Discuss your challenges with our solutions experts

Is the end of high US solar system prices in sight?

System prices remain high as supply chain constraints and policy uncertainties create a high-risk environment for US solar PV development

1 minute read

Sagar Chopra

Senior Research Analyst, Solar

Sagar Chopra

Senior Research Analyst, Solar

Sagar focuses on PV system pricing for US and LATAM regions.

Latest articles by Sagar

-

Opinion

Supply shortages and an inflexible market give rise to high power transformer lead times

-

Opinion

Top 10 solar PV inverter vendors cornered 86% of the market in 2022

-

Featured

Brighter skies for US solar in 2023? | 2023 outlook

-

Opinion

Is the end of high US solar system prices in sight?

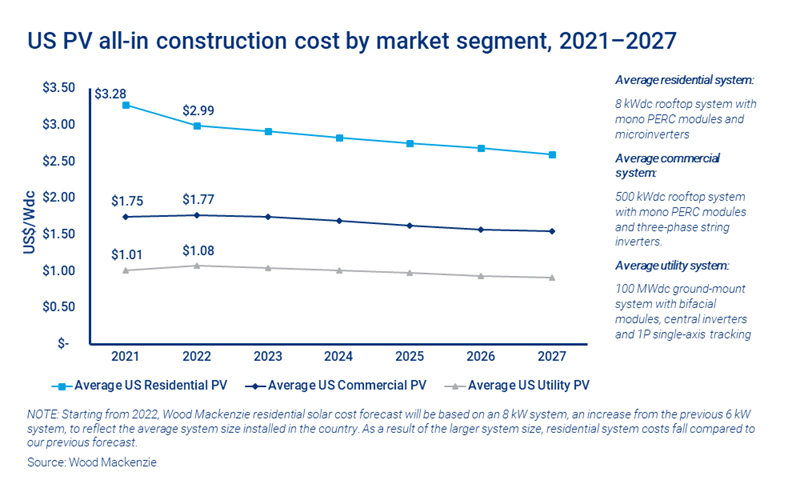

US solar PV system prices remain high through the first half of 2022. However, improvements in module technology and the adoption of large format modules could bring some relief.

The latest US solar PV system pricing report from our PV Technology Systems & Operations Service explores the drivers of costs and prices in detail. Visit the store to access it in full, or read on for an introduction.

A perfect storm for US solar system prices

The pandemic brought considerable challenges across all US solar market segments. The most immediate effect was the disruption of the entire supply chain, which led to increased freight costs and longer lead times. Elevated commodity prices, such as steel, aluminum, and copper will remain high in the face of the Russia/Ukraine conflict, continuing to squeeze already-tight developers’ margins. Labor shortages driven by the ‘Great resignation’ from 2021 will drag on 2022 and increase development costs.

Other soft costs, such as margins, contingencies, insurance costs and project management fees have also increased due to all the risks associated with project development in this uncertain environment.

Cost pressure is being felt across all US solar market segments

Utility-scale projects coming online in 2022 have had the most significant impact on procurement, driving costs up by 7% for an average 100 MWdc system.

The current high-risk environment is forcing manufacturers, vendors, distributors, developers and engineering, procurement, and construction (EPC) firms to add contingencies to their prices as a hedge against these fluctuations. EPCs continue to pass price increases to the developers, or let developers procure high fluctuation components like modules and trackers to avoid risks. As a result, developer costs have increased in the form of project management and insurance costs.

Average rooftop commercial PV system prices are also up. However, with the adoption of large-format modules and power-dense 1500V string inverters, electrical balance-of-system (EBOS) and structural balance-of-system (SBOS) costs are kept in check despite rising component costs.

On the other hand, residential system pricing has actually dipped in 2022. This is because of the larger average system size (increasing from 6 kW to 8 kW) which not only helps amortize the cost but is also a win-win for both the system owner and the solar industry.

Expected relief for US solar prices in the future?

Improvements in technology have greatly helped to offset the recent cost surges. Widespread adoption of large format modules provides relief against the cost headwinds. Starting in 2022, our system pricing estimates include the M10 wafer format module for large utility-scale ground-mount and commercial ground-mount projects.

The climate provisions under the Build Back Better act propose ITC extensions beyond 2026 and additional tax credits for domestic content. This could provide much-needed incentives for the utility-scale PV segment. However, the stringent prevailing wage and apprenticeship requirements could increase the cost of labor and reduce the qualified labor pool in the near term.

An extension of Section 201 tariffs on mono PERC modules continues to create pricing pressure, but the exclusion of bifacial modules could provide some relief for the next four years. Modules represent about 30-35% of the total system cost in the US for an average 100 MWdc system, so increased module prices weigh heavily on total system costs. However, the recent decision by the US Department of Commerce to review the anti-circumvention case brought up by a US manufacturer also cast a dark shadow over the already strained module supply chain. We estimate that the price of bifacial modules imported from the southeast Asian countries affected by the investigation will increase, on average, by nearly 10 c/W over the next five years.

As industries and businesses return to normal in the wake of the global pandemic, we expect long-term prices to decline by 2026-2027. However, the potential antidumping and countervailing duties (AD/CVD) tariff on Southeast Asian module imports could prolong the high-cost environment.

Get closer to the detail of US solar prices

The latest US solar PV system pricing report covers cost breakdowns for residential, commercial and utility-scale projects, and provides state-level system pricing.

The report is produced by our PV Technology, Systems & Operations Service, which features a bottom-up interactive US cost model that provides the option of viewing and comparing all-in system costs across market segments.