global solar asset ownership ranking that includes China, 86% of the companies that made it to the top 15 are state-owned enterprises. Most of these are Chinese, as 82% of the capacity represented in the ranking is concentrated in the Asian country.

Learn more

To find out more about global solar asset ownership trends, and gain access to charts detailing regional variations, please fill out the form at the top of the page to download your complimentary extract from our ‘Global solar asset ownership 2023’ report.