Goldwind captures the top spot for global wind turbine supply

Three different OEMs realised double-digit GW installations in 2022, despite multiple supply chain complications

5 minute read

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Latest articles by Endri

-

Opinion

Wind turbine technology evolution is diverging quickly between China and the rest of the world

-

Opinion

Western wind turbine manufacturers are prioritising profit over volume, opening the door for Chinese market share growth

-

Opinion

Goldwind captures the top spot for global wind turbine supply

-

Opinion

The wind energy industry paradox: short-term headwinds and long-term optimism

-

Opinion

Wind industry faces a perfect storm of profit pressures

Last year was another challenging one for the wind turbine supply segment, particularly for wind turbine original equipment manufacturers (OEMs). Profitability challenges, exacerbated by supply chain disruptions, geopolitical tensions, inflationary pressure and delays on project execution saw new wind capacity fall by 13% in 2022, to 90.7 GW, following two years of record-setting 100 GW+ installations globally.

So, which OEMs have risen to the challenge? Who’s leading the pack for new installations? We explored this topic in a new report, Global wind turbine OEMs 2022 market share. Fill in the form for a complimentary extract and read on for a few highlights.

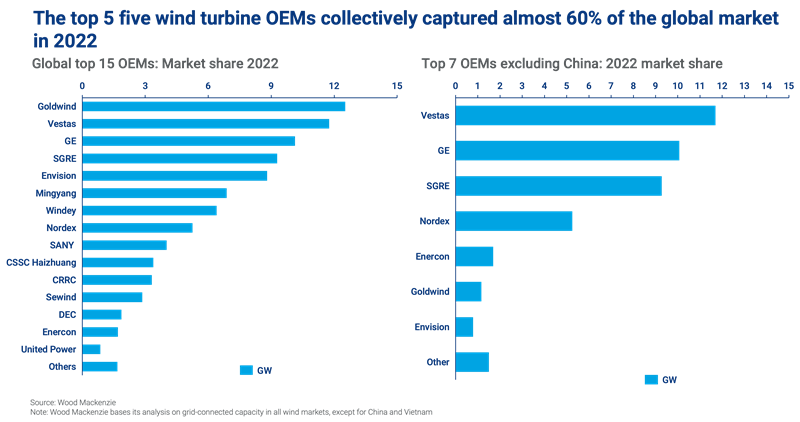

Goldwind secures the top spot – followed by the three dominant Western wind turbine OEMS

Our analysis finds that Goldwind gained the leading position for 2022, by adding 12.5 GW of new installs. This marks the first time that a Chinese OEM has captured the top global market share position. Vestas, who lost the top spot for the first time since 2015, followed closely with 11.8 GW. GE came next with 10.1 GW closing the trio with double-digit GW Installations. Siemens Gamesa and Envision installed 9.3GW and 8.8 GW, respectively, to conclude the top five OEMs – a group that collectively controls almost 60% of the global markets.

Outside of China, Vestas continues to be the leader for the seventh consecutive year, followed closely by GE and SGRE. Nordex and Enercon round out the remaining major Western OEMs.

Western OEMs (Vestas, GE, SGRE, Nordex and Enercon) are dominating the markets excluding China, concentrating 92% of the new installations.

Robust domestic market solidified Chinese wind turbine OEMs

China continues to be the largest global wind market, contributing 54% of the new wind capacity. This is despite the 11% drop YoY, which is primarily due to strict lockdown policies that significantly limited new capacity additions in Q4 2022.

However, domestic demand boosted Goldwind to the top global market share position, as the Chinese OEM installed 91% of its new capacity in its domestic market. Goldwind capitalised on the success of its GWH191 model, marking a pivotal shift to geared drive architecture for the company, which has historically relied upon direct-drive technology. Geared drive turbines constituted approximately 40% of the Goldwind turbines installed in 2022.

The robust domestic market shielded most Chinese OEMs from the supply chain headwinds that severely affected Western turbine OEM profitability. Therefore, the majority thrived on a robust home market improving their YoY financial results and garnering more future volumes through a record year of order intake in China.

Turbine technology has also accelerated in China. An average onshore turbine rating of 4.7 MW in China in 2022 eclipsed the average turbine size in most Western markets. These turbine size increases have led to a 31% YoY decrease in the onshore turbine supply costs and an overall 36% decrease YoY in the EPC costs, as our latest onshore capex outlook showed.

