Discuss your challenges with our solutions experts

Three factors driving the upstream M&A market

Operators are under growing pressure to optimise portfolios. What's having the biggest impact on decision-making?

1 minute read

Jamie Taylor

Principal Product Specialist, Lens (Asia Pacific)

Jamie Taylor

Principal Product Specialist, Lens (Asia Pacific)

Jamie is a senior product manager who brings in-depth upstream sector knowledge and regional expertise to his role.

Latest articles by Jamie

-

Opinion

How NOCs’ exploration strategies are evolving

-

Opinion

Three factors driving the upstream M&A market

Upstream operators are sharpening their portfolio strategies. A low oil price environment and global macroeconomic events have led to tightening margins and a change in focus. Attentions have switched from growth to strengthening balance sheets and portfolio resilience. So, what does that mean for the M&A market?

At our recent APAC Energy Summit we looked at how these dynamics are playing out in the context of the Australasian market, and how Wood Mackenzie Lens® enables you to shorten data-discovery time and explore opportunities. Read on for a summary.

Is it really time to sell?

It’s not an easy time to sell an upstream project. The coronavirus pandemic and the collapse in oil and gas prices killed M&A deal activity earlier this year, with no transaction in H1 over US$1 billion. But while activity globally has been muted, there’s evidence in some markets that companies are still looking at asset sales or partial divestment to help futureproof their businesses. In Australasia, for example, the M&A market has been hotting up.

How can analysts spot the assets that will continue to earn their place in these realigned portfolios? And where will businesses look to decrease their exposure, or divest completely?

Put simply, operators will focus on what they consider their best, most advantaged assets. For many this means greater scrutiny on low-margin onstream projects or capital intensive, long-life developments still awaiting a final investment decision (FID).

How are upstream operators identifying assets for divestment?

Right now, there are three crucial drivers for operators scrutinising upstream assets: portfolio rationalisation, deleveraging balance sheets, and the energy transition.

1. Portfolio rationalisation

Operators are stress-testing their portfolios to ensure they can stand up to oil prices of US$30-40/bbl. This means questioning and reassessing the value of their low-margin assets. Short-cycle, quick-payback projects are favoured above capital-intensive, pre-FID projects, with a longer lifespan.

Our Lens® platform helps to pinpoint assets which could be in line for divestment. These might be legacy assets in decline, or pre-FID projects which have been delayed. With its intuitive search and screening tools, Lens® can highlight, for example, where production is declining, but opex and capital costs are rising.

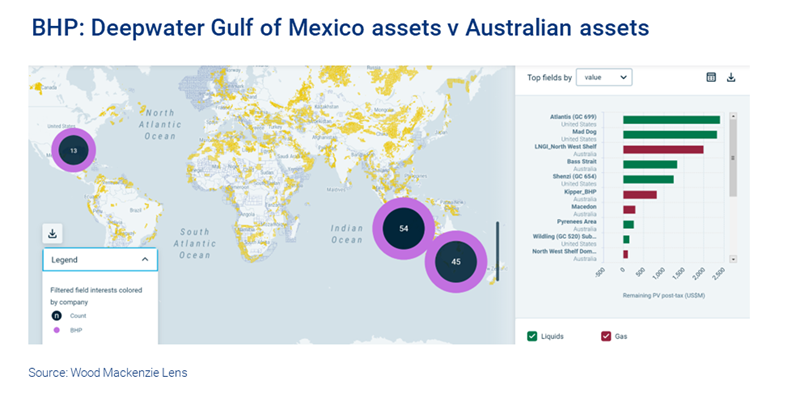

Take BHP. As it shifts focus to high-margin, advantaged growth assets (largely existing oil positions in deepwater Gulf of Mexico), M&A activity is likely to centre on its Australian holdings. BHP has already put its legacy position in the Bass Strait up for sale. Screening using Lens® reveals other potential candidates for future divestment – non-core assets that could struggle to compete for capital in a streamlined upstream portfolio.

Deleveraging balance sheets

The oil and gas industry’s pursuit of growth has left many companies with weakened cash flows and stretched balance sheets. Following the oil price crash, they’re now cutting costs and delaying major capital projects to reduce debt levels. Many are scouring portfolios for potential opportunities to monetise assets or farm-down existing positions, ideally reducing future capital commitments to boost free cash flow generation.