The offshore market shows further evidence of rapid Chinese technology evolution. The average installed Chinese offshore rating was 7.4 MW, a massive leap of 32% compared with the 2021 value of 5.6 MW.

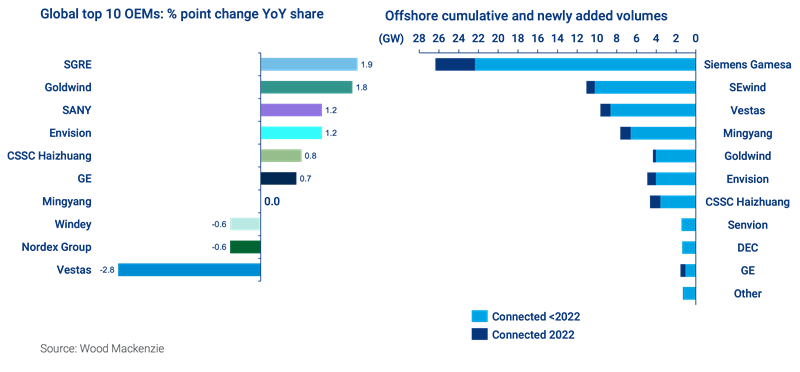

Multifaceted setbacks resulted in a 15% decrease YoY in wind turbine installations outside China

Decarbonisation ambitions and positive policy responses to the energy crisis have strengthened the global wind outlook. We estimate that global installed capacity will double by 2029. However, a challenging mix of inadequate transmission infrastructure in most of the markets, inflation and supply chain disruptions caused more than a 7 GW drop of the installed capacity in 2022, compared to 2021.

In this adverse environment western OEMs experienced another year of significant financial losses, forcing drastic measures. Turbine price increases, headcount reductions and cost discipline were just a few of the measures OEMs took to mitigate profitability risks. As a result, total capex of a typical wind farm increased by 20% in global onshore markets (excluding China).

Vestas was the most impacted Western OEM, realising the lowest grid-connected capacity they have delivered since 2019. Vestas did mechanically complete over 13.1 GW, which would be enough to secure first market share position, but only 11.8 GW was grid-connected, leading to their drop to 2nd place. (We report market share in terms of grid-connected capacity in all markets outside of China and Vietnam, which suffer from significant delays between turbine installation and grid connection.)

Vestas leveraged a mature supply chain footprint and global deployment of V150, the Danish manufacturer’s most installed turbine in 2022. The commercial debut of the Enventus V162 in 2022 promises a bright future based on a strong order book.

GE was also impacted by market slow down connecting 10.1GW - a 7% drop year-over-year. However, this was the third straight year that GE achieved activity above 10GW+. This sees GE joining Vestas and SGRE in the club of over 100GW cumulative installed capacity. GE’s success is primarily driven by the dominance of the US market with the 2MW platform. Nordex also experienced a drop in market share in 2022 as they installed 5.2 GW in 18 different markets. Despite the 1.4 GW drop YoY, 2022 was the second-best year for the German manufacturer, with Delta4000 series concentrating 77% of the new installed volumes.

Siemens Gamesa Renewable Energy (SGRE), on the other hand, installed 9.3 GW in 27 different markets. This represents 6% growth over its 2021 volumes. SGRE’s success is mainly attributed to its offshore leadership position, including installations of the SG8.X DD, the company’s most widely installed platform.

SGRE regains the leadership position in the offshore wind segment

The removal of the Central Feed in Tariff (FT) subsidy in China at the end of 2021 caused a substantial drop of 8 GW (-77% YoY) on the global offshore wind segment. Consequently, Chinese OEMs took a severe hit on 2022 installed offshore capacity with SEwind, Mingyang, Goldwind and DEC losing significant market share compared with 2021.

Outside of China, developers added a record 5.5 GW (+45% , +1.7GW YoY) with the UK, Netherlands and Taiwan as the leading markets.

SGRE regained the top spot on the offshore wind turbine manufacturer ranking, installing 38% of the global volumes (72.5%, excluding China), while debuting SG11.X-DD following a challenging commercialisation cycle.

After two years of inactivity on the offshore segment, GE re-appeared by installing 480 MW of Haliade 150 in France. Following a record offshore year in 2021 Vestas’ 2022 installs halved as it is finalising the market introduction of the V236.

Get a closer look at the wind turbine OEM landscape

Our report, Global wind turbine OEMs 2022 market share, explores the market in detail. Fill in the form at the top of the page for a complimentary extract.