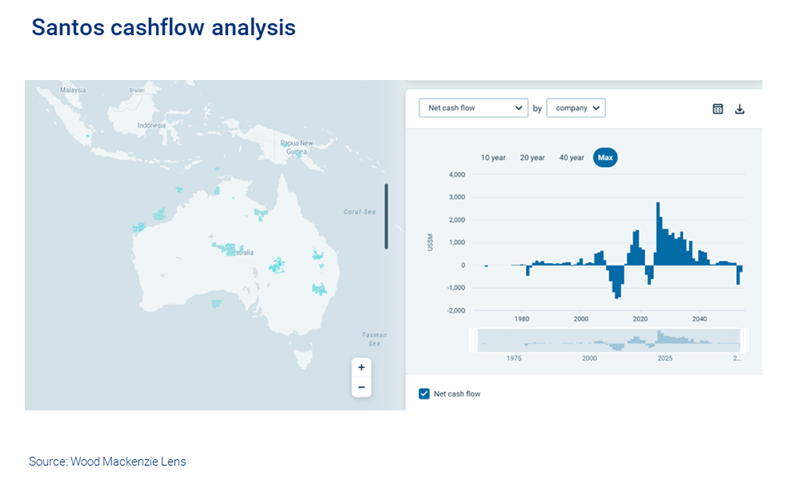

Santos is one such highly geared company looking to reduce its debt burden following acquisitions in recent years. A cashflow analysis using Lens® highlights negative cashflow for the next three years, due to large capital requirements. Farming down its positions in some of its recent acquisitions would provide upfront capital to pay down debt, as well as reducing the capital outlay for development costs.

3. The energy transition

A longer-term driver for refocusing portfolios is the global trend towards net zero. Increased scrutiny on carbon emissions is transforming the global upstream corporate landscape.

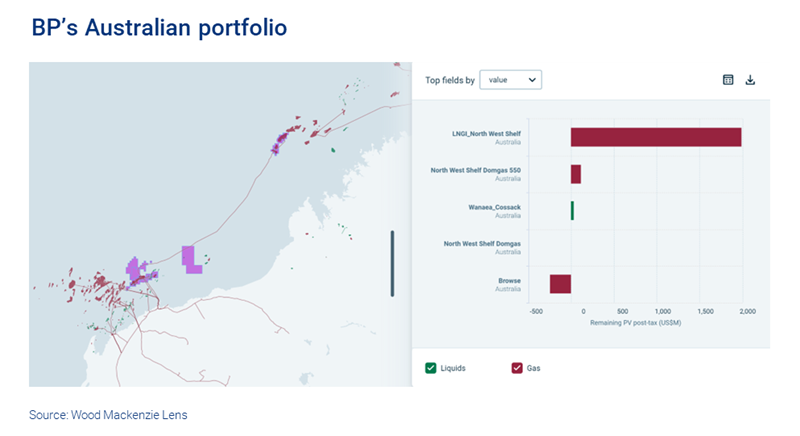

Majors such as BP and Total have set the tone with bold decarbonisation targets and will inevitably mean divestment from carbon-intensive assets as they restructure.

The Majors’ response to the energy transition will present plenty of buying opportunities for those with different strategies. BP’s Australian portfolio is one we think could be divested as part of its energy transition pivot. This includes the onstream North West Shelf asset and development opportunity, Browse. Additionally, there is potential exploration upside with drilling activity on the Ironbark-1 wildcat well currently underway. If a success, this could be tied back into the NWS infrastructure, which is 50 km away.

Who are the likely buyers as legacy operators restructure portfolios? In our insight on the Australasian upstream market we highlight four main buyer types: infrastructure funds and utilities, institutional investors and private equity, local buyers, and regional buyers. It’s a diverse group – but in the current climate deal-making is still likely to be tough. To find out more, visit our store to access the full insight.

See opportunity through our Lens

Analysing oil and gas assets, and their M&A potential, requires multiple datasets, including valuations, production estimates, well attributes and company fundamentals.

Gathering, cleaning and integrating this data slows down data-discovery time. We work with companies to understand their workflows and where valuable time can be saved – and what essential steps can be automated.

As oil and gas valuation models grow in complexity and sophistication, our goal is to free up your time to focus on where they add the most value – at a speed expected by today’s investors and financial institutions.

Lens® gives you instant access to clean and accurate data, including asset, company, public markets, and transactions in a single platform. The intuitive search and screening enables you to quickly discover all aspects of our upstream dataset and rank assets in portfolios by production type, valuation and resources, model cash flow and more.